‘The rest of us get short-changed’: CommBank staff slam CEO’s $10.4 million pay packet after record profit

CommBank CEO Matt Comyn has been slammed during a staff town hall, amid growing outrage over the lender’s record profit.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

CommBank chief executive Matt Comyn has been slammed during a staff town hall, amid growing outrage over the lender’s record profit as Australians face spiking mortgage costs and shrinking pay packets.

On Wednesday, the nation’s largest bank announced its largest ever cash profit of $10.2 billion in 2022-23, with the 6 per cent increase driven by expanding profit margins after soaring interest rates pushed the bank to hike variable mortgage repayments 10 times in that period.

Mr Comyn received an eye-watering $10.4 million pay packet, which included nearly $8 million in bonuses.

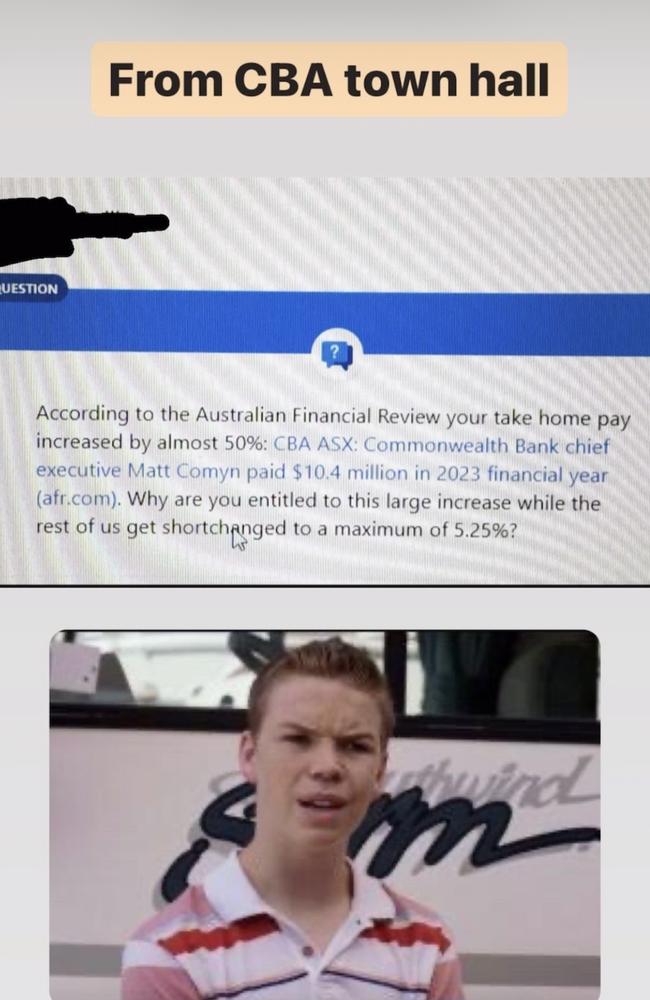

“According to The Australian Financial Review your take-home pay increased by almost 50 per cent,” one staff member wrote in an online town hall question, shared on Instagram by The Aussie Corporate account.

“Why are you entitled to this large increase while the rest of us get short-changed to a maximum of 5.25 per cent?”

Users on social media also expressed outrage. “So the CBA has recorded record profits and giving the bosses huge bonuses,” one man wrote.

“Maybe the best thing that could happen tomorrow is every one walk into their nearest greedy CBA branch, close their account and withdraw their money. Nothing but pure greed deserves nothing less than closure due to lack of funds.”

Another described it as “totally obscene that the head of CBA earned $10.4 million last year and their exec level all earned bonuses while so many of their clients are going through serious hardship”.

“These folk are employees! They haven’t risked a cent of their money for these windfall remunerations while SMEs all around the country are struggling, in a large part, because of their bank charges,” he said.

“A lot of these small businesses risk absolutely everything to try and get ahead but because of inflation not meeting government thresholds, because of war, global and local Covid recovery and many things out of the individual’s control, the banks somehow get licence to rip into the non-elite population.”

Australian Council of Trade Unions secretary Sally McManus wrote, “The CBA just announced a record profit. Price gouging much?”

News of Mr Comyn’s pay came after CommBank offered staff a 17 per cent wage increase over four years, below pay proposals at NAB but higher than ANZ, The Australian reported.

“We have tabled an offer and we communicated that to our people of 12.75 per cent over three years,” Mr Comyn told the newspaper. “I think it’s a reasonable position. We hope it will be supported.”

But Finance Sector Union national secretary Julia Angrisano said the bank’s record profit “very obviously” showed it could “afford to pay more”.

“Their proposed pay rise would be a pay cut in real terms, given inflation,” she told The Australian.

“CEO Matt Comyn’s pay increase of 50 per cent to 10.43 million dollars is a slap in the face to CBA workers who delivered the profit that drove this increase. CBA needs to reward its staff with industry-leading pay increases.”

Since May last year, Australian households have been hit with 12 interest rate hikes, skewering household budgets. With the cash rate jumping by 4 per cent, repayments on an average home loan of $585,000 are now an extra $1415 every month.

The number of home and personal loans in arrears rose, but still remains low, with Mr Comyn stating arrears and impairments remained below long-term averages.

However, the bank also revealed new analysis which showed how rate hikes and high inflation were being felt disproportionately by younger Australians. While customers under 34 have seen their savings fall over the 12 months to June 2023, customers 35 and above have seen their savings grow.

The bank largely attributed the profit result to an increase in net-interest margins (NIMs), the amount of interest that a bank receives on a loan after it pays its customers interest, which jumped 0.17 percentage points in the year to June.

“The Australian economy has been resilient with the tailwinds of a recovery in population growth, relatively high commodity prices and low unemployment,” Mr Comyn said in a statement accompanying the profit result.

“However, there are signs of downside risks building as rising interest rates have a lagged impact on mortgage customers and other cost of living pressures become a financial strain for more Australians. We are seeing consumer demand moderate and economic growth slow, and we are closely monitoring the impact of reduced discretionary spend, particularly on our small and medium-sized business customers.”

— with NCA NewsWire

Originally published as ‘The rest of us get short-changed’: CommBank staff slam CEO’s $10.4 million pay packet after record profit