‘There is no alternative’: Australia’s dire iron ore news as China turns its back

There is growing concern that Australia’s reliance on China could be our undoing – and we’re already “very much in negative territory”.

Mining

Don't miss out on the headlines from Mining. Followed categories will be added to My News.

When it comes to the perception of Australia’s economic reliance on commodity exports to China, it at times seems to flip between the two extreme ends of the spectrum.

In years past, there was a great deal of commentary about the “Asian Century” and how the demand for Australian commodities would seemingly last forever.

At the other end of the spectrum, there is a deep concern that Australia’s reliance on commodity exports to China could end up proving to be our nation’s economic undoing.

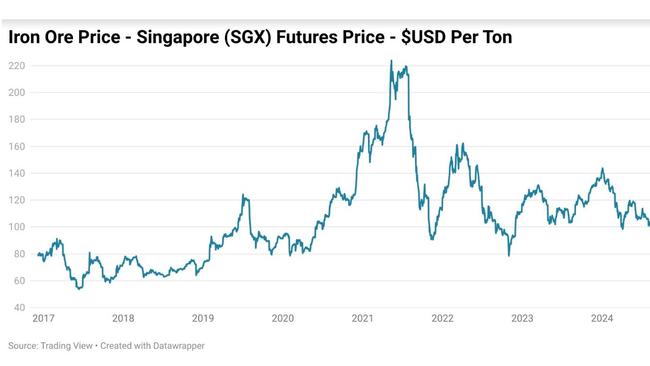

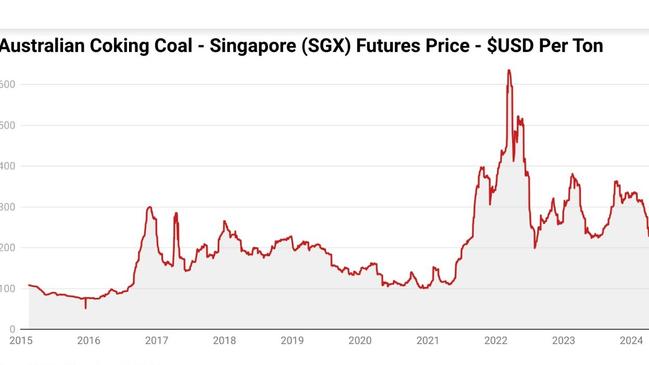

With iron ore prices near two-year lows and comments from within the Chinese steel sector claiming the industry found itself amid a “harsh winter”, the needle for measuring attitudes toward Australia’s reliance on commodity exports to China is currently very much in negative territory.

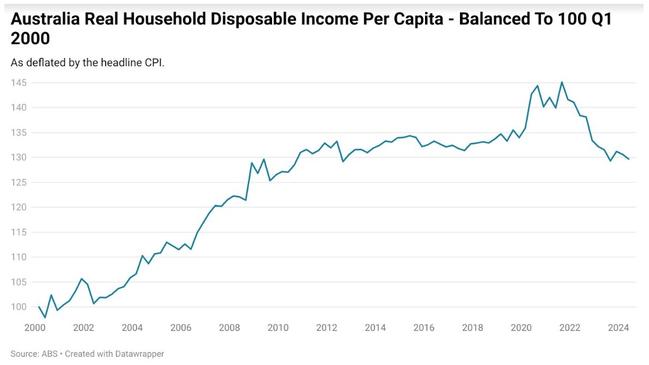

There is a misconception that has built up over the decades that China’s prosperity will mean Australian prosperity. In the years up to and including the mining boom, this was largely the case, as China’s meteoric rise as an industrial superpower helped to underpin strong growth in real Australian disposable household incomes.

But in the present, that is no longer necessarily the situation.

A Chinese economy powering on through stronger consumer spending and hi-tech manufacturing is not anywhere near as beneficial to Australians as a China consuming ever-greater quantities of our nation’s minerals at prices miners could only have dreamt of 25 years ago.

A broken transmission mechanism

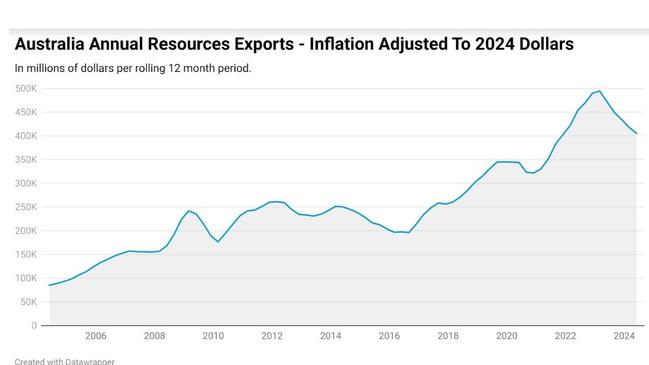

At the turn of the new millennium, total annual resources exports came to $37.7 billion. By the December quarter of 2008, the annual value of resources exports had risen to just shy of $150 billion.

In that time, real household disposable income per capita rose by 29.9 per cent.

Fast forward to the present day, and annual resources exports now sit at $405 billion, down from the all-time peak of $473 billion in the March quarter of 2023.

Yet despite the enormous rise in the value of resources exports, the economy has become increasingly poor at seeing the benefits flow through to households.

Today, real household disposable income per capita sits just 1.6 per cent above where it did in the December quarter of 2008.

In short, the benefits of the growth exports of the resources sector are flowing to state and federal Treasury coffers in the form of higher levels of revenue, but in recent years the windfall has not flowed through to households in the form of higher real disposable incomes and by extension, living standards.

The game is changing

For well over a decade, the prospect of the Simandou iron ore mine in the West African nation of Guinea kicking off a torrent of iron ore exports has been something of a proverbial bogeyman lurking in the background and threatening the value of the nation’s resources bounty.

Originally, the mine was slated to open all the way back in 2015, but progress was delayed by all manner of issues over the years, including legal battles, political upheaval and the 2021 Guinean military coup.

But now, more than 27 years since the project was first conceived by Rio Tinto, it’s finally on track to begin production in late 2025.

Macquarie estimates that production will gradually be ramped up, hitting 40 million tons in 2026 and 90 million tons by 2028. Some analysts have suggested that at full capacity, the mine could be exporting as much as 120 million tons per year.

This would represent up to a 7.5 per cent expansion in total global iron ore exports, or more than the total global export supply has expanded in the last nine years combined.

Meanwhile, on the other side of the Atlantic from West Africa, Brazilian mining giant Vale is looking to significantly expand its own iron ore production capabilities.

Vale plans to upgrade production at three of its mines in the coming years, with total production capability to increase by 50 million tons per year. Vale estimates that by 2026, total net production capabilities will expand by 20 to 40 million tons per year.

Assuming that the other major players maintain their production at 2023 levels, the production from the Simandou mine and the resurgence in Brazilian iron ore production would represent the most sizeable increase in global iron ore production in more than a decade.

Chinese demographics are deteriorating

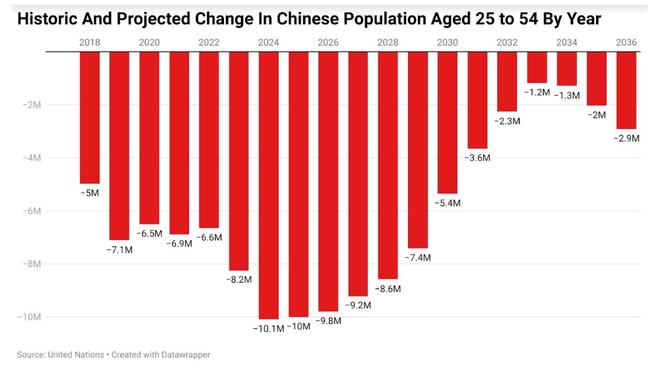

According to data from the United Nations, the size of the Chinese 25-to-54 age demographic (aka the prime consumption age demographic) is currently falling by more than 10 million per year. Since peaking in 2017, the number of people in this demographic has fallen by more than 40 million people and is set to shed more than 100 million people by 2030.

In short, that is a lot less Chinese on balance looking to purchase homes or consumer goods, which are ultimately often built with raw materials imported from Australia.

With the overwhelming majority of new homes built prior to the pandemic being sold to property investors, according to a National Bureau Of Economic Research (NBER United States), the drop in the level of demand for new homes in China has significantly further to fall than the underlying demographics would imply.

Looking forward and a silver lining

The risk that in the coming years Chinese demand for bulk commodity imports from Australia could be dramatically reduced is very real.

But there is something of a silver lining. Australia is a stable democracy and has some of the lowest production bulk commodities in the world. While commodity prices would fall significantly if a downside scenario were to be realised, it’s largely mines in other parts of the world that would shutter long before a large majority of Australian production was seriously impacted.

There is also the ongoing expansion of so-called “Green Minerals” exports on the horizon, as nations continue to pursue new technologies in order to reduce carbon emissions.

While there is an upside, it’s not an especially large one for a nation that derives over $400 billion a year in export revenue from the resources sector.

In the world of finance, there is an acronym, TINA – “There is no alternative”. This perhaps describes Australia’s unique position better than anything.

If Chinese commodity demand were to dramatically reduce as its population shrinks and its economy evolves, there is no real scenario in which any nation or combination of nations could come to fully replace that demand in the short to medium term.

Some look to a rapidly growing India as the next great source of commodity demand, but the reality is India is actually a net exporter of iron ore and is looking to become largely self-sufficient in metallurgical coal by 2030.

Ultimately, Australia has a symbiotic relationship with the sectors of Chinese industry reliant on bulk commodities, not the broader Chinese economy.

China may prosper or it may falter, but for the Australian economy, it may come down to what we dig out of the ground more than anything else.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as ‘There is no alternative’: Australia’s dire iron ore news as China turns its back