States turn blind eye to risky casino junkets

Most Aussie states have washed their hands of regulating casino junkets, despite the high-roller tours being a prime risk for money laundering.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

Most Australian states have washed their hands of regulating casino junkets, despite the high-roller VIP gambling tours being a prime risk for money laundering and terrorism financing.

Queensland’s gaming regulator is the only state authority that actively licenses the junkets, as both Victoria and Western Australia ditched the approval processes more than 10 years ago.

The controversial tours primarily attract wealthy mainland Chinese gamers to Australian casinos for exclusive gambling events.

Most states have now placed responsibility on individual casinos to ensure third-party junkets are compliant with anti-money laundering and counter-terrorism financing laws.

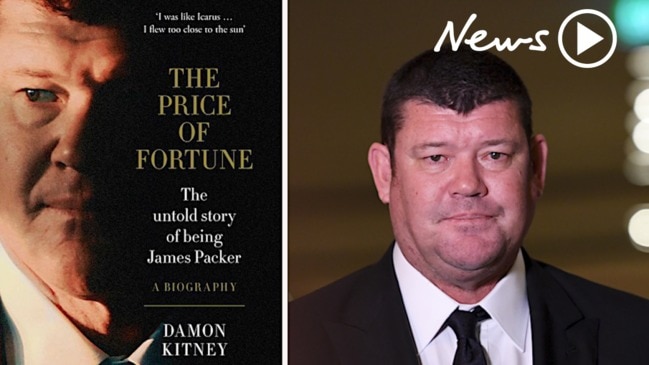

The lack of oversight follows recent claims against Crown Resorts for allegedly allowing junket operators to launder money through its Melbourne and Perth casinos.

The allegations have raised serious doubts with the New South Wales regulator as to whether Crown is fit to hold a gaming licence for its new $2.2 billion Sydney Barangaroo venue.

A 2017 AUSTRAC report also flagged a lack of consistency by state gaming regulators when it came to the oversight of casino junkets.

“AUSTRAC found that there is an inconsistency between the states and territories in relation to the extent of the junket oversight they undertake,” AUSTRAC said.

“There is a limited extent which state-based regulation could be said to mitigate the gaps in AUSTRAC’s regulation of junkets.”

The financial crimes watchdog also noted some gaming regulators were planning on relinquishing junket due diligence to independent casinos due to “budget pressures”.

In 2004, the Victorian Commission for Gambling and Liquor Regulation (VCGLR) made legislative changes removing the licence approval for junkets and placed the responsibility on the casino.

“Probity requirements for junket operators became the responsibility of the casino operator,” a VCGLR spokeswoman said.

“Currently, the (Victorian) Casino Control Act does not contain a licensing regimen for junket operators.”

The West Australian regulator, the Department of Local Government, Sport and Cultural Industries, relinquished its responsibility on June 5, 2010.

Queensland, where Crown’s major rival The Star Entertainment Group has two casinos, is the only state that has implemented licence approvals for junket tours to operate.

The NSW Independent Liquor and Gaming Authority also has not implemented junket approval licences, however the regulator has the power to exclude companies and individuals from a casino.

An ILGA spokesman said the probe into Crown Resorts would examine the state’s casino laws and would recommend any reforms, including the regulation of junkets.

Crown’s money laundering scandal has centred on its relationship with Macau junket operator Suncity, which allegedly has known links to organised crime syndicates in Asia.

Leaked footage in 2019 from the dedicated Suncity room at Crown Melbourne showed a man unloading huge wads of cash from a blue cooler bag to exchange for gaming chips.

It was revealed during hearings at the NSW inquiry that Suncity’s money pit at Crown Melbourne had a playing cap of $100,000, however the money held at the time was in excess of $5.6 million.

Crown Resorts permanently ceased all relationships with junket operators, unless the respective state gaming authority approved a junket with an operating licence, it said in a statement to the Australian Stock Exchange on November 17.

The Star’s casino operations in both Queensland and NSW also had operating partnerships with Suncity. The group is yet to announce if the relationship will continue.

The Queensland Office of Liquor and Gaming Regulation said junket operators were subjected to police checks, which review criminal history, and also needed to provide police clearance from the junket’s country of residence.

“As part of the suitability assessment, junket promoters and their representatives are subject to an interview, which is typically conducted by the Queensland Police Service in the company of an OLGR officer,” a spokeswoman said.

“OLGR also reviews the terms of any junket agreement entered into between a junket promoter or junket representative, and a casino operator.”

AUSTRAC said it was finalising a risk assessment on junket tour operations.

“This will further inform AUSTRAC and the sector about the risks posed, and educate casinos to put in place measures to mitigate money laundering/terrorism funding risks and criminal exploitation of their businesses,” a spokesman said.

The global financial crime fighting body, the Financial Action Task Force, also raised concerns back in 2009 that casino junkets were a major money laundering risk.

It is understood, other major gaming jurisdictions, such as Macau and Nevada, required junkets to hold a licence to operate.

Originally published as States turn blind eye to risky casino junkets