‘Will all collapse this year’: Huge news for Aussie economy revealed as RBA rate cuts loom

Aussies have been slammed by the RBA’s brutal interest rate moves for years – and now, a finance expert has made a major prediction.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

COMMENT

It’s about to rain rate cuts.

Perhaps not surprisingly, Australia has post-traumatic stress disorder when it comes to interest rates.

After experiencing an effective per capita recession for three years, the worst fall in living standards in a century, and being punished by a recalcitrant central bank, who could blame them?

This economic PTSD is expressing itself in paranoia about what the Reserve Bank of Australia will do next as a flock of feral interest rate hawks warn that inflation isn’t beaten. They could not be more wrong.

Inflation is crushed

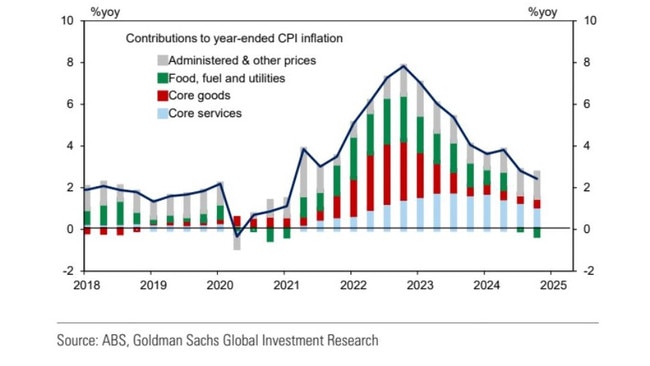

All the major inflationary forces of Covid, the reopening, and the Ukraine War are wiped out, and there is no wage-push cycle to keep prices rising.

MORE:Why ‘certain’ RBA cut will make things worse

The global goods inflation cycle of Covid is gone.

The energy shock of the Ukraine War has been erased by rebates.

This has plunged headline inflation back into the RBA’s target band, and that means the 20 per cent of the consumer price index (CPI) made up of “administered prices”, which adjust automatically according to the headline rate, will all collapse this year.

There’s literally no core inflation left.

MORE:1.5 million Aussies in limbo despite rate cut

On top of that, the post-Covid immigration surge that skyrocketed rents has also collapsed, as totally unaffordable prices destroyed demand as more and more people moved in together.

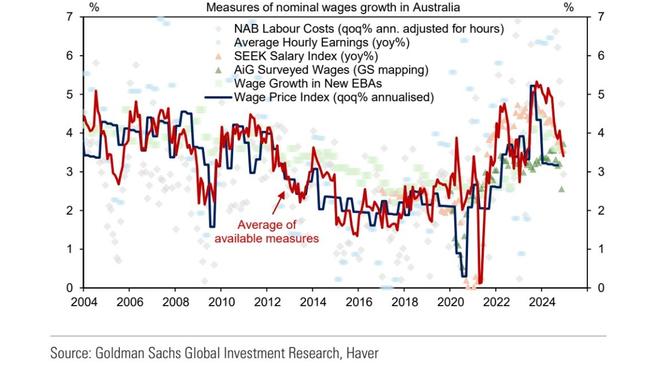

Moreover, the same immigration surge has smashed wage growth. It is fast-headed back to a two-handle.

Without wage growth, inflation cannot get a foothold in the services-dominated Aussie economy.

A foolish RBA

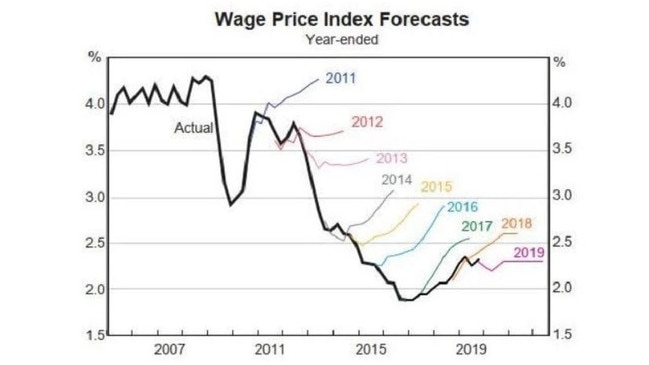

In fact, all of this has been obvious for several quarters, and the RBA is behind the inflation curve on the downside, not up.

The core of the RBA’s blundering is that it refuses to accept that the Australian economic growth model differs from other developed markets.

Most developed economies grow via business investment that expands capacity and lifts productivity.

Australia, on the other hand, grows via mass immigration which expands the size of the labour market. This model leads to disinvestment and falling productivity, so egghead economists keep expecting wage inflation.

What they ignore, for political or ideological reasons, is that the model supplies its own permanent cheap labour supply shock.

The model simply does not do wage growth, so it cannot produce enduring inflation either.

This hawkish mistake was the only reason that the Albanese government undertook RBA reform with a new governor and board structure after a near-decade of pointlessly smashing the economy.

If the new boss is the same as the old boss, then Michele Bullock should be shown the door too.

What will it do?

The RBA should and very likely will cut interest rates this week.

It is unlikely to signal an ongoing cycle of cuts, but will indicate that it is data-dependent for the forthcoming months.

The thing is, the inflation data is collapsing and will continue to do so (barring some new shock), meaning it is about to rain rate cuts whether the RBA knows it yet or not.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.

Originally published as ‘Will all collapse this year’: Huge news for Aussie economy revealed as RBA rate cuts loom