‘Enhanced competition’ needed to bring grocery prices down

Australia needs more competition in the supermarket industry to stop customers paying a higher margin on their groceries, an industry expert warns.

Retail

Don't miss out on the headlines from Retail. Followed categories will be added to My News.

The supermarket sector would benefit from more competition, but an ACCC boss stopped short of calling Woolworths and Coles a duopoly.

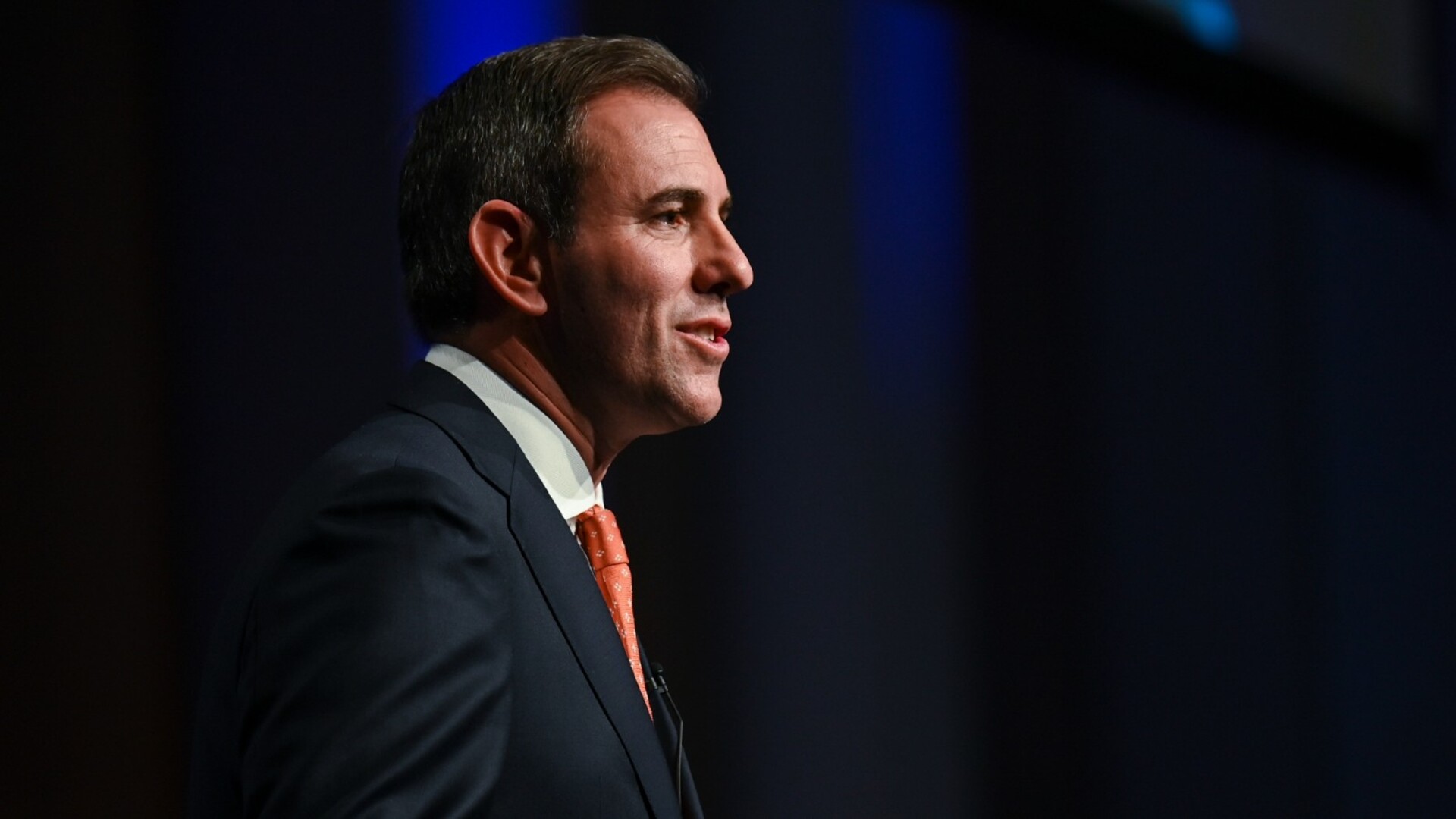

In an interview with the ABC, ACCC deputy chair Mick Keogh said the best way to stop margins rising in the supermarket sector was through competition.

“We think a better way to go is to enhance competition because that allows consumers to better understand pricing, look at true value, understand where the best bang for their buck is and get some of the confusion out of the system,” he said.

“It will mean (the supermarkets) will have to compete to get those dollars.”

Mr Keogh said the ACCC couldn’t give a “fair margin” on all items due to the complexity of supermarkets carrying up to 30,000 items ranging from essentials to luxury goods.

When asked about price gouging, Mr Keogh stopped short of calling out the supermarkets, saying it was hard to define.

“What we found is the supermarkets have been able to steadily increase their margins over the last five years and that is a reflection of their power in the market,” he said.

“They are such a strong presence in the market that they can require their suppliers to fund promotions while they retain their margins.”

In response to the ACCC report, both Woolworths and Coles said the sector remained competitive.

In a statement to the ASX, Woolworths Group chief executive Amanda Bardwell said Woolworths faced “considerable competition”.

“Our experience, in our store and online, is that the Australian grocery sector is very competitive,” she said.

“Our customers have greater choice than ever before and are cross-shopping between different retailers more often. If we don’t get it right for customers, they shop elsewhere.”

Coles also said in a statement the sector was highly competitive, evolving rapidly and offered consumers greater choice than ever before.

“Over recent years, Coles has not only been competing with traditional supermarkets like Woolworths and IGA but also now with major multinational players like Aldi, Costco, and Amazon who have all established significant businesses in Australia and are expanding their market share,” Coles said.

Coles said it held less than a 30 per cent share of the market.

“Customers are increasingly cross-shopping and splitting their grocery spend across a range of retailers — both in store and online — which means Coles must compete vigorously for a share of consumers’ grocery baskets,” Coles said.

Despite Woolworths and Coles servicing a large part of Australia and being able to put pressure on suppliers, Mr Keogh said there was not a duopoly in Australia.

“We recognise the importance of Aldi, albeit the limited range and their geographic extent, so it’s not strictly a duopoly,” he said.

“There is also some competition from specialist retailers – butchers, green grocers – and also some of the other retail chains like Chemist Warehouse and Bunnings are starting to carry some of the products that supermarkets sell.”

Mr Keogh said shoppers still valued convenience, which gave the supermarket chains power.

Originally published as ‘Enhanced competition’ needed to bring grocery prices down