Covid-19 lockdowns overshadow profits surge

The prospect of snap lockdowns across the nation in coming months has cast a shadow over what had been shaping up to be a bumper profit season.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The prospect of snap lockdowns across the nation in coming months has cast a shadow over what had been shaping up to be a bumper profit season, with corporate Australia expected to take a more cautious stand towards the earnings outlook and potentially dividends.

Market consensus is for ASX100 earnings per share to rebound 50 per cent for fiscal 2021 before rising a further 9 per cent in the current financial year. That follows a collapse of earnings last financial year as Covid hit.

Resources and financials will drive the earnings rebound on the back of higher commodity prices, a booming housing market and consumer spending.

“However, given recent lockdowns, and the risk of future lockdowns amid the Delta variant of Covid, there is a material increase in economic uncertainty,” UBS analysts led by economist George Tharenou said.

“Hence, some companies may withdraw guidance, or pause planned dividend increases to keep balance sheets strong,” they said, noting that businesses have also faced cost pressures and capacity constraints through 2021.

Indeed, UBS sees labour shortages deteriorating further while international borders remain closed.

On Friday Prime Minister Scott Morrison said Covid restrictions such as lockdowns and border controls wouldn’t be eased until the nation reached the 70 per cent vaccination threshold.

Over the weekend a snap lockdown was imposed in southeast Queensland to tackle a growing outbreak centred on several schools, including Brisbane Boys Grammar. The lockdown is expected to be extended into this week after nine new cases of Covid-19 were confirmed on Sunday. In addition, NSW remains under its longstanding lockdown orders after the state reported 239 new cases on Sunday.

Citi has taken a similar view on the outlook and sees the Delta variant and potential for extended lockdowns as a driver for listed companies to withhold guidance.

But unlike UBS, it is still looking for listed companies to reward investors with a decent dividend haul.

“Expect big dividends with buyback potential from BHP, Rio Tinto and Fortescue off the back of strong cashflows and under-geared balance sheets,” UBS said.

“Buybacks are also forecast for the big banks following ANZ’s recent buyback.” National Australia Bank on Friday also flagged a $2.5bn share buyback.

The broker expects the previous lockdown winners and losers to stay in their lanes, meaning “more upside can be found in banks, mining, healthcare, retail, and REITs (fund managers & residential developers).

“Conversely, the technology sector and retail landlords have more potential for downside.”

Following a strong year of economic recovery, Citi puts the potential upside outweighing the downside surprises at 2:1.

The lower Australian dollar, meanwhile, will affect guidance, according to Morgan Stanley.

A tactical push towards US70c “turns the table on what has been a valuation and earnings headwind for the global grower cohort,” the broker said.

This “sits well with our focus to hedge out mid-cycle rotation dynamics with enhanced quality exposure”.

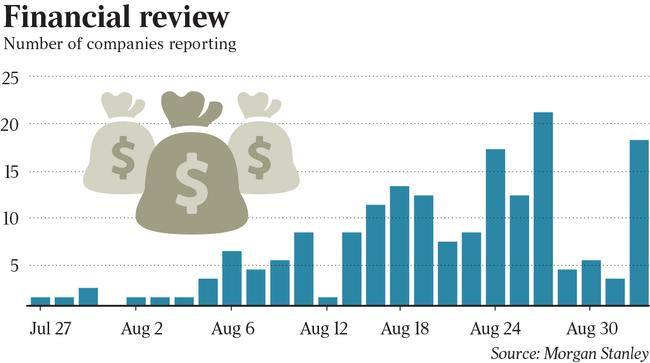

The ongoing lockdown in NSW and a snap lockdown in Queensland would mean a more volatile earnings season for domestic-facing sectors than anticipated just weeks ago, with the scrutiny now on margins rather than sales, Morgan Stanley said.

“The escalating (and extending) lockdown in NSW and now a further snap reaction in other states comes at a time when cost pressures are rising and crisis assistance is more piecemeal in nature.

“A new back-story could be required when selling the next outlook statement – making the results season possibly more volatile and domestic outlooks (and margins) will be in focus.”

While resources and financials are expected to account for much of the earnings rebound, analysts are also watching for outperformance in the retail sector.

“This earnings season will see retailers report strong performance but with significant uncertainty regarding the outlook,” Citi said.

Investor focus would be on the impact of lockdowns on the fiscal 2022 outlook, the broker’s analysts told clients.

“There is risk that some degree of mobility restrictions, either mandated or self-imposed, will remain for sections of the public even after lockdowns are eased, for which the timing is also uncertain,” Citi said.

“In our view, we think the lockdowns will constrain demand despite positive underlying factors supporting latent demand. We do not expect retailers to provide guidance for fiscal 2022.”

Among the candidates Goldman Sachs sees surprising on the upside are Super Retail, Healius, Origin, Pepper Money, Viva Energy and Coles.

“We are expecting the August result and fiscal 2022 outlook commentary at the result to confirm our expectation that energy markets have troughed and should steadily rebuild from fiscal 2023,” the broker said of Origin.

This will be underpinned by rising domestic gas and electricity prices as well as the rebound in global LNG and oil prices.

“We believe Origin is well positioned to consider capital management over the next 12 months and is currently trading on around a 17 per cent free cashflow yield,” the analysts said.

Non-bank lender Pepper, meanwhile, has a strong growth outlook, while Super Retail will continue to benefit from international travel restrictions and investors could see a positive surprise from Coles’ liquor and express divisions, they added.

“Importantly, we expect to see improvement in key metrics like e-commerce penetration and market share,” analysts said.

“Additionally, we forecast the outlook for fiscal 2022/23 to remain strong … Coles continues to trade at a significant discount to Woolworths and we expect this discount to narrow as the underlying margin improves.”

The broker’s negative candidates are Seek, CSL, Fortescue, Magellan and Ingenia Communities.

Originally published as Covid-19 lockdowns overshadow profits surge