It was the fitness fad that had the world lunging, squatting and sweating.

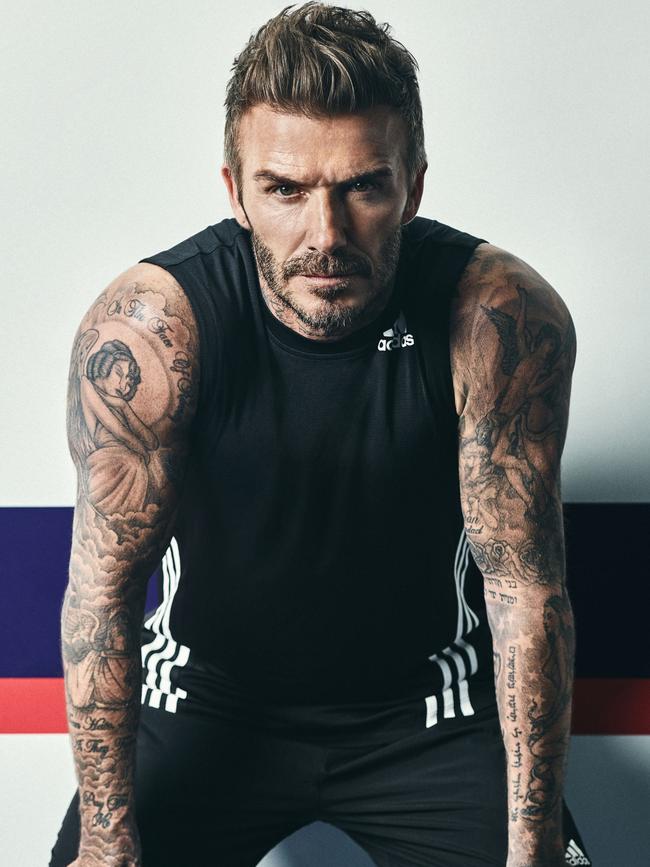

Propelled to a billion-dollar stock exchange listing in the Big Apple by celebrity endorsements from the likes of Mark Wahlberg, David Beckham and Greg Norman, F45 made its founders rich and lured in hundreds of Aussies keen to own their own gym.

But with the chain now in dire trouble, battling a falling share price and desperate-to-sell franchisees, News Corp can reveal other business strategies F45 is alleged in court to have used to build its globe-spanning fitness empire, including using tax haven companies and allegedly fake exercise bikes.

Celebrity sportsmen Beckham and Norman are also suing in a Los Angeles court case, alleging F45 has failed to pay them US$15m ($A22m) owed in return for promoting the chain’s brand of high-intensity workouts. F45 denies the claim.

SEE THE LA COURT DOCUMENT:

If you’re having trouble reading this document on our news app, try here.

Founder Rob Deutsch, who received an estimated US$145m ($A215m) after selling his stake before the company floated in 2021, continues to live well. Three weeks ago, he and model wife Nicole Person added to an already bulging luxury property portfolio by splashing $36m on a mansion in exclusive Sydney suburb Bellevue Hill.

“I’m upset for the franchisees, I’m upset for the business and the investors,” Mr Deutsch told News Corp. “I wish them all nothing but the best for the future - there’s definitely a turnaround potential there.”

After the stock exchange listing, co-founder and former chief executive Adam Gilchrist (not the cricketer), emerged owning a quarter of the company, worth US$367m ($A540m) at the time.

But Gilchrist, who left the company last July as it admitted it would not hit its forecasts, has disappeared from sight and is mired in a multimillion-dollar lawsuit brought by a pair of Sydney lawyers and a private eye.

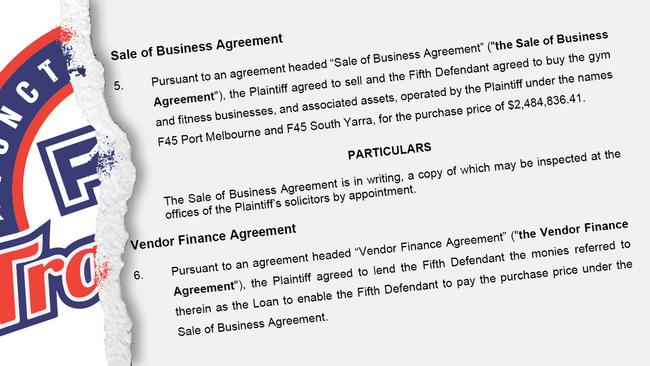

Franchisees are also suffering from the turmoil. The owner of what was once F45’s biggest Australian gym, in Port Melbourne, closed the last of his three studios last week while listing sites show close to 100 franchises are on the market for as little as $59,000 – well short of the minimum of $261,650 it costs to set up a new one.

“It seemed that all people in positions of management seem to be very antagonistic and forthright, egotistical, like you couldn’t have a pragmatic discussion with them, they would shut you down,” one former F45 franchisee told News Corp.

He said F45 was a pioneer of “functional fitness”, but now faced stiff competition.

“I think people are starting to realise, well, I should sell now before it gets a little bit harder,” he said.

F45 was valued at US$1.6bn ($A2.37bn) when it listed on the New York Stock Exchange in July 2021 but is now worth just US$240m ($A355m), delivering financial pain to investors.

The company makes its money by selling franchises and exercise equipment to fitness trainers who operate each gym independently. Each costs between $261,650 and $540,000 to set up, including the fee paid to F45, equipment, rent to the landlord and other expenses.

In return they are promised a “dynamic and unique business opportunity” that “can help you change your life”.

But for Luke Hogbin and his wife, Emily Crawford, the dream is over. Until recently, they ran three F45 studios, including what was Australia’s No. 1 operation, in Port Melbourne.

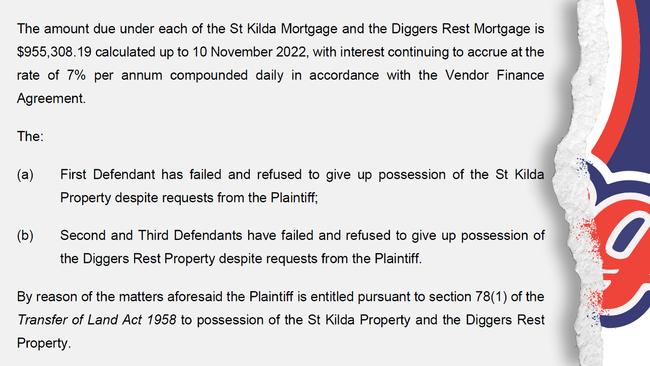

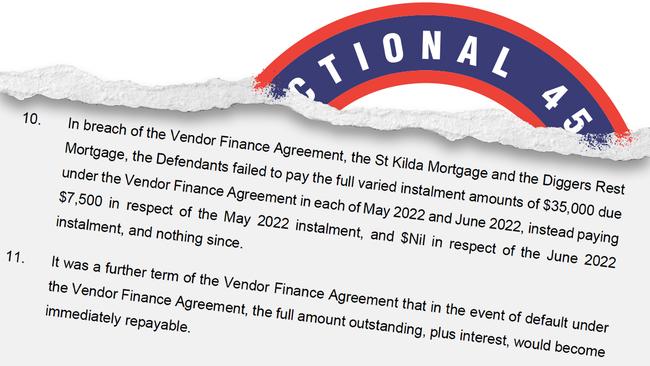

Now, all three are shut, with their gym in Melbourne suburb Ascot Vale gym closing down last Friday, and creditors who bankrolled the gyms are pursuing the pair and their business associates through the Victorian Supreme Court for almost $1m.

Mr Hogbin, who has yet to file a defence, declined to comment.

Meanwhile, other franchisees are dumping their gyms at well below the set-up cost.

Of the 95 F45 gyms advertised for sale on website anybusiness.com.au last week, only 10 had an asking price above $261,650, the minimum set-up cost of a new franchise.

Owners are also dumping gym equipment on Facebook, charging as little as $2 a kilo for kettlebells – well under what F45 charged for them.

At least one US franchisee has also taken legal action against F45 claiming that Mr Gilchrist and Mr Deutsch used companies registered in tax haven the Cayman Islands to mount their push into the huge US fitness market.

In a lawsuit filed in the US District Court for the eastern district of Michigan last year, an angry American businessman has accused F45, Mr Deutsch, Mr Gilchrist and other company executives of making “baseless promises and representations” in order to lure him into setting up a gym in suburban Detroit. F45 is fighting the claim.

Documents filed in the case show that F45 set up a US company in 2015 called F45 Training Incorporated, which was owned by a pair of companies registered in the Caribbean territory: B-36 Holdings, which Mr Deutsch owned, and J-37 Holdings, which Mr Gilchrist owned.

The Cayman Islands structure was dismantled in 2017.

Mr Deutsch said the companies “never did anything, they never transacted”.

“It was naive of us to go there,” he said.

Separate court documents claim that F45’s rise to the top was also allegedly fuelled by selling counterfeit exercise bikes to franchisees, sparking a legal fight back in Australia.

In 2015, F45 asked sporting goods importer Lee Alenaddaff to source Chinese knock-offs of the high-end Danish brand, Body Bike, that it was supplying to franchisees at the time, the Australian Federal Court was told.

Court documents claim that the bikes were initially branded as “Body Bikes” in the equipment catalogues Mr Alenaddaff’s company supplied to F45.

In an affidavit filed with the court, Alenaddaff said that in March or April 2015 Mr Deutsch asked him to “source from China a bike similar in looks to what he was using in the F45 studios”.

Mr Alenaddaff said he found a Chinese manufacturer to supply similar bikes but the machines generated a high level of complaints about mechanical problems, which “were not good for business”.

Mr Deutsch said F45 was trying to “drive the cost of the bikes as low as possible for the franchisees”.

“We actually didn’t do anything wrong except we called the new bikes Body Bikes - that’s where we stuffed up,” he said.

The case was settled out of court on confidential terms.

F45’s origins have also been the subject of yet another legal controversy. The group was set up in 2013, while Mr Gilchrist was bankrupt after running up more than $50m in debt to creditors including banks that funded his property development business.

According to company records, he didn’t become a shareholder in F45 until 2017, three years after his bankruptcy was annulled.

However, News Corp can reveal allegations he was an F45 shareholder while bankrupt have been aired as part of an Australian Federal Court fight over his assets.

In 2020, as F45 prepared for the lucrative NYSE listing, Mr Gilchrist agreed to pay Ironbark Consulting, which is controlled by Sydney lawyers Michael Forrest and Brendan Wyhoon, $8.25m, and Oracle Investigations, controlled by British-born Max Turbett, $6.75m, to strike a deal with Mr Deutsch and others removing the statement that he held F45 shares while bankrupt from official paperwork that asserted mistakenly to the contrary.

As part of the agreement, Mr Gilchrist also agreed to pay another person involved in F45 US$20m ($A30m).

Ironbark and Oracle have told the court they got the deal done but Mr Gilchrist failed to pay the entire amounts and still owes them a total of $10.8m.

Speaking through his lawyer, Mr Gilchrist declined to comment on the lawsuit.

Mr Gilchrist’s former trustee in bankruptcy, Jason Cronan of SV Partners, said he was unaware of the legal action. “That’s something we’ll take a look at and see if we need to be involved,” he said.

The case continues.

Is your F45 gym affected? See your rights and if you can get your money back.

‘Overstep’: City’s gas phase-out slammed

A major Aussie capital city has announced it will phase out future residential gas appliances by the end of the year, despite the Premier slamming it as an “overstep”.

Mel Gibson’s cinema chain fined

A cinema chain co-owned by Mel Gibson has paid an almost $20,000 penalty, with industry-wide ticket pricing now under the microscope.