‘Rising threat’ terrorising Aussies as US election looms amid inflation battle

The world is facing the very real possibility of a second Donald Trump presidency – and it would have huge impacts on Australia.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

In the world of finance and economics, the stakes are rarely as high around an ABS data release as they were for the latest quarterly inflation figures released on Wednesday.

In the run-up to the release, the average market forecast was for 1.0 per cent inflation in quarter-on-quarter terms for both the headline reading and the RBA’s preferred inflation metric, the trimmed mean.

Wednesday’s figures also mark something of a watershed moment for the ABS’s headline quarterly inflation numbers.

From this point on, and to varying degrees over the next two years, the figures will be distorted by the Albanese Government’s $3.5 billion energy bill relief policy, along with a long list of other subsidies and discounts provided to households by various state governments.

The numbers

Despite concerns of a challenging upside surprise, headline inflation came in bang on analysts’ expectations at 1.0 per cent quarter-on-quarter and 3.8 per cent year-on-year. This is exactly where the RBA expected it to be at this point, based on the forecasts contained in its latest Statement On Monetary Policy.

In terms of the RBA’s preferred inflation metric, the trimmed mean, it came in weaker than market forecasts at 0.8 per cent quarter-on-quarter, versus an expected 1.0 per cent.

However, it came in slightly hotter than the RBA’s forecasts were anticipating, with it rising by 3.9 per cent over the last 12 months versus 3.8 per cent predicted by the RBA.

The drivers

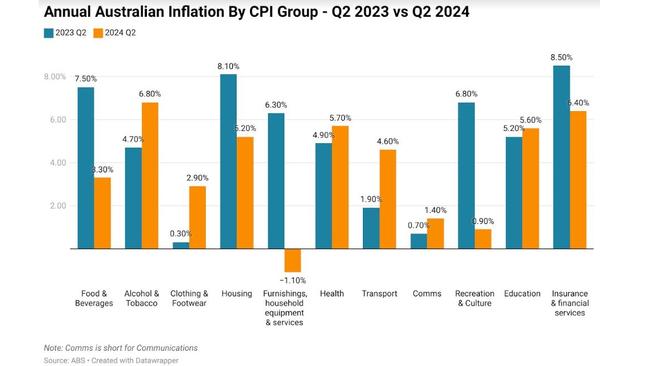

In terms of annual inflation by category as broken down by the ABS, the strongest five contributors were: alcohol and tobacco (+6.8 per cent), insurance and financial services (+6.4 per cent), healthcare (+5.7 per cent), education (+5.6 per cent) and housing (+5.2 per cent).

At the other end of the spectrum, the weakest five categories were: furnishings, household equipment and services (-1.1 per cent), recreation and culture (+0.9 per cent), communication (+1.4 per cent), clothing and footwear (+2.9 per cent) and food and non-alcoholic beverages (+3.3 per cent).

When contrasting annual inflation by category in the present with the June quarter of 2023, the largest contributors to the reduction in inflation have stemmed from: furnishings, household equipment and services (-7.3 per cent), recreation and culture (-5.9 per cent) and food and non-alcoholic beverages (-4.2 per cent).

These falls have been heavily driven by the dramatic reduction in price growth in holiday travel costs and household goods in particular. For example, in the June quarter of 2023, annual inflation for domestic holiday travel and accommodation was 13.9 per cent, with its international counterpart up 22.5 per cent.

Today, domestic holiday costs are down 2.2 per cent in the last 12 months and up 0.6 per cent for international holidays.

What does the future hold?

Between the impact of government subsidies causing inflation to initially fall and then subsequently undergo a resurgence as their effect feeds out of the data, and the highly uncertain geopolitical and global economic outlook, to say the path forward for Australian inflation was complicated would be an understatement.

Throughout much of the developed world, the deflationary impulse stemming from imported consumer goods has done much of the heavy lifting in the fight against inflation, as this once strong contributor to headline CPIs became a net detractor.

But after more than nine months of commercial shipping through the Red Sea and Suez Canal being impacted by attacks by Houthi groups, shipping costs are once again rising as the impact of longer transit times and diverted sailings take their toll on global maritime trade.

So far, Australia has been lucky to avoid the worst of rising shipping costs, with the Shanghai Containerised Freight Index showing passage to New Zealand and Australia up 91.2 per cent from its lows this time last year.

Costs for shipments from Shanghai to the US are up 157 per cent and from Shanghai to Europe up 304.1 per cent.

The risk is that rising shipping costs could begin to put upward pressure on the price of some of the key goods which have played a major role in suppressing inflation so far, such as household appliances and furniture.

There is also the rising threat of trade barriers and tariffs.

While this particular risk has been rising for a while now, with China increasingly gaining market share in industries traditionally held by Western companies, the re-election of former US President Donald Trump could see an escalation in trade actions.

Mr Trump is proposing that the United States impose a 60 per cent tariff on all goods from China and a 10 per cent tariff on imported goods overall.

According to an analysis by Pictet Asset Management chief economist Patrick Zweifel, this would see the average rate of taxation imposed on US imports by tariffs rise to 16.9 per cent, up from 2.4 per cent today.

That would result in the highest tariff burden on imported goods into the US since 1936.

The risk is that we could see a round of global tit for tat tariffs and trade barriers being implemented, which could ultimately push up the cost of consumer goods globally, including in our generally quiet corner of the South West Pacific.

The impact on interest rates

In the run up to the release of the figures, there were concerns that a reading above 1.0 per cent for quarter on quarter trimmed mean inflation could potentially force the Reserve Bank of Australia’s hand and drive another increase in the cash rate.

In a stroke of luck for mortgage holders, this did not come to pass.

In the wake of trimmed mean inflation surprising to the downside, some of the nation’s top economists, such as AMP’s Shane Oliver and Westpac’s Luci Ellis, are calling that interest rates have peaked for this cycle.

Despite the chances of a rate rise being dramatically reduced by this inflation print, the prospect of a rate cut remains somewhat elusive.

Based on pricing from interest rate futures markets, a full 0.25 per cent reduction in rates is not fully priced in until March next year, with a second expected in June.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as ‘Rising threat’ terrorising Aussies as US election looms amid inflation battle