’Backfired spectacularly’: One ‘mistake’ behind Australia’s interest rate disaster

Interest rates are collapsing across the developed world – but Aussies are still paying through the teeth thanks to one huge mistake.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

Interest rates are collapsing across the developed world.

Canada, New Zealand, Europe, the UK, US and Canada, as well as a raft of other emerging economies including China, are all slashing rates.

But on Tuesday, the Reserve Bank of Australia (RBA) held the official cash rate at 4.35 per cent following its board meeting, flagging that inflation was “still too high”.

In a statement, the RBA acknowledged inflation had “fallen substantially” but was still past the “midpoint” of its target of 2 to 3 per cent, leading to the seventh consecutive hold.

Australia is now thoroughly isolated, with a stagflation problem – weak growth and strong inflation – all of our own making.

What went so horribly wrong?

Huge mistake

In macro, it is not often one can point to a mistake by a treasurer in shaping a broad measure like the cash rate.

But this time we can.

In the first months of the Albanese government, the Ukraine War erupted and so did global gas prices.

This should not have affected Australia. We have an embarrassing amount of cheap gas to deliver cheap electricity.

But, for the first time, the global gas shock transpired after the formation of the East Coast gas export cartel.

This meant that global markets, not local extraction costs, set the price of Australian gas. And boy, did we pay.

Instead of the historical price of $3 per gigajoule, Australia paid up to $72 per gigajoule for its own gas, extracted up the road for $1 per gigajoule.

This was war profiteering by the gas cartel and should have been crushed by the Albanese government.

Instead, for most of 2022, it hid under its desk, led by a treasurer terrified of upsetting foreign-owned miners.

Energy shock

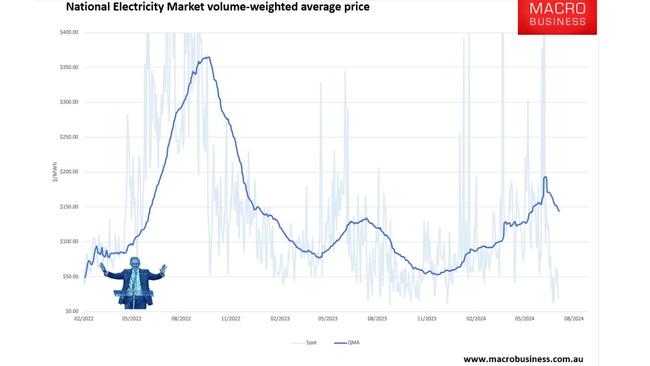

The result was a monstrously inflationary energy shock in both gas and power markets.

Although prices have come down since, they are still much higher than they were historically.

Moreover, owing to the official price setting mechanism, retail bills lag the wholesale price of electricity by a year.

So, a lot of the shock is still embedded in bills.

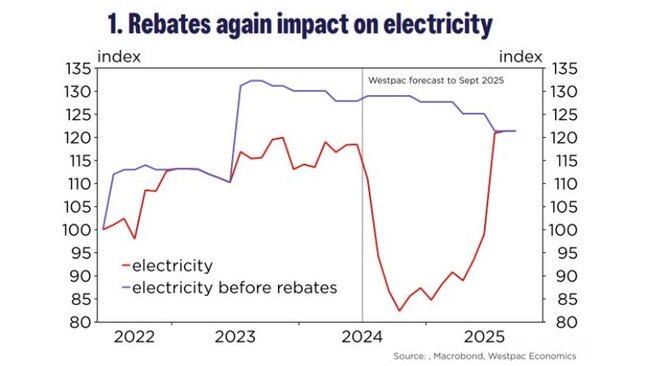

However, to avoid the retail backlash of huge jumps in utility bills, Treasurer Jim Chalmers pulled a swiftie.

He introduced household and business bill rebates that covered the cost. State governments chipped in with more, so in some states, energy costs actually fell.

An angry RBA

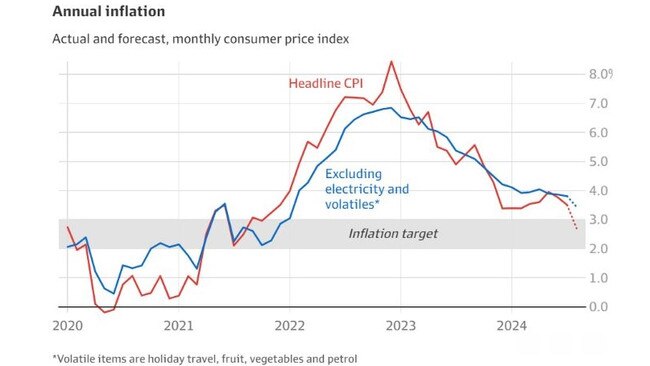

The Australian Bureau of Statistics accepted this as reducing inflation at the headline level so, as the rebates rolled out in the last quarter, the consumer price index crashed and will likely come in around 2.5 per cent.

That would normally trigger a lot of interest rate cuts.

But the Treasurer’s trick did not wash with the Reserve Bank. It uses what is called Trimmed Mean inflation, which eliminates volatile items such as energy.

Trimmed Mean or “core” inflation removes the Treasurer’s temporary rebates and so is nearly 1 per cent higher at 3.5 per cent, owing entirely to the energy shock.

The RBA won’t cut rates while it is so high.

The upshot is that a timid Treasurer allowed a foreign-owned gas export cartel to rort Australia blind and subsequent attempts to hide the fact have backfired spectacularly, as all of planet Earth – except Australia – slashes interest rates.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.

Originally published as ’Backfired spectacularly’: One ‘mistake’ behind Australia’s interest rate disaster