Real estate agents could face fines, jail time for superannuation advice

Australia’s corporate watchdog has warned real estate agents could face heavy fines and even jail time by advising vulnerable tenants to access superannuation to pay rent.

Super

Don't miss out on the headlines from Super. Followed categories will be added to My News.

Real estate agents could face heavy fines and even jail sentences by advising tenants to access their superannuation early to pay rent.

Australia’s corporate watchdog has issued a letter to the real estate institutes of each state, warning the advice could constitute a breach of the Corporations Act.

“Financial advice must only be provided by qualified and licensed financial advisers, or financial counsellors, not by real estate agents who neither hold the requisite licence, nor are an authorised representative of an Australian Financial Services Licensee,” the letter from the Australian Securities and Investments Commission (ASIC) enforcement director Tim Mullaly says.

“The Corporations Act imposes significant penalties for a contravention of section 911A. For individuals this can be a maximum of 5 years imprisonment, and/or a fine of up to $126,000 (600 penalty units), and for corporations a fine of up to $1,260 million dollars (6000 penalty units).”

The letter says that pointing tenants to, and recommending them to “consider the specific possibility of accessing superannuation” would likely amount to a breach of the Act.

ASIC said it would be raising the issue with state regulatory bodies. It urged real estate institutions to circulate the letter with their members, adding it would write directly to real estate agencies alleged to have breached the law.

“ASIC intends to monitor this situation closely, and if contraventions of the licensing requirements of the Corporations Act are found, ASIC will not hesitate to act swiftly to protect vulnerable consumers,” the letter says.

Real Estate Institute of Australia president Adrian Kelly said agents should not be providing financial advice.

He added he was pleased there would be government announcements today which would establish “some grount rules” following Prime Minister Scott Morrison’s announcement on Sunday that the states and territories would move to ban rental evicions for the next six months.

“Agents should not be providing financial advice to anyone as that’s illegal. Financial advice must only be provided by qualified and licensed financial advisers,or financial counsellors,” Mr Kelly said.

“Thankfully today we will receive some government announcements around tenants and property owners which will lay the ground rules so we can start to clean up some of this mess.”

WATCHDOG WARNING AFTER TENANTS TOLD TO PAY RENT WITH SUPER

Yesterday, ASIC warned tenants to ignore unsolicited financial advice after real estate agents were caught suggesting they access their superannuation early to pay rent.

A war of words also erupted between the Australian Council of Trade Unions (ACTU) and the Real Estate Institute of Australia (REIA) after the peak union body asked the Institute to tell its members to stop giving tenants the advice.

ASIC said only qualified individuals were able to provide advice on accessing superannuation, and warned early withdrawals could impact retirement options.

“Anyone who gives financial advice must have an Australian financial services (AFS) licence or be an authorised representative of a licensed business,” an ASIC spokesperson told News Corp Australia.

“You should only seek advice from licensed advice businesses or authorised financial advisers. “You will be better protected if things go wrong and you will have access to free dispute resolution services.”

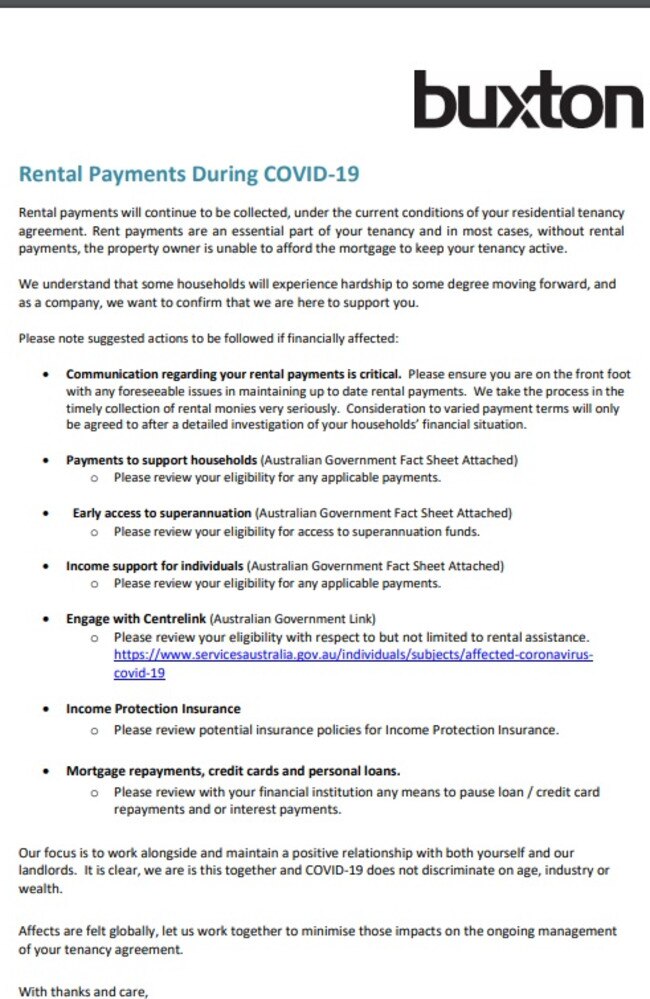

The warning comes after News Corp Australia recently revealed renowned Victorian real estate chain Buxton, and Leo Tsimpikas Real Estate in Brisbane provided a list of suggested actions tenants could take if their income had been affected.

Both agents suggested tenants could access superannuation early, apply for Centrelink payments and ask financial providers to pause loan repayments.

Labor’s Shadow Assistant Finance Treasurer Stephen Jones called on ASIC to issue a warning” to real estate agents after evidence of them providing “unqualified financial advice” had emerged.

“There are now widespread media reports of real estate agents advising tenants to access their superannuation funds if they are facing difficulty in paying their rent. We have received copies of some of these communications,” Mr Jones wrote in a letter to ASIC commissioner James Shipton seen by News Corp Australia.

“We are concerned that this advice may not be in the best interest of individuals.”

“Financial advice should only be provided from qualified advisers and financial counsellors, not their real estate agent,” he wrote.

“We ask you to consider issuing a warning on this matter.”

The ACTU has also taken aim at agents’ “unhelpful and unsolicited financial advice”.

ACTU president Michele O’Neil has written to the REIA asking it to instruct members to stop sending it.

“We have been made aware that many renters have received threatening correspondence from their real estate agents regarding the payment of rent and notice around evictions,” Ms O’Neil wrote to REIA president Adrian Kelly.

She said ACTU members had told of an unwillingness among landlords and real estate agents to “broker a temporary rent freeze or reduction through this crisis”, who had also advised tenants to withdraw from their superannuation and presumed their eligibility for JobSeeker payments.

She asked the REIA to “desist from providing financial advice to tenants” and suggested implementing temporary rent freezes.

She said it should tell landlords that they could access mortgage relief “through nearly every bank”.

MORE NEWS:

Best ways to get instant financial help during COVID-19

What AirBnB’s $405m lifeline means for Aussie hosts

Virgin ‘wont get $1.4b bailout’

Defiant Aussie travellers ‘should pay own quarantine costs’

In a response to the letter, Mr Kelly told News Corp: “The priority for our people at the moment is looking after our tenants and property owners in particular those that have lost employment.”

“I would have hoped that the ACTU would be doing the same with its own members in achieving practical outcomes for everyone instead of writing letters making scurrilous claims.”

Prime Minister Scott Morrison said the states and territories would move to ban rental evictions for the next six months.

It’s understood the National Cabinet meeting on Friday will further consider the issue of rental and commercial tenancies.