Domino’s swings to first half loss

The pizza chain has slammed the brakes on its aggressive global expansion and shuttered stores and cut costs, causing heartburn for investors with the company swinging to a loss.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

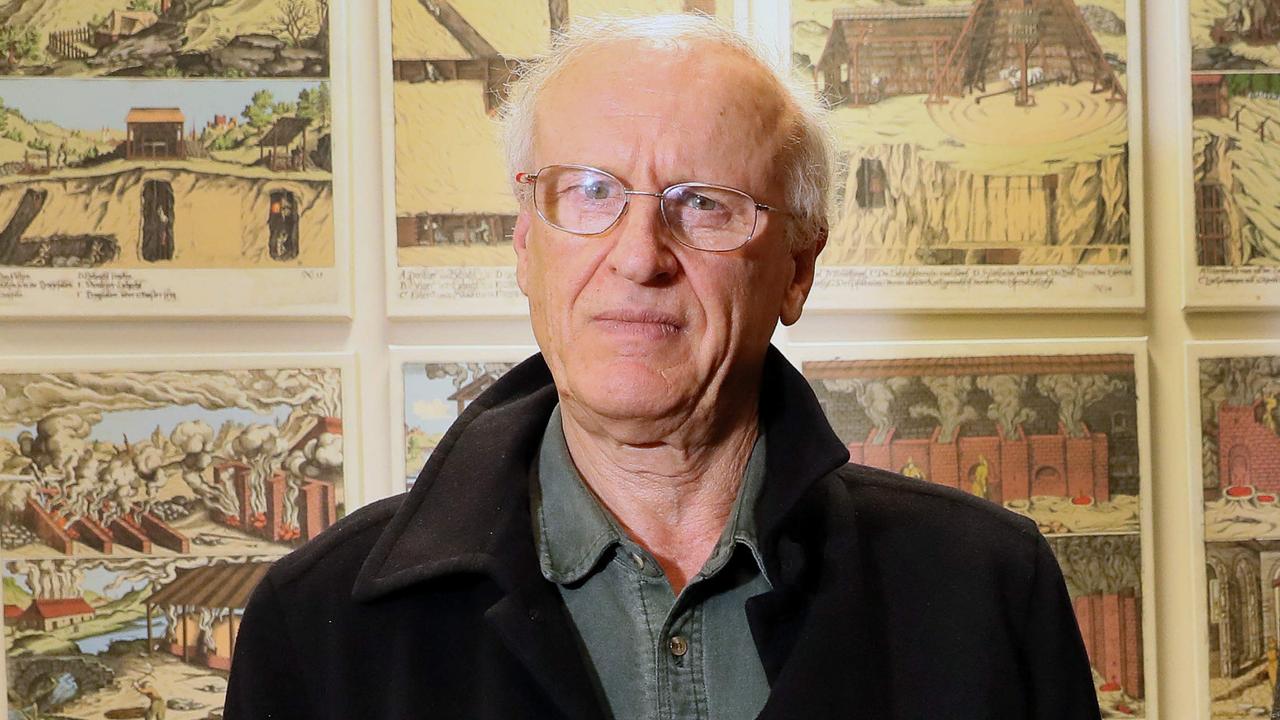

Domino’s Pizza has slumped to a loss, hit by a string of writedowns and restrucuting costs, with new chief executive Mark van Dyck pledging to return the company to profitability as he simplifies the business.

The company has reported a loss of $22.2m for the six months to December 29, smashed by $115.6m in writedowns, impairments and restructuring costs.

Acting quickly to close loss-making stores, reinvest in the business and create a “simpler and better Domino’s”, Mr Dyck’s first few months at the helm have already started to cause some heartburn for investors with the pizza maker plunging into losses and two out of its three regions suffering from sliding earnings.

Its flagship Australian business did see an improvement in earnings for the first half but overall same store sales growth for its stores from Melbourne to Tokyo and Paris fell 0.6 per cent against 1.3 per cent growth in the previous corresponding period. The company, which has operations across Australia, New Zealand, Japan and Europe, said sales dropped 6.4 per cent to around $1.17bn.

Despite the loss against a profit of $58m for the first half of 2024, and weaker sales, Domino’s did maintain its dividend at 55.5c a share, payable on April 2.

Investors knew that some earnings pain was coming, after earlier this month Mr van Dyck – only three months in then role – slammed the brakes on Domino’s breakneck expansion under its former CEO Don Meij, by announcing the closure of 205 loss-making stores, of which 172 will be in its struggling Japanese market.

Domino’s has begun that painful journey and in the first-half accounts unveiled $115.6m in significant items which plunged the company into the red. These one-off items include $80.6m in impairments and writedowns for the closure of stores, $11.3m in writedowns to assets, land and buildings and $6.6m in restructure costs.

Domino’s reported pretax earnings of $100.6m, down 6.7 per cent, and in line with guidance at the recent trading update in February.

“At our recent trading update we announced the first outcomes of a detailed operational and financial review to create a simpler and better Domino’s, including taking decisive actions to close loss-making stores and deliver savings to reinvest in growth,” said Mr van Dyck.

“Those steps were the first in a comprehensive business review, which is ongoing, designed to improve profitability, strengthen franchise partnerships, and position the business for long-term sustainable growth and improved shareholder returns.”

Across its regional operations, its local operations were strong with earnings up 7.6 per cent to $67.7m. But this was offset by a weaker performance in Asia, down 19 per cent to $17m, while earnings from Europe dropped 11 per cent to $32.3m. Its operations in Japan and France were the subject of close focus as management work to turnaround their underperformance.

Mr van Dyck said cost control plus sales growth was a “powerful equation” in its business with the Domino’s model delivering great leverage for stores as they build sales.

“But we know there is more work to be done. The 13.7 per cent improvement in franchise partner profitability is an important step in restarting our growth flywheel, underlining the importance and urgency of more savings and sales.

“These results demonstrate early progress, however we have more to do to restore value for our shareholders, franchise partners, and customers – as we do so, we will be prioritising profitable same store sales growth similar to other retailers, with selective store additions.”

Originally published as Domino’s swings to first half loss