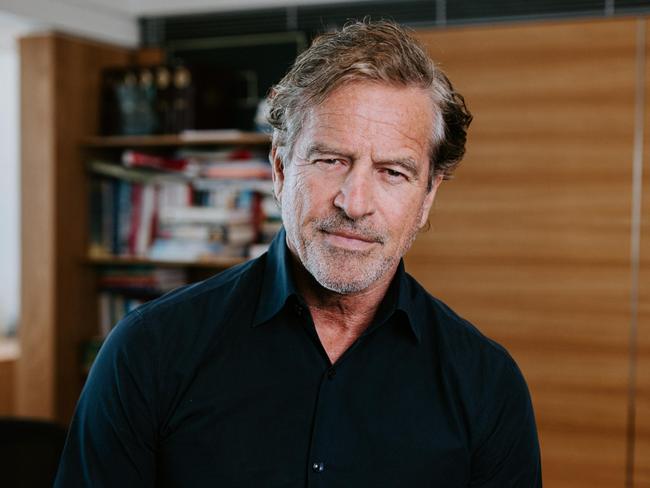

‘Definitely’: Mark Bouris’ grim recession claim

Finance guru Mark Bouris' has delivered a grim wake up call on the state of the Australian economy.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

Finance guru Mark Bouris' has delivered a grim wake up call on the state of the economy, claiming the country is “definitely” in a recession – and has been for quite some time.

Speaking ahead of the RBA’s rate decision on Tuesday, the Yellow Brick Founder said the country has been in a recession for over a year, based on the country’s GDP per capita.

“I want to be a bit crazy here … on a per capita basis, we’ve been in recession for about 18 months,” Mr Bouris' told Ben Fordham on Sydney’s 2GB radio.

“If you (look at) what is the GDP growth numbers per capita … given that we’ve had nearly a million people come to the country over the last two years, we are definitely in a recession.”

A recession is defined as two consecutive quarters of negative growth decline in real (inflation-adjusted) gross domestic product (GDP).

In Australia, the GDP per capita, a measure for living standards, fell 0.4 per cent over the first three months of 2024 and 1.3 per cent over the past year.

“I don’t know why they don’t look at that (per capita) number. They just look at the overall number,” said Mr Bouris'.

“But on a per capita, we are absolutely (in a recession) which means our standard of living is reducing.”

“The standard living per person in this country is lower than it was two years ago.”

Addressing fears of a possible US recession, Mr Bouris' pointed to the “Sahm rule” – an indicator that a recession is imminent or underway.

“(Economist Claudia Sahm) has put up a proposition that has been around for a long time now that says that if in a three-month period, if you get a half a per cent variation in unemployment compared to the whole year’s lowest unemployment number – which is what’s happened in America – then we’re going to have a recession in the US.”

A year ago, the US unemployment average was 3.6 per cent, so 4.3 per cent. July’s figure, is 0.7 basis points above that.

“They’re basically saying there’s going to be recession US, the Federal Reserve’s gone too hard, which is what our RBA’s got to be careful of … our RBA has been going too hard for too long. Give it a rest.”

US’ disappointing new jobs figures

It comes as US jobs data released last week ignited fears of a global recession.

Figures showed the jobs market of the world’s largest economy cooled much more than expected in July with unemployment reaching its highest rate since 2021, fuelling calls for interest rate cuts as high levels bite.

In July 114,000 jobs were added, down from June’s revised 179,000 figure, said the US Department of Labor.

The jobless rate rose to 4.3 per cent, the highest since October 2021, according to government data.

Wall Street stocks slid further into the red on Friday with the tech-heavy Nasdaq index dropping as much as three per cent after the employment report.

It’s now down more than 10 per cent from an early July high.

Australian share market suffers worst day since May 2020

As fears of a recession grow in the US, the Australian share market suffered its worst day in more than four years on Monday.

The S&P/ASX 200 index lost 3.7 per cent and $102bn of value, with consecutive record highs set last week seeming a distant memory.

Analysts say Monday’s trading in Australia mimicked a defensive rotation seen in the US after windfalls across Wall Street, particularly in tech shares, in recent weeks.

It was the ASX tech equities leading the wipe-out on Monday, losing six per cent.

Logistics software firm WiseTech Global tanked nearly nine per cent, falling to $84.26. It is one of the very few mid to large-cap tech companies to have declined over the past 12 months.

There was a flurry of trading on data centre operator NEXTDC, which lost 7.3 per cent to close at $15.67.

The ASX 200 financials sector sunk a shade under five per cent as a whole, with some staggering standouts.

Betashares CRYPTO Innovators dropped more than 21 per cent, limping to $4.00 at the close.

Vaneck Bitcoin followed suit, closing 16.3 per cent down at $16.82.

Originally published as ‘Definitely’: Mark Bouris’ grim recession claim