Daniel Grollo’s bid to settle Grocon debts delayed by creditors

As Daniel Grollo tries to settle his Grocon debts, creditors want more information around loans to companies under his control.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Daniel Grollo’s bid to settle his Grocon debts has hit a road bump with creditors succeeding in extending the administration process in a bid to gain more information around millions in personal lending and family assets.

Key creditors including property fund APN Property Group and the Australian Taxation Office backed a motion to extend the administration process for 10 days at a second meeting of creditors held on Tuesday.

The extension was granted against the recommendation of Grocon administrator KordaMentha.

Major creditors, led by APN, are seeking more information around millions of dollars in lending made to Mr Grollo and companies controlled by him and his former wife.

They also want more information around the assets held by companies controlled by the Grollos — including an apartment in the US — which remain outside the administration process, as well as Mr Grollo’s build-to-rent property business which continues to operate.

“What we are looking for is some transparency from Daniel about what assets exist,” APN representative Anthony Simpson told the meeting.

KordaMentha had recommended creditors, who are owed about $100m, accept a deed of company arrangement drawn up by Mr Grollo to settle their debts.

KordaMentha director Craig Shepard argued against extending the administration, telling the meeting he had already asked for detailed information around the issues raised by APN but had limited power to force Mr Grollo to hand it over.

“It’s not a knock it out of the park DOCA,” Mr Shepard said.

“Everything you have asked for is all valid. I can ask but we will be back … with all the same information because they can tell me to bugger off.”

Mr Shepard said a liquidator would have the power to probe Grocon further, but warned it was a risky process and creditors were likely to get less than what they would under Mr Grollo’s proposed settlement.

Speaking at the meeting, Mr Grollo said he had provided more information than he was legally required to and noted there were business confidentiality issues to take into account.

“Given that there are some concerns — I fear that there will be concerns at the end of 10 days — if a 10 day adjournment is proposed we will be supportive of that to clarify the situation if in fact that it can be clarified,” he said.

Mr Grollo apologised to creditors and said every decision he had taken had been with their interests in mind.

“I would like to thank you for your patience, support and understanding,” he said.

“Many of you have contacted me personally over recent months expressing empathy and backing me even though the stakes are high.”

Mr Grollo laid the blame for Grocon’s downfall over its dealing with NSW Infrastructure at a former project at Barangaroo in Sydney.

Grocon is suing the NSW government for $270 million amid a dispute centered on views of Sydney Opera House and Harbour Bridge.

“We have secured litigation to fight to the very end,” Mr Grollo said of the case.

“I believe we will win the fight.”

As part of his proposed settlement with creditors, Mr Grollo will tip in $10m and also sell his level 80 Eureka Tower penthouse.

That will ensure Grocon employees and small creditors — those owed less than $10,000 — are paid in full.

But larger creditors will only get their money in full if Grocon wins its case against the NSW government.

Some large creditors risk getting back 3c in the dollar.

Mr Grollo’s former wife, Kat, has also claimed ownership of the Eureka Tower penthouse.

KordaMentha’s Mr Shepard told the meeting that Ms Grollo had informed him that she will drop the penthouse claim provided she is provided with Eureka Tower’s rooftop space which is leased out.

Mr Grollo retains ownership of the roof space, valued at $2.9m by administrators, under his proposed settlement.

Mr Shepard said he did not believe Ms Grollo had any valid claim to any assets controlled by administrators.

“I personally don’t believe there is a strong case for Mrs Grollo to claim any ownership or any equity in any of the assets that we control,” he said.

The adjournment complicates Mr Grollo’s attempt to walk away from the legacy construction arm of Grocon and focus on the build-to-rent side of the business which remains operating.

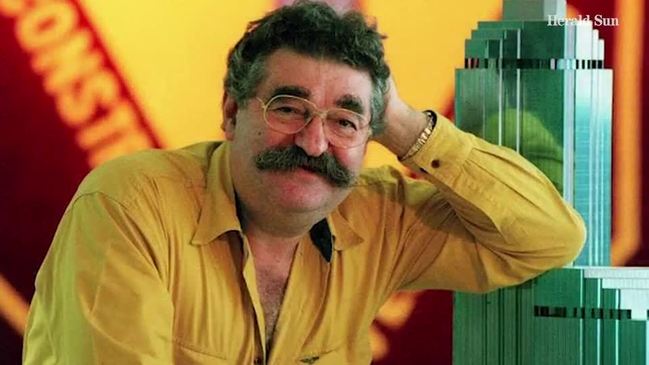

Grocon built Eureka Tower in Riverside Quay Southbank, along with other Melbourne landmarks including the Rialto, Crown Casino and the Emporium shopping centre.

But it has fallen on hard times in recent years, calling in administrators in November.

Three generations of Grollos turned a small concerting business into the nation’s largest private building company over six decades.

Mr Grollo took full control of the business in 2012.