RBA preparing to make ‘devastating’ announcement on Tuesday

The RBA is expected to raise interest rates again on Tuesday – and for months to come – sparking warnings Australian families will be “devastated” by the cost.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

All eyes are on the Reserve Bank of Australia (RBA), which tomorrow will hand down its June interest rate decision.

Economists are universally tipping the RBA to again lift the official cash rate (OCR) from its current level of 0.35 per cent; although opinion is divided on whether it will opt for a traditional 0.25 per cent hike or a sharper increase.

The RBA is also forecast to aggressively lift interest rates over the coming year. The median economists’ forecast is for the OCR to peak at around 2.5 per cent, which corresponds with RBA governor Phil Lowe’s statement in May in which he said he expects to lift the target cash rate to at least 2.5 per cent.

The futures market is even more hawkish, tipping the RBA will lift the OCR to around 3.5 per cent by May 2023.

Forecast interest rate rises would devastate household finances

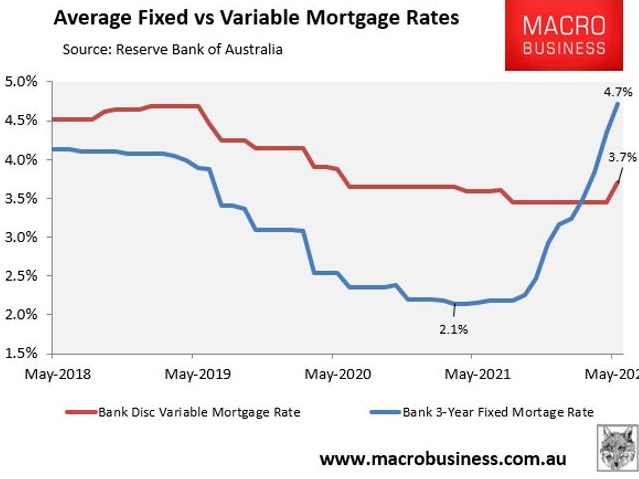

Assuming the economists’ or market’s OCR forecasts were fully passed on to mortgage holders, the average discount variable mortgage rate would soar from its current level of 3.7 per cent to between 5.85 per cent and 6.85 per cent by mid-2023.

This would represent the sharpest proportional increase in mortgage rates in Australia’s history and would devastate household finances, the housing market, and the Australian economy.

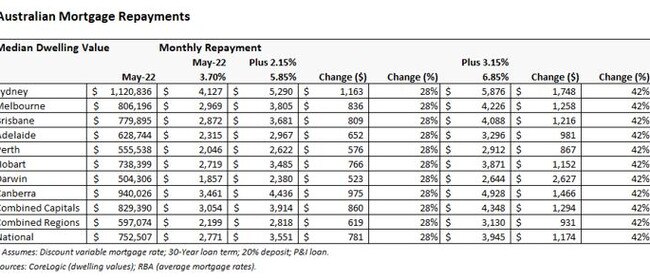

To illustrate why, consider the next table showing the average monthly repayment on the median-priced dwelling across Australia, assuming a 30-year principal and interest variable rate mortgage and a 20 per cent deposit:

If economists’ forecast comes to fruition, and the OCR rises another 2.15 per cent (to 2.5 per cent), then the average monthly mortgage repayment on the median priced Australian home would rise by $781, or 28 per cent. The impact would be greatest in Sydney, where monthly mortgage repayments would jump by $1163.

If the futures market’s forecast comes true, and the OCR rises another 3.15 per cent (to 3.5 per cent), then the average monthly mortgage repayment on the median priced Australian home would soar by $1174 (42 per cent), with repayments across Sydney ballooning by $1748 a month.

The impact would be even more severe for borrowers who took out a fixed-rate mortgage during the height of the pandemic at rock bottom rates below 2.5 per cent.

Under the economists’ OCR forecast, these fixed rate borrowers would face more than a doubling of mortgage rates when they come to refinance in 2023 and 2024, whereas mortgage rates would triple under the market’s OCR forecast.

With around $500 billion worth of fixed rate mortgage terms due to expire by the end of 2023, hordes of Australian households face a devastating mortgage reset shock.

The economy could be thrown into recession

Household consumption is the Australian economy’s biggest driver, accounting for around 55 per cent of growth on average. So, if mortgage repayments rise too sharply, then this will mean there are less funds available for spending across the economy, in turn crunching economic growth.

The negative drag on household consumption would be exacerbated by a sharp fall in house prices, which would make Australians feel poorer.

The cratering of mortgage rates to record lows over the pandemic was the key driver of Australia’s generational house price boom. Soaring interest rates would have the opposite effect in delivering a major house price correction.

In its latest Financial Stability Review, the RBA estimated “that a 200-basis-point increase in interest rates from current levels would lower real housing prices by around 15 per cent over a two-year period”.

Therefore, the economists’ forecast 2.5 per cent OCR suggest a peak-to-trough fall in real Australian house prices of more than 15 per cent, with nominal values falling by more than 20 per cent.

The futures market’s 3.5 per cent OCR, however, would ‘crash’ the housing market, with real housing prices falling by around 25 per cent in real terms and by more than 30 per cent in nominal terms, under the RBA’s modelling.

Aggressive interest rate rises won’t stop inflation

Australia’s inflationary pressures are primarily imported, including via petrol prices and materials.

The broadest gauge of domestic inflation – wages – remains soft, despite the tight labour market. The march quarter wage price index printed annual growth of only 2.35 per cent, whereas last week’s Q1 national accounts recorded only 2.2 per cent growth in average compensation per employee.

Most telling is Australia’s real unit labour cost (ULC), which according to the Australian Bureau of Statistics “are an indicator of the average cost of labour per unit of output produced in the economy” and “are a measure of the costs associated with the employment of labour, adjusted for labour productivity”. They have collapsed 6.3 per cent below their pre-pandemic level and have fallen for the better part of 35 years.

Clearly, the RBA is not facing a wage-price spiral like those being observed in some other jurisdictions and does not need to run hard against wages growth by aggressively hiking the OCR. On the contrary, wages in Australia are disinflationary given the falling ULC.

As such, there is little justification for the RBA to hike rates aggressively to counter imported (cost-push) inflation. Such a strategy would exacerbate cost-of-living pressure for households and hammer the economy without relieving the very forces driving the inflation problem in the first place.

The Government should help the RBA fight inflation

The main risk to Australian inflation is via an energy crisis that is also imported by war-profiteering gas and coal firms.

The only enduring solution to this is for the Australian Government to reserve enough domestic volumes of gas and coal to crash local prices. With fixed prices if necessary.

Energy is only 3 per cent of the CPI but it is already on its way to doubling, and because it is a cost for every other business, all costs will rise and end-user prices too.

If nothing is done to rectify the energy crisis then the RBA may be forced to lift interest rates higher than the wider economy can handle to make room for an empty energy price shock.

That would be pointlessly destructive to Australian standards of living.

Leith van Onselen is Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review. MB Fund is underweight Australian iron ore miners.

Originally published as RBA preparing to make ‘devastating’ announcement on Tuesday