The tough money decision Aussies face after rate rises

After a third rate rise in as many months today, these are the Australians suburbs that will suffer the most.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

Australian homeowners already enduring the pain of rising mortgage repayments are bracing for more financial stress as the cash rate treads over 1 per cent.

The RBA increased rates by 50 basis points to 1.35 per cent on Tuesday.

Today’s rate rise is the third announced by the Reserve Bank of Australia (RBA) this year, after the first increase occurred in May, which saw rates rise to 0.35 per cent and then to 0.85 per cent in June.

It means Australian households could now have to choice between health insurance or putting food on the table.

Economists are also warning mortgage holders to brace for even higher hikes, with the cash rate potentially reaching above 2 per cent by the end of the year.

A number of suburbs across the country will be put under financial strain as a result, as well as mortgage lenders who entered the property market from November 2020 and haven’t had to deal with rates this high.

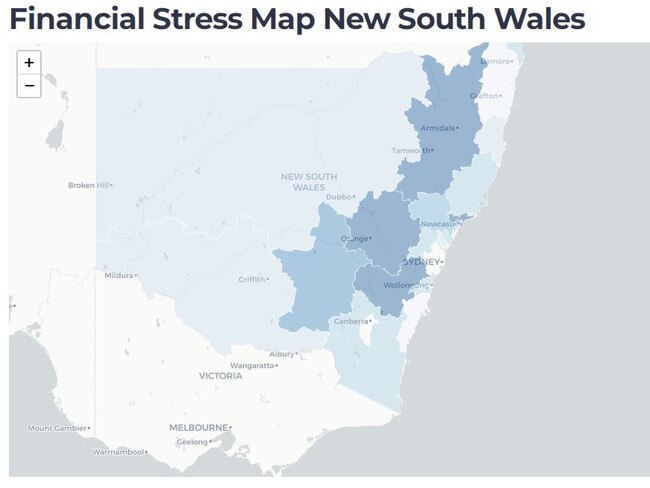

Based on data from Digital Finance Analytics, housing advocacy group Everybody’s Home created an interactive map to highlight which electorates across the country were in financial stress.

Everybody’s Home spokeswoman Kate Colvin says Australians are deemed to be under “mortgagee” or financial stress when they have less than 5 per cent of their ordinary income left after covering day-to-day costs.

“If all of your income is committed to your insurance (and) your health costs … and there’s only 5 per cent of (your income) left, then something like an increase in interest becomes an unavoidable expense,” Ms Colvin told news.com.au.

“You’ve only got that 5 per cent to play with to meet those costs. Otherwise, you have to start cutting back on other ordinary expenses like cancelling your health insurance.”

Which suburbs are most at risk of ‘mortgagee stress’?

Ms Colvin said already struggling lower income households, inland communities and city border suburbs will be most affected by the rate rise.

Looking at the country’s east coast for example, households in the New South Wales electorates of Hume, New England and Calare have mortgage stress rates of above 60 per cent.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Meanwhile in Victoria, the electorates of Calwell and McEwen have mortgagee stress rates over 50 per cent and over 60 per cent of renters are in stress.

Whereas in Queensland, mortgagee stress rates aren’t as high with the electorate of Blair having the most households under financial stress.

That state, however, does have more renters facing financial stress, particularly in the electorates of Wright, Bowman and Forde, all sitting at the high 50 per cent mark.

Ms Colvin said lower income households who stretched themselves to get into the housing market will feel the pinch the most, particularly as cost of living pressures increase.

“A lot of lower income households … are often on the outskirts of our cities, so those are households that will also be feeling the pressure from the increased cost of petrol, for example,” Ms Colvin said.

“And one of the other things that we’re worried about in terms of rising interest rates, is that because we’ve got low (rental) vacancy rates, there’s a risk that the increased cost of interest to investors will be passed onto renters.”

Experiences of financial stress

According to a Families in Australia survey released in November last year, the most common experiences of financial stress include having to seek help from family and friends, not being able to pay bills on time and having to go without meals.

“I struggle every week to put food on the table and meet basic needs. We do not lead an extravagant life and don’t smoke or drink but by the time child care, school fees, kids’ food and needs are met, there is nothing left,” a 39-year-old respondent with children said.

Meanwhile, a 34-year-old male respondent who also has children said rental prices in his unspecified regional city have skyrocketed, which is making it hard for his family to make ends meet.

“We would like to move into a three-bedroom home but finding one for less than $500 a week is extremely difficult. This makes it difficult to save money which, combined with the rising purchase price of housing makes it less and less likely that we will ever own our own home,” he said in response to the survey.

Future financial stability was another concern for many respondents, with many worried they wouldn’t have enough savings for retirement.

According to the Australian Bureau of Statistics (ABS) the consumer price index (CPI) rose by 5.1 per cent in the last 12 months, with new dwellings one of the most significant contributing factors.

Grocery items were also hit by inflation with the price of fruit, vegetables and beef rising by a collective total of 18.8 per cent in the March 2022 quarter.

Ms Colvin said it’s these cost of living pressures and further interest rate rises that will force families out of their homes.

“For some households, this will mean that the financial stress is so great that they’re not able to keep their home,” Ms Colvin said.

“And that further highlights the importance of having more social housing so that there’s options for people when they’re hit by hard times.”

Originally published as The tough money decision Aussies face after rate rises