More than one million Aussies facing mortgage stress

Aussies are being hit with “extreme pressure” from the cost of living crisis with millions facing an impossible choice.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

More than 1.6 million Aussies are facing mortgage stress with the figure blowing out by 88,000 more compared to the month prior, new research has revealed.

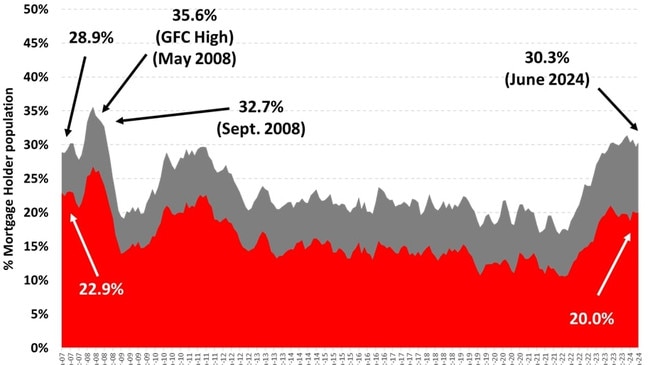

This means almost 30.3 per cent of Australia’s property owners who hold a mortgage are facing a battle to make their repayments.

The record high of 35.6 per cent of homeowners in mortgage stress was reached in mid-2008 during the GFC.

However, in the past 14 years there has been population growth and increased numbers of mortgages meaning there are now more Australians at risk of mortgage stress, according to Roy Morgan.

The data paints a grim picture for Australians trying to keep a roof over their head.

Compared to May 2022, when the Reserve Bank of Australia began a cycle of interest rate increases, the number of Australians at risk of mortgage stress has leapt by 795,000.

Interest rates are now at 4.35 per cent – the highest interest rates have been since December 2011 – and there are fears a hike is imminent in August.

Meanwhile, over a million mortgage holders are now considered extremely at risk, which is significantly above the long-term average over the last 10 years of 14.5 per cent.

Meanwhile, the latest Roy Morgan unemployment estimates for June show over one in six Australian workers are either unemployed or underemployed adding up to more than 2.7 million.

Concerns over out of control inflation have also been ratcheting up.

The ABS monthly inflation figures for May 2024 showed annual inflation at 4 per cent – up 0.4 per cent from April 2024 and the highest figure this year.

The renewed increases in the cost of living in recent months have moved the official level of inflation further away from the Reserve Bank’s preferred target range of 2 to 3 per cent target, said CEO of Roy Morgan Michele Levine.

“In addition, key inflation indicators such as petrol prices remain high – for the first time in history average retail petrol prices have been above $1.80 per litre for a record 53 straight weeks – over a full year,” she said.

But the Stage 3 tax cuts would also offset some of the mortgage stress, she added.

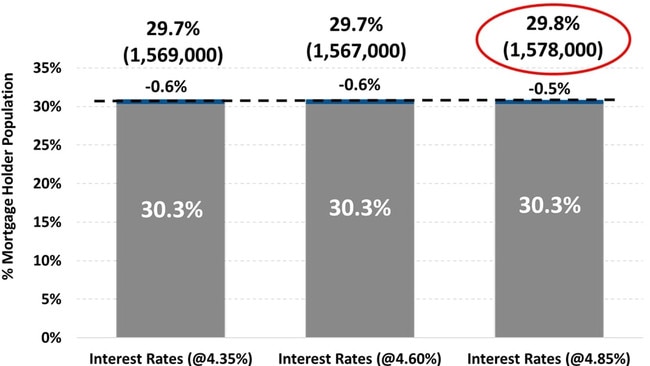

“Even if the RBA increases interest rates by 0.25 per cent in both August and September to 4.85 per cent, the level of mortgage stress would still drop by 24,000 to 1,578,000 mortgage holders considered at risk in the three months to September 2024,” she noted.

“The latest figures for mortgage stress show that when considering the data, it is important to appreciate that interest rates are only one of the variables that determines whether a mortgage holder is considered at risk of mortgage stress.

“The Stage 3 income tax cuts are delivering significant financial relief, and a boost to take home pay, for millions of Australian taxpayers – including many mortgage holders.”

However, rising unemployment figures could make things difficult for homeowners.

“The employment market has been strong over the last year – the latest Roy Morgan estimates show 673,000 new jobs created compared to a year ago – and this has provided support to household incomes which have helped to moderate levels of mortgage stress since the highs of early 2024,” she said.

However, new research also found almost a million homeowners could be forced to take drastic action if interest rates remain elevated until next year, according to Finder.

It found 165,000 people would have to sell their house if mortgage rates remain high.

Australians have been counting on a rate cut but instead have found themselves hung high and dry, said Finder’s personal finance expert Sarah Megginson.

“Many homeowners are stretched so thin financially, they’re facing the prospect of having to sell their home, or they’re turning to loved ones for support with paying their bills,” she said.

“With interest rates projected to remain high until next year – and some even calling for a hike in August – mortgage holders could be waiting longer than they expected for this pressure to ease.”

The research showed one in 10 homeowners would have to move to an interest only mortgage if rates remain as high as they are, while 4 per cent would need to borrow money to afford the mortgage repayments.

A further 3 per cent would have to rent out a room in their house and 2 per cent would be forced to ask for a repayment holiday.

Betashsares chief economist David Bassanese said the June consumer price index due out at the end of this month could make or break the case for an interest rate hike in August.

“My base case is that the CPI will come within a whisker of being bad enough to place extreme pressure on the RBA to raise interest rates next month,” he warned.

“My expectation is that annual growth in both headline and trimmed mean inflation will be 3.9 per cent in the June quarter, or just above the RBA’s latest forecast of 3.8 per cent. But if either or both annual inflation rates crack 4 per cent or more, the RBA will be under pressure to act.

“That’s because a higher-than-expected CPI would make it harder for the RBA to continue to believe inflation will fall to within the 2 to 3 per cent target band by end-2025 without further monetary tightening.

“The RBA would then face the dilemma of either having to raise interest rates – risking economic growth – or further push out the timing of when it expects inflation to within the target band – risking a lift inflation expectations and a further dent to its anti-inflation credibility.”

However, some economists are predicting a rate cut as soon as November.

KPMG chief economist Dr Brendan Rynne warned that the Australian economy was a “heartbeat away from recession” given the weakest level of growth in more than two decades.

“Households are continuing to struggle with increases in the general cost of living, which can be seen in the fall in the household saving ratio in the first half of 2024,” he said.

“This is due to gross disposable income lagging behind the rise in consumption costs, although prices for goods will start to soften in line with easing domestic demand.”

He said unemployment will also continue to rise and forecast a rate cut in the first quarter of 2025.

Originally published as More than one million Aussies facing mortgage stress