Woolworths, NAB, BHP slammed for ‘crisis profits’ from Covid, Russia’s invasion of Ukraine

Millions of people have been pushed to the brink by rising prices yet a report has revealed Aussie companies made billions from devastating world events.

Retail

Don't miss out on the headlines from Retail. Followed categories will be added to My News.

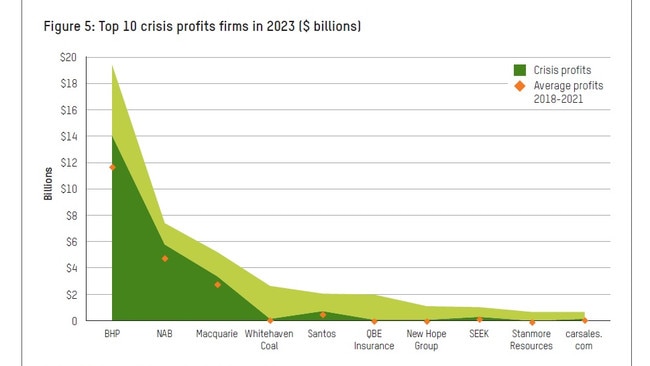

Australia’s biggest companies including BHP, Woolworths and big four bank NAB raked in $98 billion in additional “crisis profits” off the back of the Covid-19 pandemic and the Russian invasion of Ukraine, a new report has revealed.

As a result, Oxfam which produced the report, is calling for a crisis profits tax to discourage price gouging and address growing inequality in Australia.

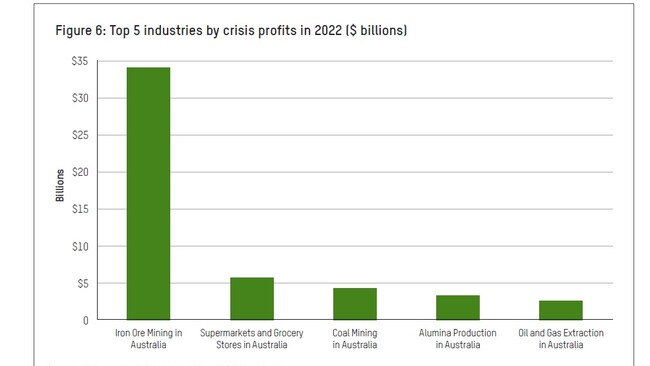

The analysis revealed that BHP recorded the largest crisis profit raking in $37.6 billion as mineral prices surged around the world after Russia’s invasion on Ukraine.

Meanwhile, Woolworths made $5.6 billion in crisis profits, increasing its prices and putting the squeeze on suppliers while inflation skyrocketed in 2022, according to the Oxfam report.

Then there was NAB which pocketed $2.7 billion in crisis profits as interest rates have soared, while mining outfit Hancock Prospecting made $1.6 billion in crisis profits.

In fact, the profits made were more than 20 per cent above their 2018 to 2021 average, the report found.

News.com.au has reached out to the companies named for comment.

Hancock Prospecting declined to comment.

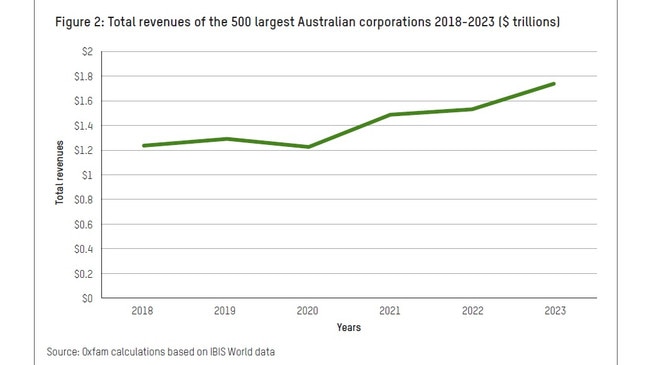

The top 500 Australian corporations made the $98 billion in additional crisis profits, which the report defined as earnings significantly higher than what would have been achieved under normal conditions.

It identified mining, banking and the supermarket sectors as recording some of the biggest gains in crisis profits between 2021 and 2023, which the report slammed, as everyday Australians struggled with costs of living due to the pandemic and subsequent global inflation.

Staggeringly, the crisis profits amount to an extra $134 million per day for two years, the report added.

A recent poll from Oxfam revealed that 76 per cent of voters reported growing concerns about economic inequality and the gap in wealth and income between most Australians and the very rich.

Its results also showed that 80 per cent of Australian voters believe it is unfair to allow tax loopholes for big corporations, and 68 per cent support a crisis profits tax.

Oxfam Australia chief executive officer Lyn Morgain said that as a result of intersecting global crises, corporate crisis profiteering and poor government policy, economic inequality is skyrocketing.

“Between the Covid-19 pandemic and high inflation caused by war and corporate profiteering, it was a tough start to the decade for most,” she said.

“Even in relatively wealthy countries like Australia, millions of people have been pushed to the brink by rising prices of food, energy and unaffordable rent. In stark contrast, this has been a profits bonanza for some of Australia’s biggest corporations.”

Oxfam is calling on the Australian government to implement a crisis profits tax on excessive corporate profits and use revenue raised to address inequality in Australia and abroad.

According to Oxfam analysis, a 90 per cent tax on these crisis profits could have generated $88 billion in revenue.

These funds could have paid for crucial responses to the crises of the early 2020s such as the increased Covid-19 healthcare costs, energy bill relief and the coronavirus supplement to income support.

Even then funds would still remain to double the aid budget and invest in social housing.

“A tax on the crisis profits of corporations would not only discourage price gouging, but also boost the budget when crisis hits and generate more funds for addressing inequality and cost of living pressures,” said Ms Morgain.

“A crisis profits tax is a crucial step towards reining in corporate profiteering, tackling the root causes of economic inequality and ensuring we have the funds to properly manage the impacts of crises, without sending the budget into deficit.”

Originally published as Woolworths, NAB, BHP slammed for ‘crisis profits’ from Covid, Russia’s invasion of Ukraine