NAB customer loses whole month’s pay to 25 transactions in Sydney brothel

A Gold Coast woman was scammed out of her entire pay over the space of 25 transactions at a Sydney brothel and she’s been left “angry” by the bank’s response.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

Chelsea Paton was horrified to discover her entire pay for the month had been drained from her bank account via 25 transactions worth just under $200 each for a Sydney brothel.

Always paid on the 10th of the month, she initially thought she hadn’t been paid or it was 24 hours late hitting her account but the next day alarm bells rang when she received a text message from National Australia Bank (NAB) that her card had been blocked.

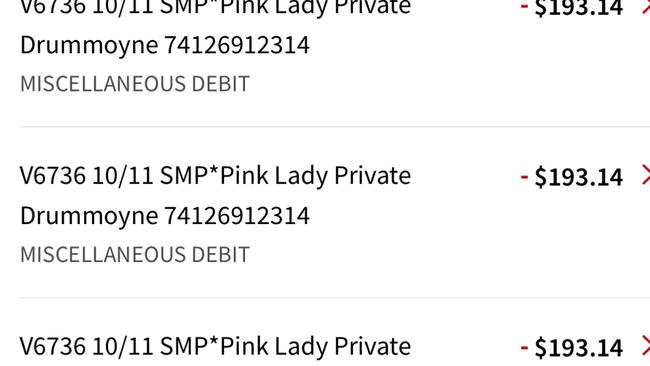

The Gold Coast local took a deeper look at her transaction history in November last year and was horrified to discover a series of debits worth $193.14 each spent at Pink Lady Private Hotel, which is described as “Sydney's hottest brothel” on its website.

Want to stream your news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer available for a limited time only >

Straight away she suspected she had been scammed and called NAB.

“The whole thing was really a hassle – you are on hold for so long it was almost two hours and I finally got through,” she told news.com.au.

“(Customer service) was really lovely and she said I can see you attempted to put your card on a Samsung phone on the November 4 and then on the November 10 at 4.07am they have done their first transaction and it’s worked out to be transactions every two to three minutes apart.

“They continued to do every single transaction until there was no money left so that was my whole pay for the month.”

Have a similar story? Continue the conversation | sarah.sharples@news.com.au

The 36-year-old realised later she had received a text message to alert her to the fact that a Samsung phone had been added to her card on the November 4 – but had dismissed it as a scam – because she had two factor authentication set up and had not authorised a new device.

She has no idea how her card details were obtained and the only thing she can think of is her card was skimmed at an ATM or the details were stolen from online shopping.

The business development manager has been left “frustrated” and disappointed by NAB’s fraud investigation, which found “no NAB error in process or platform has occurred which contributed to the loss” – a decision she said she had to chase the bank on.

The investigation also found “there was no opportunity in which NAB could have intervened to have prevented your loss” in an email sent to Ms Paton and seen by news.com.au.

Ms Paton said she was “shocked” the bank would not refund the almost $5000 she lost, particularly as it was “so obvious” it wasn’t her.

“You could see all my transactions for 15 years. The bank knows all the things I am doing and buying,” she added.

“I looked up the transactions and Pink Lady is in Drummoyne – it’s a brothel in Sydney – and I live on the Gold Coast. Why would I be at a brothel at 4.07am? It’s laughable.

“I feel pretty sick about it when I think about it and talk about it. I get that really anxious feeling in your tummy. I have lost that money now, it was stolen and no one is helping. I feel like no one has helped.”

She is still confused by how her details were obtained.

“I have actually tried to put my card on to my partner’s phone and it straight away sends a text message to say this is the authorisation code. I wonder if the scammer rang the bank pretending to be me,” she said.

Ms Paton added the loss of a whole month’s pay meant she had to rely on her savings and her partner for help – but said five years ago she would have been in a terrible position and forced to either get a loan from the bank or borrow money from friends.

“At a time right now in the world where everything is more expensive, not only couldn’t I add to my savings but I had to use them to live it off. There’s also the idea that I worked so hard for a month and have had that all just taken away by whoever,” she said.

She added she had banked with NAB for 15 years but no longer trusted the organisation.

“I am so disappointed and I don’t feel important to them. I’m a nobody but that amount of money means nothing to them … I am definitely going to be changing banks,” she said.

“I honestly don’t feel safe – anytime I use my bank I’m worried.

“I’m constantly checking my account, I got my pay again and I feel anxious about it all the time now and I’m still struggling a bit after Christmas looking at my savings, it’s not changing and it’s a time in my life where we are wanting to get a house.”

NAB Executive, group investigations and fraud, Chris Sheehan said he couldn't comment on an individual case, but the bank undertakes thorough investigations to understand each situation and how a scam has occurred.

“Once an investigation is complete we provide a full response to the customer. Customers are always provided with the option to also refer their case to the Australian Financial Complaints Authority (AFCA) should they choose,” he said.

“Scammers are sophisticated and look for any way to get to personal information, passwords, and authentication details. This is a society-wide issue and we all have a role to play in taking action, driving education, and raising awareness so we can prevent more cases.

“When someone makes an approach – no matter where they claim to be calling or texting from – we encourage everyone to take their time and never be pressured to click a link, pay immediately for something, transfer your funds to another account or provide personal or banking information.”

Ms Paton said she had lodged a complaint with AFCA but still feels “angry”.

“It’s definitely an invasion of privacy. I seriously just want to put my money in a mattress right now,” she said.

“I feel really annoyed, it can affect your mental health – it’s not just being able to pay bills it’s ongoing.”

Mr Sheehan added NAB had seen a significant increase in scams in recent years and it knew the results can be devastating on those they impact, both emotionally and financially.

“In addition to the investment we make in our own systems to help detect scams and fraud, we also know education is critical to helping people avoid scammers,” he said.

“Where someone is the victim of a scam we make every effort possible to recover funds for the customer, however, once the funds have left the account it is extremely hard to retrieve them due to the sophistication and speed that the criminals move the stolen funds.”

Originally published as NAB customer loses whole month’s pay to 25 transactions in Sydney brothel