‘Devastated’: Melbourne pensioners could lose home after $280,000 ‘fraud’ by Westpac introducer

A Melbourne couple fear they will be left homeless by Westpac after discovering their mortgage was based on a “fraud”.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

EXCLUSIVE

An elderly Melbourne couple could be left homeless by Westpac after discovering the mortgage they had been diligently paying off for the past 10 years was based on a “fraud”.

Miriam Wright, 70, and her husband Michael, 72, made the shocking discovery on a visit to their bank branch last year — when they were told they had to cough up $280,000 within months.

“We were devastated,” Mrs Wright told news.com.au.

Mr Wright is gravely ill with emphysema and asbestosis, and the pensioners are pleading with Westpac not to foreclose on the family home where they have lived for more than three decades.

The couple, who are both illiterate, allege that the loan application filled out on their behalf by a third-party “introducer” was fraudulent and Westpac failed to double check the information. Miriam’s name was even misspelt.

Westpac has told news.com.au it will “conduct a thorough review” of the loan and “take further action if any wrongdoing is found”.

The bank said it would see if there was a “resolution” that would avoid the couple being turfed from their home.

The application stated that Mr Wright was earning $92,000 a year as an “investment relations executive” for a company called Capital Realty, and included a PAYG payment summary to that effect.

Mr Wright has been on the disability support pension or the aged pension since 1995 and prior to that worked as a construction labourer.

He has never worked for or heard of a company called Capital Realty.

“They should never have been given the loan,” said their nephew Joseph Mifsud.

“When I asked them how they got the loan, my aunty and uncle said, ‘I don’t know.’ It would be impossible to get that kind of money living on the pension. All the documents are incorrect — it’s fraudulent.”

In 2009, the couple took out the $280,000 mortgage over their house — which today is estimated to be worth around $800,000 — to use the money for a restaurant.

Mr Mifsud said “whoever did the paperwork” incorrectly put it down as home renovations.

The restaurant venture ultimately did not succeed, but the couple continued making their $1400-a-month repayments, believing that the loan would be fully paid out at the end of 10 years.

Unbeknown to them, what they had actually been signed up for by the introducer was an interest-only loan that was required to be repaid in full by October last year.

By that stage they had already paid nearly $170,000 in interest to Westpac.

“My aunty and uncle can’t read or write and they were too embarrassed at that stage (when applying for the loan),” Mr Mifsud said.

Shine Lawyers, which is representing the couple, contacted Westpac but was informed that the bank approved the loan within its policy at the time and had no reason to believe the documents provided were false.

Mr and Mrs Wright do not remember who the loan introducer was, and a copy of the application provided to the couple does not mention any referrer or third party.

Shine Lawyers says it has asked Westpac to confirm the name of the referrer but the bank so far has not responded.

“That document is clearly forged,” said Shine Lawyers senior solicitor Joseph Crane.

He added that Miriam’s name on the application was also recorded as “Mary”, which “sort of indicates no one spoke to her at all, certainly it indicates no one checked her ID”.

“The royal commission made a big deal about banks relying on documents (provided by introducers) without checking the accuracy,” he said. “It was common, particularly at the time.”

Mr Crane said the banks had no incentive to do so. “The broker gets a commission, the banks get the benefit of the interest on the loan, the person who gets a raw deal is the consumer,” he said.

Westpac has held off making an enforcement decision while it looks into the couple’s situation, but the worst-case scenario is the bank could foreclose and kick the couple out of their house.

At this point their options are either to take Westpac to court for an “extremely lengthy” battle, Mr Crane said, or to lodge a complaint with the newly formed Australian Financial Complaints Authority.

“AFCA’s pretty new so the jury’s still out on how they deal with these things and the speed at which they do,” he said.

The ideal situation, however, would be for Westpac to “acknowledge they’ve done the wrong thing in this situation and let Michael and Miriam get along with their lives”.

“The banks have indicated they want to right the wrongs of the past,” Mr Crane said. “It would be good if they could do it rather than talking about it.”

In a statement to news.com.au, Westpac said it was looking into the case.

“Westpac will be conducting a thorough review of the matter and will take further action if any wrongdoing is found,” a spokeswoman said.

“We recognise the customers’ current circumstances require additional support and we will be taking further steps to assist them. This includes working with the customers to find a resolution to help keep them in their home and providing financial assistance.”

‘ENVELOPES OF CASH’

One of the biggest scandals to emerge from the banking royal commission was the banks’ widespread use of often unqualified introducers — from gym owners to tailors — to drum up business in exchange for hefty commissions.

NAB’s introducer program came under greatest scrutiny amid revelations staff in some western Sydney branches accepted “envelopes of cash” in bribes to approve loans based on dodgy documentation.

In the first court action to arise from the royal commission last year, the Australian Securities and Investments Commission sued NAB over failures its program, which brought in loans worth more than $24 billion from 2013 to 2016.

Introducers were only to provide the bank with a potential customer’s name and contact details, but ASIC alleged introducers who did not hold a credit licence gave NAB employees information and documents that went beyond that “spot-and-refer” remit.

They allegedly provided completed home loan applications, tax returns, pay slips and letters of employment and other material. “In some cases, information or documents provided by introducers to bank officers was false,” ASIC said in its court filing.

The regulator alleged the conduct exposed the customers and NAB to the risk of wrongful conduct by the introducer, including possible fraud, and “also exposed customers to a risk that loans would be advanced to them that were unsuitable”.

The case returns to court in April.

While NAB scrapped its program last year, the rest of the big three have quietly kept theirs running — albeit with what they claim are more stringent controls and due diligence checks — despite Commissioner Kenneth Hayne QC asking whether such schemes are “compatible with responsible lending obligations”.

Westpac’s own introducer scheme largely escaped scrutiny, although in his interim report in September 2018, Commissioner Hayne noted that Westpac had “acknowledged a number of … events of misconduct in relation to home lending”.

“In one instance Westpac approved a loan referral from a third-party broker for a home loan of over $529,000 to an 80-year-old man who spoke poor English,” he wrote.

“A credit card debt approved at the same time was later written off.”

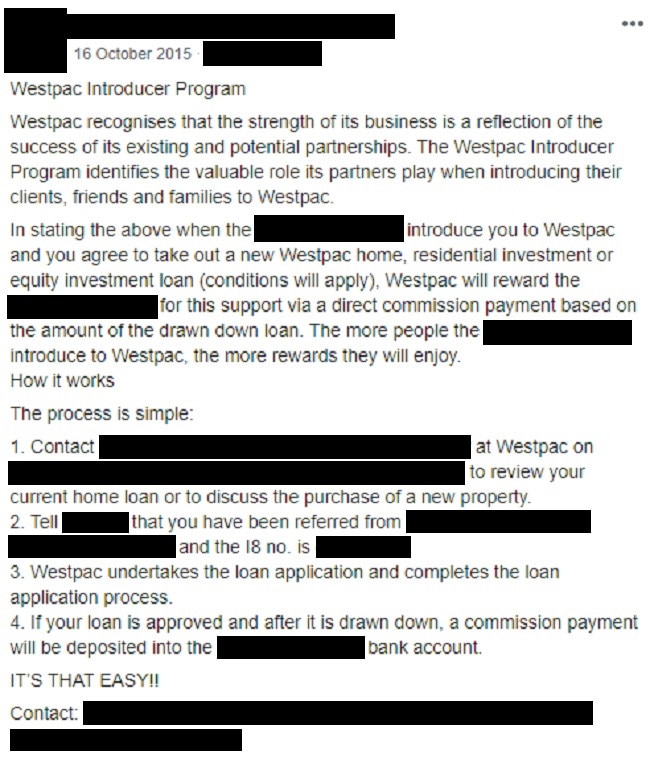

In a Facebook post from 2015, one local NRL club in NSW described how Westpac’s introducer program works, and that “the more people (the club) introduce to Westpac, the more rewards they will enjoy”.

“If your loan is approved and after it is drawn down, a commission payment will be deposited into (the club’s) bank account,” the post said. “IT’S THAT EASY!!”

Originally published as ‘Devastated’: Melbourne pensioners could lose home after $280,000 ‘fraud’ by Westpac introducer