Spending slips through April as inflation crunched households hold out for budget relief

With family budgets coming under further strain, consumers heavily wound back on spending on non-essential items in April.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

Cash strapped consumers wound back spending further in April, heavily reducing their spending on eating out and recreation to cover soaring education, insurance and utilities costs.

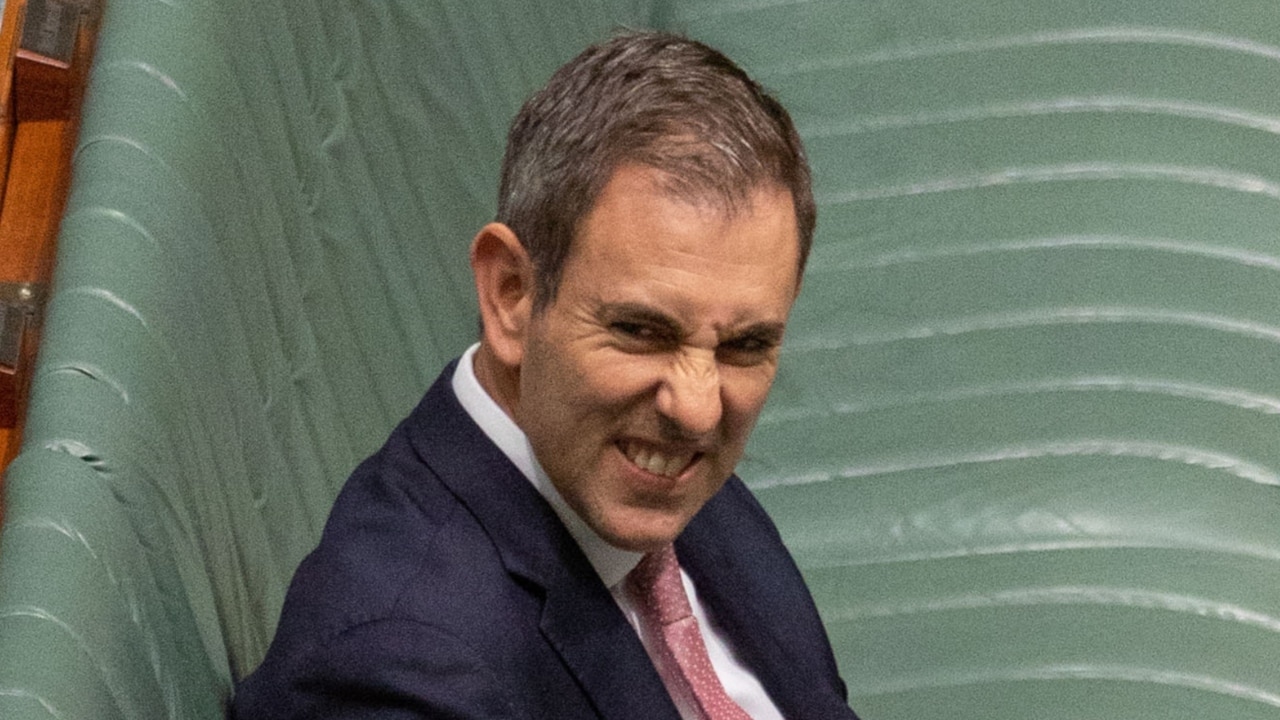

Ahead of Tuesday’s federal budget, where Treasurer Jim Chalmers is widely anticipated to announce a further round of cost of living relief, fresh Commonwealth Bank data showed household spending slipped 1 per cent last month as elevated interest rates and stubborn inflation crunched family budgets.

In the 12 months to April, spending growth slowed to just 2.6 per cent.

The figures capture payments data from seven million of the bank’s retail customers, equating to 30 per cent of total spending across Australia.

While spending rose across discretionary categories, led by education, which climbed 3.7 per cent as childcare, school and university fees rose sharply higher, consumers kept their wallets closed for non-essential items.

Hospitality spending across cafes, restaurants, bars and takeaway stores slumped, down 3.3 per cent, while spending across recreation, covering everything from music stores to motor home rentals, skidded 2.6 per cent.

Food and beverage spending similarly slumped, falling 3.8 per cent, as consumers sharply reduced the size of their shopping baskets following an uptick over Easter which unusually fell in March alone.

As household budgets came under strain, spending on essential goods and services was 0.5 per cent higher over April, while discretionary purchases plunged 4.4 per cent.

Commonwealth Bank chief economist Stephen Halmarick said the fall in April reflected a continuing softening in household spending, which he anticipated would continue until the end of the year.

“Renters in particular have cut back,” Mr Halmarick said, noting that spending for this cohort had inched just 1.3 per cent higher in annual terms.

“Those who own their home outright experienced the strongest spending growth at 6.3 per cent annually.

“We expect weak consumer spending and below-trend economic growth to continue throughout 2024.”

With households squeezed, the federal budget expected to deliver an additional round of cost of living relief, with a continuation of current power bill discounts and an increase in rental assistance both widely anticipated.

The stage three tax cuts, slated to come into effect on July 1 will deliver additional support, with all taxpayers set to enjoy a cut to their annual tax bill.

Combined with an expected easing in headline inflation, the tax cuts are expected to drive an increase in real household incomes.

Originally published as Spending slips through April as inflation crunched households hold out for budget relief