Experts say house prices will decline with rate rises, but not as fast as buyers hope

Experts say rising rates will slow house price growth, so how soon can buyers cash-in?

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

Rising interest rates have put the brakes on Australia’s runaway property market, but experts say further rises may not provide the handbrake stop that buyers have long-awaited.

The Reserve Bank met on Tuesday and decided to lift the official cash rate by 50 basis points, to 0.85 per cent, after bumping it up from a record-low 0.1 per cent to 0.35 per cent in May.

It was the first rate rise since 2010, and it almost immediately cooled our red-hot property market, with house prices falling that same month by 0.11 per cent nationwide.

Concerned about rising interest rates? Read Compare Money's guide to fixed rate v variable home loans >

Evidently, the RBA’s effort to curb inflation in the wake of Australia’s remarkable economic recovery out of the pandemic worked.

And with all signs pointing toward another rate rise on Tuesday, news.com.au asked PropTrack economist Paul Ryan what it could mean for house prices, and borrowers in the short and long-term.

“We’re likely to see continued slow growth in housing prices as the cash rate increases,” Mr Ryan said. But he admitted it was difficult to predict exactly when and how much it will affect the market.

“It normally takes a little while for interest rate rises to start to affect (house) prices.

“I think, while it’s correlated, it’s more coincidental that we saw these first housing price falls in May, right after the RBA raised rates for the first time in over a decade.”

He said the price slump was less-so caused by the RBA’s decision and more a side-effect of inflationary pressures and buyers growing more cautious in anticipation of a rate rise which caused a “dramatic slowdown in growth that has culminated in a fall”.

That said, what in emerging with the interest rate rises is a “two-speed housing market”, Mr Ryan said, where growth is stalling in the most expensive capital cities (Sydney, Melbourne, the ACT) but continues in the more affordable capital cities (Brisbane and Adelaide) and regional areas.

“Because interest rates will affect different parts of the country slightly differently, just purely because margins are higher in the biggest cities and the ACT,” he said.

But the RBA is not actively targeting house prices when they raise interest rates.

“It’s kind of a collateral effect of what they’re trying to do,” Mr Ryan said. “Which is take a bit of money out of the economy to dampen those inflationary pressures.”

The effects on house prices will ripple out based on how the major banks respond to the RBA’s decision: whether and by how much lending standards tighten, borrowing capacities decline, or mortgage repayments increase.

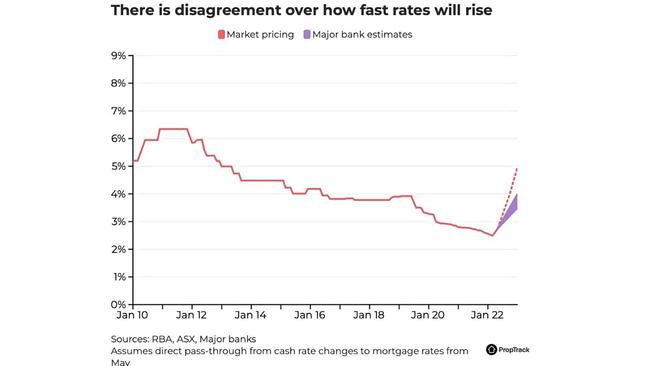

While nobody expected today’s “super-size” rate rise, Mr Ryan said the more important question was where the cash rate ends up at the end of the year – whether it rises to between 1.5 per cent and 1.75 per cent, as the banks predict, or above 2.5 per cent as financial market pricings predict.

“That (2.5 per cent) would imply that the RBA is going to raise rates at every single meeting for the rest of the year, if they go by 25 basis point increments,” Mr Ryan said.

“The difference between those two figures, that’s the thing that really matters for house prices.

“If we have the cash rate going up by another 2 percentage points (to over 2.5 per cent) then that would increase mortgage repayments by about 24 per cent.”

“If we get the bigger cash rate increases, that reduces borrowing capacity by close to 20 per cent. And that’s quite significant,” Mr Ryan said, because property prices would need to drop by more than this to leave buyers’ better off.

In short: the more interest rates rise, the more lenders will work to repair their net interest margins, and the more buyers’ borrowing capacity declines. While mortgage rates increase.

If buyers have less money to bid at auction, the market shifts to the new buying standards, and house prices (could, slowly) drop.

Experts predict house price drops anywhere between 5 per cent and 15 per cent, which the RBA estimated in their latest Financial Stability Review, over a two-year period.

And although it’s not the handbrake stop buyers hope for, and it may not be enough to immediately compensate for the reduced borrowing capacity, Mr Ryan (and the RBA) say raising rates will slow inflation to let wage growth catch-up (which makes it easier to make repayments), and ensure the economy grows sustainably.

Originally published as Experts say house prices will decline with rate rises, but not as fast as buyers hope