James Packer sells almost half his stake in Crown Resorts for $1.76 billion

James Packer has sold almost half his stake in Crown Resorts, earning him a fortune. But along the way he “lost” $236 million.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

James Packer has sold almost half his stake in Crown Resorts for $1.76 billion to a Macau-based entertainment company, far less than the $10 billion merger with a Las Vegas casino empire that was botched last month.

Consolidated Press Holdings (CPH), Mr Packer’s private investment company, confirmed on Thursday night it had sold 19.99 per cent of its shareholding in Crown Resorts to Melco Resorts and Entertainment.

RELATED: Wynn merger the latest in list of James Packer’s highly publicised woes

RELATED: Las Vegas giant makes $10 billion play for Crown Casino empire

It was sold for an aggregate purchase price of $1.76 billion, equivalent to $13 per share.

This is $1.75 per share below the deal proposed in April, meaning Mr Packer has lost $236 million in potential profits.

The fact Mr Packer was willing to sell his shares at a cheaper price is a sign he’s keen to reduce his reliance on gaming and invest elsewhere.

Once the share sale is completed, CPH will own about 26 per cent of Crown, worth about $2.3 billion, and will remain represented on the Crown board.

Mr Packer’s interest in Crown will be reduced from 46.1 per cent to 26 per cent, which means he has relinquished control of the company.

His current stake in Crown is now about $2.3 billion.

Mr Packer said Crown was a stronger company with Melco as a strategic shareholder.

“Crown has been a massive part of my life for the last 20 years and that absolutely remains the case today — my continuing Crown shareholding represents my single largest investment,” Mr Packer said of the deal.

“I am still vitally interested in Crown’s success as a world-class resort and gaming business. The sale allows me to continue my long-term involvement with Crown and at the same time to better diversify my investment portfolio.”

But the deal pales in comparison to the botched merger with Las Vegas giant Wynn Resorts in April when the Packer-backed gambling firm spoiled the deal by pre-emptively spilling the beans.

A matter of hours after Crown confirmed to the Australian Securities Exchange a lucrative deal was in motion, Wynn Resorts abruptly ended the prospect of the agreement.

“Following the premature disclosure of preliminary discussions, Wynn Resorts has terminated all discussions with Crown Resorts concerning any transaction,” the company said at the time.

The “premature” spilling of the deal sent Crown’s share price surging 20 per cent higher.

However, an agreed bid had not been finalised on the deal that would have resulted in Mr Packer walking away with about $2 billion and a 10 per cent stake in Wynn Resorts.

The Wall Street Journal spoke to a source who said Wynn executives were shocked by the Crown announcement.

“I was surprised and the US folks were surprised,” the person said.

Melco’s chief executive Lawrence Ho said the stake was a great opportunity for Melco, which operates casinos across Asia, including in Macau and the Philippines.

Mr Ho signalled he’s interested in increasing his stake beyond 19.99 per cent if he clears probity checks with Australian regulators.

“It is certainly our intention to continue if the opportunity arises to increase our stake in Crown,” Mr Ho said.

CPH will lodge a Notice of Change in Substantial Holding both with Crown and the Australian Securities Exchange.

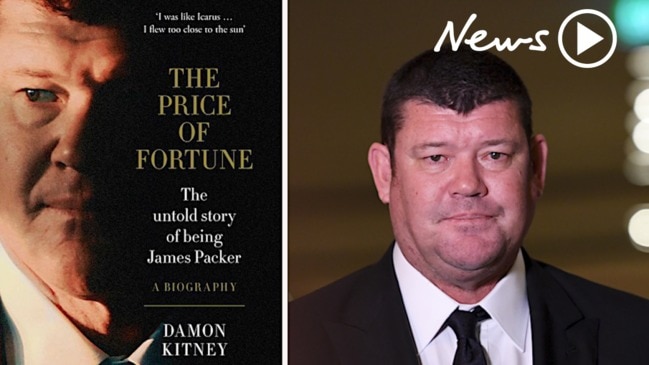

At the time the Wynn Resorts deal spiralled out of control, The Australian’s Victorian business editor Damon Kitney, who penned a biography about the billionaire titled The Price of Fortune, wrote that an end of Mr Packer’s involvement with Crown would be an end of an era for Australian business.

It would mean the Packer family no longer ran a large public company after a few years the son of Kerry Packer would rather forget.

This includes involvement in corruption, a high-profile breakup with a global star and a street brawl in broad daylight.

And although the deal with Mr Ho appears to be far weaker than the merger offer from last month, it might serve as a saving grace for an exhausted Aussie business icon who’s ready to leave the game.

The biography closes with solemn comments of resignation from Mr Packer, which Kitney says is evidence the billionaire is keen to relinquish his role as a business tycoon.

“Some people handle pressure well and some don’t. I don’t. I don’t know if that is because I am wired that way,” Mr Packer told the author. “Or if it is because bad things have actually happened to me. I am tired of being on this rollercoaster. I don’t want to do it any more. I’m ready to put my hands up for a few years. I really am.”

— with AAP

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au

Originally published as James Packer sells almost half his stake in Crown Resorts for $1.76 billion