What led to Nine’s shock takeover of Fairfax

FAIRFAX Media will be gobbled up by Nine Entertainment in a takeover that shocked the industry. Here’s the chain of events that led to the media shake-up.

Media

Don't miss out on the headlines from Media. Followed categories will be added to My News.

FAIRFAX Media will be gobbled up by Nine Entertainment in a takeover some commentators fear will further reduce media diversity but which has the backing of the federal government.

The merger, which would create a $4 billion media giant, needs consumer watchdog approval but has been made possible by changes to media ownership laws introduced by the Turnbull government.

Here’s a look back at the chain of events that led to the takeover that shocked the nation.

2018

JULY 26:

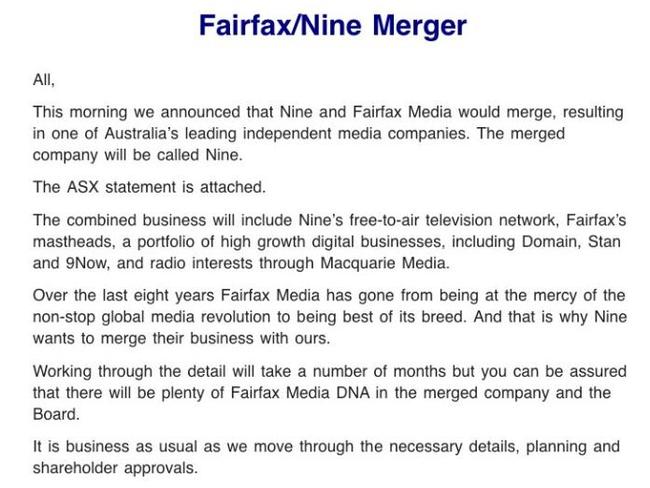

*Fairfax and Nine announce a $4.2 billion friendly takeover of Fairfax by Nine revealed with hopes with will generate annualised cost savings of $50 million.

J ULY 18:

*Fairfax signs off on deal with News Corp Australia to share printing networks, with the closure of two Fairfax print centres in NSW and Queensland, saving $15 million a year.

MARCH 6:

*The owner of New Zealand’s top-selling newspaper, NZME Ltd said an agreement to merge its operations with Fairfax Media’s New Zealand unit Stuff Ltd was terminated and new terms must be agreed if the deal is to go ahead.

FEBRUARY 21:

*Fairfax announced sale or closure of more than a third of its New Zealand print publications. It had 28 mastheads.

*Fairfax records a 54 per cent fall in first-half net profit to $38.5 million after restructuring and redundancy costs.

2017

DECEMBER 12:

*Fairfax became the first traditional media company to sign up to a partnership with Google to boost advertising and digital subscription growth across mastheads.

NOVEMBER 16:

*Domain lists on ASX as a $2 billion separate company with Fairfax retaining 60 per cent stake.

JULY 2:

*Fairfax announces Domain spin-off after it failed to entice private equity buyers to take over the media and real estate company. TPG Capital and Hellman & Friedman withdrew separate buyout proposals of about $2.8 billion after Fairfax resistance. Fairfax’s share price fell sharply to a three-month low.

JUNE 19:

*Fairfax rejects proposal for 54.5 per cent of its Macquarie Media radio asset from a consortium including businessman John Singleton.

MAY 15:

*TPG Capital and Hellman & Friedman make first proposed takeover approaches to Fairfax and bidding war commences.

*Fairfax journalists miss federal budget lockup for the first time due to strike.

*SMH, Age, Brisbane Times, WA Today journalists strike after hearing a quarter of newsroom staff — 125 persons — will be made redundant. It became the worst case of industrial action seen at the company since the 1980s.

APRIL 5:

* Fairfax announces plans to cut costs by $30 million after sharp advertising and circulation declines.

FEBRUARY 13:

*First-half net profit jumps to $83.7 million, from $33 million in the previous corresponding period.

*Editor-in-chief positions for major mastheads, SMH and The Age, dropped and new Editors appointed.

FEBRUARY 1:

*Fairfax settles defamation action brought by former Leighton boss Wal King with an apology and payment.

2016

AUGUST 10:

*Fairfax has a full-year net profit loss of $893.5 million, after $485 million writedown of its media operations.

MAY 6:

*Fairfax flags end to weekday print editions of The Sydney Morning Herald and The Age due to falling ad revenue. This never eventuated.

MARCH 17/18:

*Fairfax journalists voted to go on strike hearing 120 editorial jobs would be axed from mastheads in Sydney and Melbourne. Workers walked out ahead of Saturday newspaper editions.

*Fairfax rejects reports it’s considering buying a stake in Nine Entertainment as a “total fabrication”.

2015

AUGUST:

Fairfax made an $87 million profit in 2015.

JULY 10:

*About 43 full-time, including 37 editorial, jobs cut from 17 NSW Fairfax community papers.

JUNE 30:

* Fairfax loses defamation action brought by former Liberal Treasurer Joe Hockey.

MARCH 31:

*Macquarie Radio Network merger with Fairfax Media’s radio network gets shareholder approval giving Fairfax access to ad streams from the highly successful 2GB and 3AW.

MARCH 26:

*Nick Falloon takes over as Fairfax Media Chairman.

FEBRUARY 6:

*Billionaire mining heiress Gina Rinehart sells her $306 million stake in Fairfax Media at 86.75 cents a share. Her iron ore company Hancock Prospecting was Fairfax’s largest shareholder, with a 14.99 per cent stake before the sell down.

2014

NOVEMBER 20

*Fairfax boss Greg Hywood declares the media group is in good shape.

AUGUST 14:

*Annual earnings back in the black with a $224 million profit.

2012

DECEMBER 1:

*Fairfax chairman Roger Corbett confirms Gina Rinehart cannot join the Fairfax board without agreeing to its governance rules, while also expressing regret for not buying digital media companies and refusing to rule out more outsourcing of work.

*The board denied Mrs Rinehart a seat on the board because of her alleged refusal to accept Fairfax’s charter of editorial independence.

JUNE 17:

*Fairfax announces the biggest shake-up in its history by axing; More than 1,900 jobs axed, printing presses closed and broadsheet format for the Sydney Morning Herald and The Age dumped for “compact” tabloid style editions.

AUGUST 23:

*Annual net loss for Fairfax blows out to out to $2.73 billion for 2011/12.

FEBRUARY 1:

*Gina Rinehart became Fairfax’s biggest shareholder, purchasing a 14 per cent stake in the company.

2011:

John B. Fairfax and his family investment company, Marinya Media, sold their remaining 9.7 per cent stake in the company.

2010:

Gina Rinehart began amassing shares in Fairfax.

EARLY 2000s:

Fairfax buys New Zealand’s Independent Newspapers Limited in 2003, dating site RSVP and Stayz in 2005. Stayz was later sold for $220 million in 2013.

In 2006, Fairfax is known at the time as John Fairfax Holdings.

On January 12 2007, John Fairfax Holdings officially changed its name to Fairfax Media. The company bought radio assets for Southern Cross Broadcasting: 2UE Sydney, 3AW and Magic 1278 Melbourne, 4BC and 4BH Brisbane, and 6PR and 96fm Perth.