Email confirms Aussie CEO’s worst fears that he has been scammed out of $44k

A single email made this CEO’s world come crumbling down as he realised he had just made a massive mistake that would cost him big time.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

A CEO is issuing a warning to other Australians after he was scammed out of $44,000 in two separate elaborate ruses.

Lawrence*, a dad from Melbourne, is the chief executive officer and owner of a regulatory compliance business that has expanded along the entire east coast.

He has a post-grad qualification and has invested in shares before.

That’s why he’s speaking out after falling for a “sophisticated” investment scam that took out a big chunk of his family’s cash reserves, in what he says anyone could be tricked by.

“I think I’m not dumb,” he told news.com.au. “I consider myself pretty intelligent.”

But he realised after pouring in thousands of dollars, that he had lost his money with no chance of recovery.

“It was just a really upsetting experience. It was just so sophisticated, that was what I couldn’t get over,” he said.

The financially savvy businessman had experienced great success in the past by investing his money into companies during their initial public offering (IPO) rounds and started looking for a broker to help him with his latest venture.

Want to stream your news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer available for a limited time only >

Lawrence wanted to secure shares for a US electric utility vehicle company called Rivian, which he knew was set to go public in November last year.

So the Victorian man started searching for ways to land himself some Rivian shares.

It was here that he came across a so-called UK company called Invystor that passed him onto two different brokers.

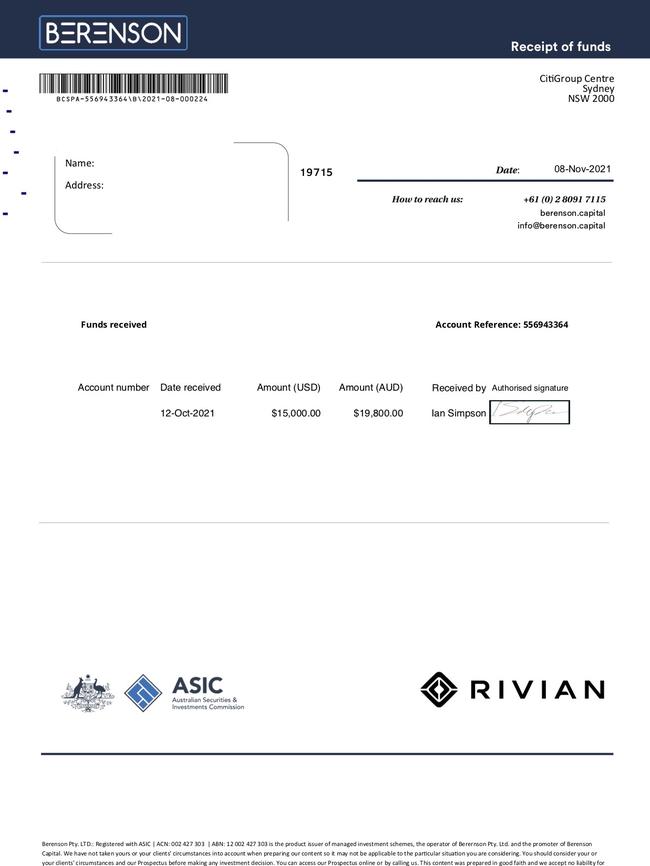

“They arranged a call from this crowd called Berenson Capital,” he recalled.

“They had this very slick website, claimed to be an Australian broking firm.”

He spoke to a man with a British accent called John Alexander who explained how the whole process would work.

He ended up investing around $20,000, by transferring the funds into a CBA bank account.

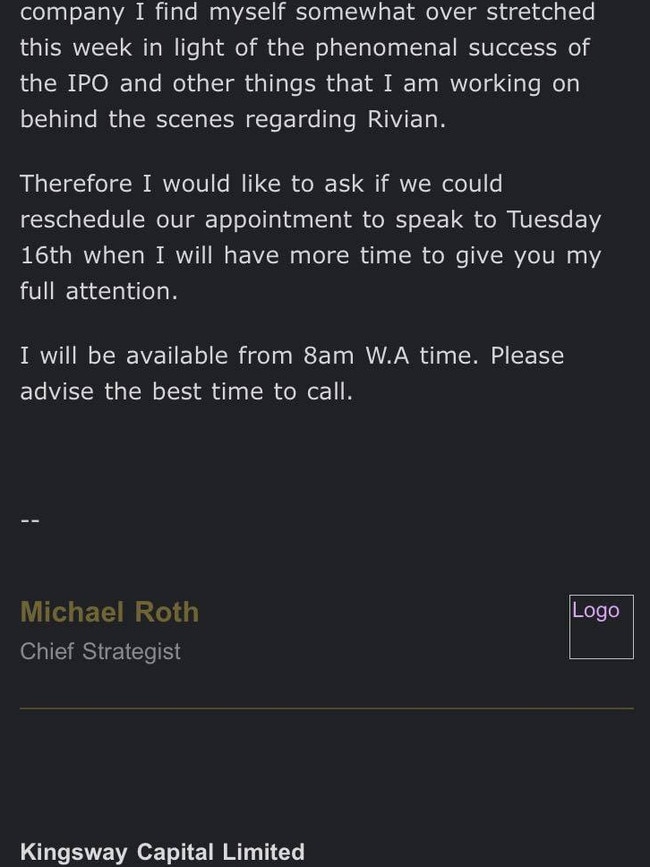

Around the same time, Invystor put him in touch with another brokerage firm called Kingsway Capital Limited.

Here, he spoke to a woman calling herself Catherine Willows, who also had a British accent.

“She was saying they had corralled some Rivian IPO shares so I subsequently committed to $24,655.”

This was done by a telegraphic money transfer to an account over in the US.

Lawrence said he went through a stringent vetting process with both companies, checking with ASIC that they had valid financial licence numbers and also looking up reviews and examining their UK counterparts.

The problem is there really is a Kingsway Capital Limited, but this wasn’t it.

“Because I’d done so much checking I felt really stupid,” Lawrence said.

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

On the much anticipated day of the Rivian float, November 11 2021, Lawrence heard nothing from both firms.

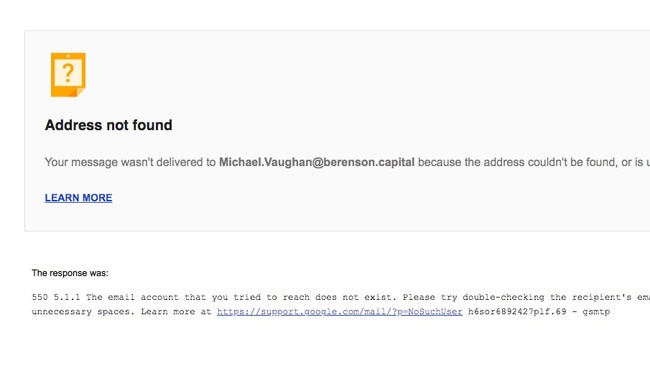

“The day of the float, I attempted to contact Berenson Capital by phone, the number rang out,” he recalled.

“I attempted to call John Alexander, he had just disappeared.

“On November 12 (which was the next day), I received an email message saying her (Catherine’s) email address had stopped.”

He went on to learnt that not only had he missed out on Rivian’s stocks hitting the market, but he had also given away $44,000 to scammers.

The UK’s Financial Conduct Authority, which is their equivalent of ASIC, has since put out a warning about scammers “cloning” Kingsway Capital.

“Almost all firms and individuals carrying out financial services activities in the UK have to be authorised or registered by us,” they wrote.

“This firm is not authorised or registered by us but has been targeting people in the UK, claiming to be an authorised firm.

“This is what we call a ‘clone firm’ … They may use the name of the genuine firm, the ‘firm reference number’ (FRN) we have given the authorised firm or other details.”

Cyber security expert, Nick Savvides, chief technology officer APAC at cyber security company Forcepoint, also told news.com.au there were a number of issues with Invystor.com, the site that originally passed Lawrence onto the other scammers.

“This site has a number of red flags,” he told news.com.au.

Those include the site assuming the registration of a legitimate financial company called Wealthstream Ltd, which hasn’t filed its paperwork for three years and is about to be struck off the register.

They also said Invystor is a registered trademark but it doesn’t appear on the UK trademark registry. Meanwhile, their Facebook, Twitter and YouTube only links to other content, which is “typical of scam set up pages, they only have links to external news articles, i.e. they don’t actually produce any content”.

They also had an associated website which had only been established in 2021.

To make matters worse, in order for Lawrence to verify his identity, he supplied the fake financial firms with his passport.

That means the scammers now have his passport details and could open loans and credit accounts in his name.

Luckily, he has since been able to recover half his stolen money.

As Bendigo Bank carried out the telegraphic transfer, they ended up reimbursing him for the $24,000.

The rest of the money, however, is unsalvageable more than a year later.

Mr Savvides believes these particular scams are “sophisticated” and “well-resourced”.

He says it is likely they had a group of people working together to steal large sums of money.

The money has probably ended up overseas and could be part of an organised crime gang, according to him.

*Name withheld for privacy reasons

alex.turner-cohen@news.com.au

Originally published as Email confirms Aussie CEO’s worst fears that he has been scammed out of $44k