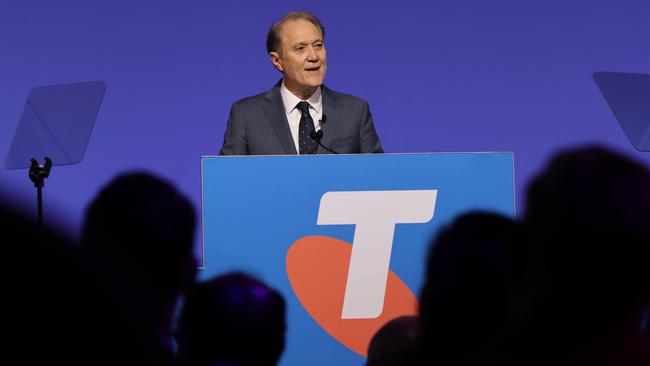

The enterprise business has held Telstra’s share price back, says new chair Craig Dunn

Telstra’s share price hasn’t performed well this year and one of the chief culprits is the drag from its enterprise business, the telco’s new chairman says.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Telstra’s share price has suffered because of the telco’s “disappointing” enterprise business, says the company’s new chair, Craig Dunn, admitting it hadn’t grown as much as expected.

The comments came about five months after Telstra announced cuts of up to 9 per cent of its workforce – or 2800 staff – many of whom were from its enterprise business.

Mr Dunn, speaking at the telco’s annual general meeting on Tuesday, said it was not just Telstra – many critical infrastructure businesses, which he described as defensive stocks, had not performed strongly this year.

Telstra shares rose 2c to $3.89 on Tuesday but are off almost 10 per cent since the start of last financial year.

“Being very clear with you, the performance of our enterprise business this year, which was disappointing, hasn’t helped that price,” he added.

Telstra’s executives and directors were just as keen as shareholders to see the share price rise, with many remuneration plans tied to the company’s performance, he said.

“We share your desire as a board and senior management team, and I don’t make that comment lightly, to drive up the value of the enterprise,” he said.

“I understand this year hasn’t achieved the same outcomes as some others have on the market … That’s a fair point.”

The new chair has also confirmed he would support a sale of Foxtel and that if a sale occurred the telco would consider paying shareholders a special dividend.

News Corp global chief executive Robert Thomson said in August Foxtel’s performance had prompted “third-party interest in a potential transaction” for the streaming-led sports and entertainment company.

Mr Dunn said he understood News Corp, which owned 65 per cent of Foxtel, was undertaking a strategic review of the business. This could lead to a potential sale, which would include Telstra’s 35 per cent stake.

“We think that would be a sensible move or decision to make on behalf of shareholders,” he said. “From time to time the importance of certain assets and their contribution to the value proposition we make to our customers does change.”

Telstra was continuing to focus on its core business and “it’s not clear to us long-term that (Foxtel) remains a part of our core business”, he said.

Asked by a shareholder whether that sale would warrant a special dividend for shareholders, Mr Dunn said the telco would consider it as it had in the past.

The telco received some criticism from shareholders who were not pleased to discover that Telstra was using offshore call centres to deal with technical faults and some after-hours inquiries.

In May, chief executive Vicki Brady proudly announced that the telco had brought its customer service call centres for consumers and small business customers back onshore.

But Telstra is still using centres in Manilla, in The Philippines and Dubai to handle some issues, and fault call-backs are done from overseas. The telco still uses offshore teams for its enterprise units, which include its Telstra Purple business.

Telstra CEO Vicki Brady also reaffirmed at the AGM that Telstra was on track this financial year to achieve growth in underlying EBITDA, as well as earnings per share and return on invested capital.

Underlying EBITDA is still expected to meet the guidance range which was revised up to $8.5bn-$8.7bn in August.

Ms Brady said Digicel Pacific continued to take a disciplined approach to capex, while strategic investment of $300m-$500m in FY25 reflected the ramp-up of the intercity fibre project.

Free cashflow before strategic investment of $3bn-$3.4bn is expected including about $300m of cash outflow related to FY24 restructuring costs.

More Coverage

Originally published as The enterprise business has held Telstra’s share price back, says new chair Craig Dunn