‘Pushed back’: What interest rate cut cycle could really look like in 2025

Homeowners desperate for some relief will learn tomorrow whether interest rates will be slashed. This is what the banks are saying.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

ANALYSIS

Throughout much of 2024, there has been speculation from commentators and economists alike that interest rates would be cut during this calendar year.

As the year has progressed, the timing of the first Reserve Bank of Australia (RBA) rate cut has been pushed back further and further, to the point where the consensus is now that rate cuts will not come until next year.

MORE:Major problem facing Aussies after RBA change

On average over the last 50 years, rate cuts have come 9.8 months after the peak in the cash rate. Currently, the clock on the current cycle has almost hit 12 months, the third longest duration of the cash rate at its cycle peak.

Rate cuts will eventually come – but the big question is what will that look like in a nation where the likes of the International Monetary Fund (IMF) are warning about entrenched inflationary pressures?

Forecasts and market pricing

As of the latest pricing of interest rate futures markets, there are two 0.25 per cent rate cuts fully priced in by the end of March 2026, with a third on the cusp of being added.

Market pricing is a bit different to what economists at the Big Four banks have pencilled in for the future trajectory of the cash rate.

The Big Four forecasts

● ANZ: First cut in February, 0.75 per cent worth of cuts by December 2025, cash rate of 3.60 per cent

● Commonwealth Bank: First cut in February, 1.25 per cent worth of cuts by December 2025, cash rate of 3.10 per cent

● NAB: First cut in February, 1.25 per cent worth of cuts by June 2026, cash rate of 3.10 per cent

● Westpac: First cut in February, 1.0 per cent worth of cuts by December 2025, cash rate of 3.35 per cent

MORE: Looming ‘threat’ if RBA fails to act

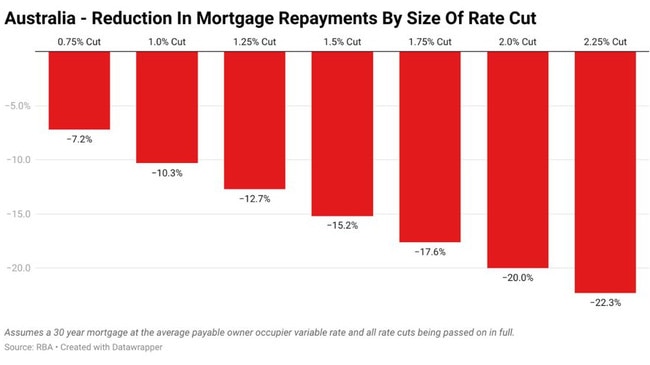

Based on the current average payable owner occupier variable rate, the scenarios laid out by the Big Four banks would result in a relative cut in mortgage rates of between 11.5 and 19.3 per cent.

If we were to implement mortgage rate cuts of that magnitude on a 30-year mortgage that is currently at the average owner occupier variable rate, it would reduce overall repayments by 7.2 per cent to 12.7 per cent.

MORE:Where homeowners owe $1m on their mortgage

Historic rate cuts

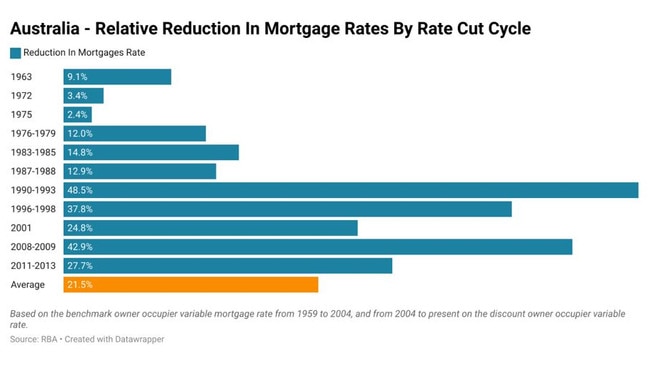

The average relative reduction mortgage rates since RBA records began have been slightly larger than the ideal Big Four bank rate cut scenario for mortgage holders, with mortgage rates on average falling by 21.5 per cent over the last 65 years.

The relative reduction in the size of mortgage rates has varied dramatically over this time. During and following the 1983 recession, the benchmark owner occupier mortgage rate was only cut by 14.8 per cent in relative terms from 13.5 per cent to 11.5 per cent. Meanwhile, the 1990-91 recession prompted mortgage rates to be cut by 48.5 per cent in relative terms, as mortgage rates fell from 17.0 per cent to 8.75 per cent.

If we were to take the average cut in mortgage rates and lay it over the current settings, the cash rate would be cut by 1.37 percentage points to 2.98 per cent and the average variable mortgage rate would fall to approximately 4.98 per cent.

Comparing scenarios

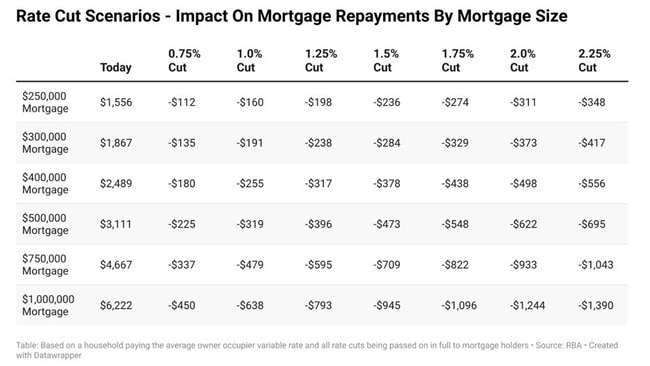

To get a handle on the real-world implications of the different rate cut scenarios, we’ll be looking at the potential impact based on several different mortgage sizes: $250,000, $300,000, $400,000, $500,000, $750,000 and $1,000,000.

The table below is based on a household having a 30-year mortgage at the current average payable owner occupier variable rate and all rate cuts being passed on in full by lenders.

Rate cuts v pre-pandemic

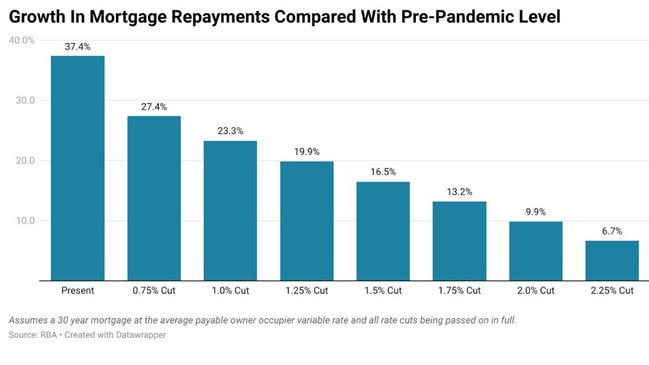

Prior to the pandemic, the average payable variable rate on an owner occupier mortgage was 3.6 per cent. Based on the size of the rate cuts forecast by the Big Four banks, the market and historical norms in the absence of a crisis or severe recession, it currently appears unlikely that the cash rate will be cut by almost 3 per cent to get mortgage rates back to where they were prior to the pandemic.

Currently, the average owner occupier with a variable rate mortgage is paying 37.3 per cent more on their mortgage than they were just before the pandemic.

In terms of the base case of 0.75 per cent worth of rate cuts forecasted by ANZ and priced in by financial markets, the average owner occupier would be paying 27.4 per cent more than in early 2020.

If a more serious downside scenario were to be realised in the economy and the cash rate were to be cut by 2.0 per cent, the average mortgage holder would be paying a little under 10 per cent more than what they were prior to the pandemic.

The outlook

Relief for mortgage holders remains on the horizon where it has spent much of 2024. Eventually it will come, but when and to what degree remains unclear.

What we do know is that the consensus expects the upcoming rate cut cycle to be more akin to tinkering around the edges than the much greater downward moves in mortgage rates Australians have become accustomed to over much of the last 35 years.

With a 1.25 per cent reduction in the cash rate, the largest rate cut currently pencilled in by the Big Four banks and the market over the next 12 to 18 months, mortgage holders may welcome the downward movement in rates, but may be left disappointed by the magnitude of the reduction.

A greater move down is certainly a possibility, but with the economy creating more than 430,000 jobs per year and inflation likely to remain in or slightly above the RBA’s 2 to 3 per cent target range, that is currently considered an outside chance.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as ‘Pushed back’: What interest rate cut cycle could really look like in 2025