Canada clears Paladin’s $1.5bn uranium takeover

The acquisition of Fission Uranium will be subject to strict conditions aimed at preventing Chinese influence.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Paladin Energy boss Ian Purdy has backed moves by Canada to prevent China sinking its claws into the uranium asset at the heart of a $1.5bn takeover of Toronto-listed Fission Uranium.

Canadian authorities have cleared the way for Paladin to complete its acquisition of Fission but imposed strict conditions around the takeover aimed at preventing Chinese influence.

The conditions were handed down after an investigation that covered attempts by Chinese interests to thwart the takeover.

Canadian Industry Minister Francois-Philippe Champagne ordered a national security review after China General Nuclear Power Corporation, a state-owned entity that has an 11.3 per cent stake in Fission, attempted to block the Paladin deal at a shareholder meeting in September.

Canadian authorities have now cleared the deal, subject to a string of conditions that Mr Purdy described as “appropriate and comprehensive”.

He said the Canadian government imposed the conditions because it had a strong view on who controlled the country’s critical minerals, and also wanted to ensure uranium supply to the domestic market and to Western allies who relied on it as an energy source.

The Paladin takeover will weaken China’s influence over the Patterson Lake South (PLS) uranium project in Canada’s Athabasca Basin via CGN’s hefty stake in Fission and an offtake deal.

The undertakings provided by Paladin include that a majority of its board must be independent within the meaning of the respective listing rules of the ASX and Toronto Stock Exchange.

Paladin must also appoint a Canadian citizen who ordinarily resides in Canada to its board within 12 months, and all senior executives of Paladin must be “independent” in the sense that they do not have current or prior contractual, financial or fiduciary relationships with any Chinese state-owned enterprise.

Paladin has agreed not to sell uranium produced from PLS to any customers, distributors or end-users in China, with the exception of sales to CGN under the existing offtake agreement.

The company is also barred from using China as a source of finance for the PLS project.

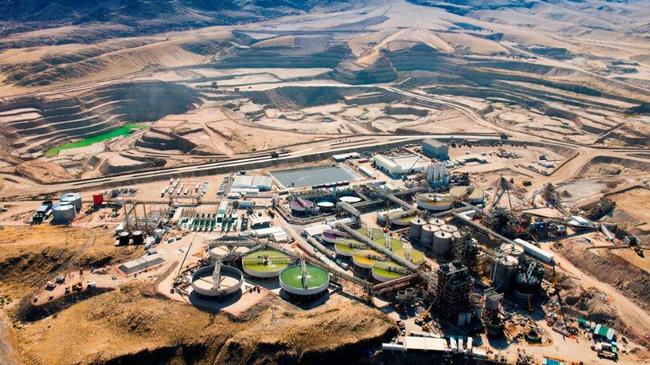

Perth-headquartered Paladin last month blamed uncertainty over Canadian approval for volatility in the company’s share price, with the prolonged investigation adding to market concerns about the ramp up of the Langer Heinrich uranium mine in Namibia.

More than $800m was stripped from the value of Paladin in November after a big downgrade in production guidance for Langer Heinrich.

Paladin will be jointly listed on the ASX and TSX post the Fission acquisition with assets that include PLS and Paladin’s Michelin project in Labrador as well exploration projects in WA and around Mt Isa in Queensland.

Paladin owns 75 per cent of Langer Heinrich, with the remainder in the hands of the China National Nuclear Corporation.

Mr Purdy said he did not expect the Canadian decision to impact the relationship with China National Nuclear Corporation, or its supply agreements around Langer Heinrich.

He said Paladin hoped to have an appropriate producer-customer with CGN for the duration of the PLS offtake deal.

“We’ll have CGN as a major customer for the first three years of operations at PLS, and we expect to maintain an appropriate producer-customer relationship,” he said.

“They were hopeful that they could retain more control and more offtake over PLS, which is understandable. We were fortunate to be approved (by Canadian authorities) and as part of the mechanics of the deal, their ownership and their offtake are truncated.

“There is a structural shortage of uranium globally today, which is expected to exacerbate over the next five to 10 years, so questions over energy security and access to fuel are very much current topics in the nuclear space.

“Canada has a strong regulatory framework already about where you can sell your uranium product, and we will comply with that framework and we’ll focus on supplying our uranium from our Canadian projects to Canada and allies.”

Mr Purdy declined to comment on the political debate raging over the Coalition’s plan to build nuclear power stations to provide much of Australia’s energy needs.

“What I can say is nuclear energy is a key part of the energy infrastructure of all the countries that we deal with. We have customers in the US, in Asia and in Europe, and we’re seeing very good demand for our product,” he said.

“We’re advocates of uranium mining. We would like to see Australia allow uranium mining. We think that would be good for Australia and good for our partners.”

Uranium mining is banned in most of Australia through state-based policy and legislation, but allowed in the Northern Territory and South Australia. WA has a ban on new mines.

Originally published as Canada clears Paladin’s $1.5bn uranium takeover