Choice reveals worst products in 2019 Shonky Awards

A fridge that doesn’t do its job, worthless pet insurance and a breakfast cereal that’s actually a “bag of sugar” are among 2019’s worst products. SEE THE LIST

Retail

Don't miss out on the headlines from Retail. Followed categories will be added to My News.

A fridge that doesn’t keep your food cold, a “nutritious” breakfast cereal that’s really “a bag of sugar” and pet insurance that is riddled with exclusions have been judged some of the year’s worst products by consumer group Choice.

A super fund that takes “money for doing nothing”, basic health cover that “fails at the basics” and an online retailer with “dodgy customer care” have also been named in the 14th annual Shonkys.

The awards help identify “the worst-of-the-worst” products, Choice chief executive Alan Kirkland said.

“In a time of fake reviews, cash for comment, salespeople and lobbyists everywhere, it’s more important than ever for independent voices to tell the truth,” he said.

Mr Kirkland said this year’s Shonkys highlight businesses and industries who have “ripped off, misled and treated Australians like cash cows to be exploited.”

Choice has revealed this year’s unenviable winners are Kogan, Medibank Basic Cover, the Ikea Nedkyld Fridge, Freedom Foods XO Crunch, pet insurance and AMP Superannuation — with the latter the worst offender of the lot.

AMP, the third largest superannuation fund in Australia and plagued by scandal in the banking royal commission, has acknowledged that it has more than 1.1 million zombie (inactive) accounts — that’s 55 per cent of its superannuation clientele.

“AMP is the worst because of the effect on people, we’ve got 1.1 million people,” Mr Kirkland told News Corp.

“We’ve got superannuation accounts with AMP that are just being eaten away by fees and charges.

“These are accounts where no contributions are being made but they are still being charged annual fees, they are still being charged insurance premiums.”

Mr Kirkland said many people don’t even know that they have an AMP account.

“People may have inactive accounts from previous jobs, they may have forgotten or moved address and are not receiving statements anymore.

“Over half of its (AMP) accounts are inactive and AMP should be doing more.”

Many of the Shonky winners are getting away with their practices because their products are confusing and difficult for consumers to understand.

“Take Kogan, what they do is they produce a warranty document with lots of terms and conditions which would make most consumers think they don’t have rights under law,” Mr Kirkland said.

“So Kogan typically says you have a warranty for six months, whereas for larger purchases under the law they are required to deal with a faulty product for longer than six months.”

Kogan had more than 300 complaints filed against it this year in NSW alone.

“If you try to return a product to Kogan it’s very hard to contact via phone or email, it’s hard to speak to an actual person,” Mr Kirkland said.

“If you do, they try to offer you an inferior product for replacement or a credit voucher which is not what they should be doing under the law.”

The advice for consumers is to take this year’s Shonkys list seriously.

“Certainly pay attention to this list, think twice before buying from any of these companies,” Mr Kirkland said.

“When you know you have got a problem, don’t take what a business says as face value. You‘ve got a product policy, you’ve got a right to fight for a repair or refund”.

And it definitely pays to be a whinger. After all the consumer is always right.

“If you got to make a claim and your claim is denied then complain. That’s how we see that there are refunds, if there are lots of complaints,” Mr Kirkland said.

And one last piece of advice: always do your research for major purchases.

THE 2019 SHONKY WINNERS

Kogan — for dodgy customer care

“Kogan is a serial offender when it comes to consumer rights — from January to July this year it has topped the New South Wales complaint register with over 300 complaints. Kogan needs to improve its customer service and stop beating around the bush when its products are defective. Kogan must simplify the process for refunds, repairs and replacements to meet community expectations and the law.”

Response: Kogan told News Corp: “Our mission is to deliver Australian customers the most in-demand products and services at the best prices, and we care deeply about the experience and satisfaction of everyone who chooses to shop with us.

“As part of this, we take customer satisfaction extremely seriously and in general, Kogan customer satisfaction is very high. Our NPS average for the past 12 months is 64.81 (on a scale of -100 to +100).

“Despite that, earlier this year, we weren’t doing well enough in resolving certain types of complaints. This was reflected in the number of complaints made to certain bodies. Since then, major action has been taken to improve complaint resolution, and the results of this effort are shown by a 92.2 per cent decrease in complaints since the post-Christmas peak earlier this year. Complaints are now at an extremely low level, especially considering that more than four million orders were delivered during the past year.

“We will continue working hard to improve the experience we deliver to our customers. We look forward to delighting our customers with the most in-demand products and services at incredibly low prices for many years to come.”

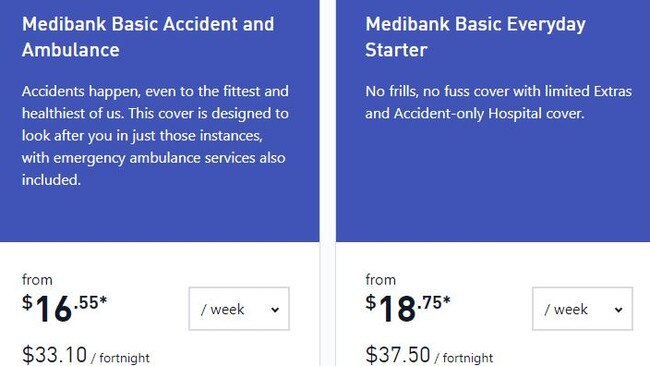

Medibank ‘Basic’ Cover Health Insurance — for failing at the “basics”

“2019 is the first year that private health insurance has topped the list of financial worries in CHOICE’s regular national surveys and it’s easy to see why. A new system that was meant to make things simpler has turned into a mess thanks to rip-offs like those from Medibank.

“Medibank’s “Basic” junk cover costs more than many higher cover Bronze policies (in NSW, ACT, NT, SA, WA and Tasmania). Medibank deserves a SHONKY for failing at the basics — simple and affordable health insurance.”

Response: A Medibank company spokeswoman said all their products include unlimited emergency ambulance.

She added: “Our Accident Boost means that our customers can rest assured that they will receive the benefits of our Gold level of hospital cover in the event of an accident no matter what hospital product they hold.”

She encouraged customers to make contact to ensure they have the right cover.

“We can assess your healthcare needs and help you determine which is the best level of cover for you. This year as part of our Right Cover program, we will have half a million check-ins with our customers.

“A great starting point is our People Like You tool which can help you understand what are the most common hospital procedures for people like you.”

Ikea Nedkyld Fridge — for failing energy tests and being bad at its one job

CHOICE score: 39% (Last place — Top scorer 83%)

Food freshness score: 35% (Top scorer 80%)

Energy test: FAILED

“The Ikea Nedkyld is one of the worst fridges we’ve ever tested. Not only is it terrible at keeping your food cold, when CHOICE tested the Nedkyld’s energy use against its star rating, it failed the test. It’s hard to understand how this fridge is still on sale in Ikea stores, especially with a misleading energy label.”

Response: In a statement to News Corp, Ikea said it was “disappointing” the Nedkyld Fridge had been included in the Choice report.

“The Nedkyld fridge is a popular model and has received positive feedback from our customers,” the company said.

Ikea said the fridge had been tested by “an independent, accredited test lab, based on the Australian regulations that measure the performance of household electrical appliances”.

“The test report gave the Nedkyld fridge an energy star rating of 3.5. Our products undergo continual testing and improvements to ensure we are providing customers with products that are both high quality and affordable.”

AMP Superannuation — for ruined retirements

“AMP received some of the strongest criticism from the Banking Royal Commission — and it was deserved. CHOICE has partnered with the new consumer group — Super Consumers Australia and found that AMP holds the largest number of zombie accounts of any other super fund — accounts that sit there being wasted away by fees and insurance. For AMP, it’s money for doing nothing. Managing people’s retirement funds isn’t your average business — there’s a higher moral standard to meet when it comes to people’s security and comfort in older age, and AMP have failed this standard.”

Response: An AMP spokeswoman said it “can be difficult to draw accurate comparisons and conclusions in relation to inactive accounts due to the varied characteristics of products within trusts and across superannuation providers.”

“For example: a large proportion of the AMP accounts classified in APRA’s data as inactive receive a capital guarantee. It is often in members’ best interests to maintain these accounts given the future benefit they will provide.

“AMP supports legislative measures that identify and aim to reduce duplicate or inactive accounts.”

She said in 2018, AMP helped more than 85,000 members identify duplicate accounts.

“This work to reduce duplicate or unused accounts is continuing,” she said.

Freedom Foods XO Crunch — for telling us a bag of sugar is healthy

Claims that a 22.2 per cent sugar cereal is “A fun and nutritious way to start your kids’ day.”

“Every year it seems there’s a new shonk in the food industry trying to pass off junk as healthy. This year, Freedom Foods XO Crunch cereal earns a well deserved SHONKY for health washing and marketing a big bag of sugar towards our kids. Freedom Foods proudly displays 4 health stars on this bag of sugar.

“CHOICE says it should be one and a half if health star ratings accurately reflected the amount of added sugar in a product — something that industry groups have lobbied to prevent. This SHONKY shows why the food industry needs to be kicked out of room when it comes to Health Star Ratings. The food industry has gamed the Health Star system to make a big bag of sugar look like a healthy choice for your kids — and that’s a disgrace.”

CHOICE has made a complaint to the ACCC regarding misleading advertising of this and other products with similar health claims.

Response: Freedom Foods has been contacted for comment.

Pet insurance — for bad insurance riddled with exclusions

86 policies reviewed — 0 recommended by CHOICE

“Pet insurance is the insurance a business sells when it wants to make money without providing any service at all. Riddled with exclusions and technicalities, pet insurance is one of this country’s worst value insurance products. It relies on emotionally manipulating your love of your pet to sell you worthless insurance.

“This year CHOICE found this industry so bad we refused to recommend any policy. There was not a single policy that we could in good conscience suggest that pet owners consider buying. This also highlights why insurance companies shouldn’t be exempt from laws against unfair contract terms — it’s vital this special loophole for insurers is closed.”

Response: Magdoline Awad, Chief Veterinary Officer for PetSure, said the industry “reject previous analysis that claims pet insurance isn’t valuable.”

“It’s not backed up by thorough and full analysis of the facts around pet health and pet insurance claims, nor by experts in animal health such as leading veterinary surgeons,” she said in a statement to News Corp.

She said PetSure claims are accepted in around 85 per cent of cases.

“This is an insurance that’s made to be used, and claims numbers demonstrate that,” she said.

“With over 500,000 claims processed each year, we pay the equivalent of a claim every minute of every day of the year.”

Ms Awad said pet insurance often means the difference between life and death for cats and dogs.

“Today, many lifesaving treatments are beyond the reach of average family finances — in practice, this means pets that could be saved or receive necessary treatment are being euthanised or given lower quality care, causing distress to pet owners and to the vets who treat those animals.”