‘Largest drop in history’: Global markets in chaos as recession fears explode

The last 10 days have seen global markets experience the most jarring rollercoaster ride since the pandemic. Here’s what’s really going on.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

The past 10 days have seen global markets experience the most jarring rollercoaster ride since the pandemic.

In a single day, the main Japanese stock exchange, the Nikkei, saw the largest drop in its history, falling by almost 4500 points. In percentage terms, the 12.4 per cent fall was the largest drop since the famous October 1987 stock market crash.

Meanwhile, interest rate futures markets in the US began pricing in an emergency rate cut that would take place between the scheduled meetings of the US Federal Reserve as panic began to set in.

The volatility index or VIX of the main US stock index, the S & P 500, rocketed to a level seen only twice in its more than 30-year history, during the height of the Global Financial Crisis and the pandemic.

Amid this wild ride in global markets, it’s worth exploring what is driving this volatility and what may lay ahead as a result.

Shifting sands in Japan

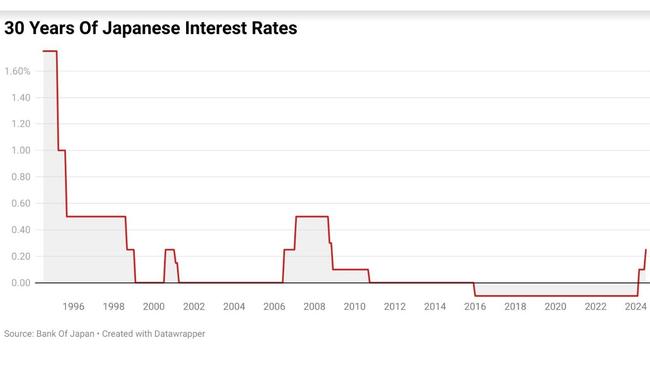

For almost 30 years, the Bank Of Japan’s cash rate has been hovering at or around 0 per cent, with it dipping to a negative figure of 0.1 per cent for more than seven years between 2016 and 2024.

This near unprecedented set of circumstances created a unique series of incentives for investors.

An investor could borrow in Japanese Yen from a Japanese bank at extremely low rates, invest that money in stocks, bonds or even a simple high interest savings account, then pocket the difference.

This is known in the world of investing as a carry trade.

Over time, the idea of the Bank Of Japan raising interest rates became almost unthinkable in the eyes of many, as the debt burden of the Japanese government continued to head ever skyward to sit at 266 per cent of GDP as of the latest figures.

Outside of nations embroiled in near-constant crisis or ongoing civil wars, Japan’s enormous debt burden stands in a completely different ballpark to the rest of the world.

Yet despite the size of Japan’s government debt, when confronted with the consistent weakening of their nation’s currency, the Bank of Japan’s hand was forced into raising interest rates multiple times for the first time in almost 20 years.

This effectively dropped several large stones in a small pond, creating ripples that continue to echo through global markets.

The rise in borrowing costs undermined the viability of some carry trades, forcing some to close out positions.

The rise in the Japanese Yen and interest rates incentivises the return of capital to Japan, while the sale of foreign assets can still potentially get significantly more Yen for their foreign currency.

A large degree of the recent strength of the Japanese stock market has been driven by the weakness of the Yen and therefore its attractiveness to foreign investors. If the Yen continues to rapidly appreciate, the risk is that Japanese stocks may continue to see strong selling, with knock on effects possible throughout global markets, including Australian stock indices.

The return of risk

For the longest time, a US recession in 2023 was widely tipped, as the US Federal Reserve undertook the largest and fastest relative tightening of monetary policy in American history. But amid the Biden administration running Great Depression and World War era sized deficits and a renaissance in domestic manufacturing investment, this recession did not end up coming to pass.

As 2024 wore on, the prospect of a US recession became less and less of a factor on the radar of markets and was increasingly dismissed as a possibility by many commentators. With the release of the latest US unemployment figures, the prospect of a serious economic slowdown or a recession was catapulted back to the forefront.

The expectation was of a stable unemployment rate at 4.1 per cent and for the US economy to have created 175,000 new jobs in July. In reality, it created just 114,000 jobs and the unemployment rate rose significantly to 4.3 per cent.

This deterioration in the labour market triggered the so-called Sahm Rule. The rule dictates that if the three-month moving average of the unemployment rate rises 0.5 percentage points above the 12 month low, the US is highly likely to enter a recession. The Sahm Rule has correctly predicted every US recession since the early 1970s.

This swiftly caused concerns to rise that the US economy may have slowed to a significantly greater degree than other data had suggested and investors were swiftly forced to reassess their perspective on the possibility of a recession. As the Japanese stock market went into meltdown on Monday, this arguably provided additional fuel for the sell off, as investors confronted both issues simultaneously.

What it could mean for Australia

When Australian interest rate futures closed on Tuesday, markets were pricing in a full 0.25 per cent rate cut for the RBA’s next meeting on September 24. Last week, the market didn’t have a 0.25 per cent rate cut pencilled in until March next year.

As of the close of the market on Wednesday, the first 0.25 per cent rate cut is now fully priced in for February, with a second expected to follow in May. It is worth noting that global markets very much remain in flux and a high degree of uncertainty remains.

If the Sahm Rule is once again correct and the US is headed for a recession, Australia may get rate cuts significantly earlier than what the market was pricing just last week. But that likely comes at a cost – the slowing of the domestic economy and the possibility of our own recession.

As for the result of the volatility in global markets and the unwinding of decades of easy Japanese monetary policy, we could be witnessing the beginning of a sequence of events that will lay bare the weaknesses within the global financial system.

From commercial real estate to private equity lending, there are more than a few issues that have largely been papered over in recent years.

On the other hand, we could see markets calm down as the Bank Of Japan attempts to moderate its rhetoric and buyers attempt to drive a resurgence in the AI mania and mega tech company driven bull market.

Meanwhile, in the real economy, we could see the Sahm Rule proven wrong for a change, perhaps as a result of US politicians pledging to throw even more cash into the economy during a hotly contested election year.

Ultimately, it all remains very much up in the air.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as ‘Largest drop in history’: Global markets in chaos as recession fears explode