Australian share market rallies in afternoon trade as Origin board rejects Brookfield ‘plan b’

A rally in tech and industrials saw the benchmark finish in the green on Thursday as Origin Energy’s board rejected a proposed takeover bid.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

The Australian share market rebounded strongly on Thursday, buoyed by gains in cyclical stocks, after a lacklustre start to trading.

The benchmark S&P/ASX200 added 0.74 per cent, or 52 points, to reach 7,087.3, while the broader All Ordinaries rose a similar amount to 7,297.7.

The Australian dollar was higher at the end of trading, buying US66.44c, up 0.4 per cent.

Tim Waterer, chief market analyst at KCM Trade, told NCA NewsWire the benchmark enjoyed an “afternoon growth spurt” to finish in the green after a mediocre performance earlier in the session.

“Equities are still getting some mileage out of Wednesday’s tamer than expected CPI readings,” Mr Waterer said.

“Some of that optimism from yesterday, on the back of the inflation data, did carry forward into our session today and propelled some further gains on the ASX 200.”

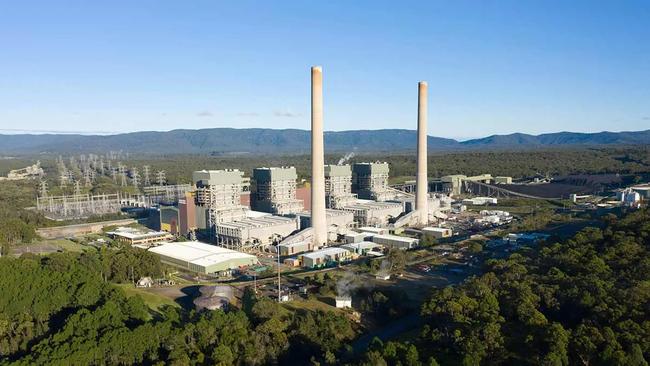

Across the benchmark, utilities were the worst performing sector, with takeover target Origin Energy falling 1.9 per cent to $8.24.

Origin, Australia’s largest energy retailer, said on Thursday the “complex” new offer lobbed by the Brookfield-EIG consortium to buy out the firm is not in the best interest of shareholders, rejecting the proposal.

“The revised proposal is incomplete, complex, highly conditional and does not provide sufficient certainty for Origin shareholders,” the company wrote in a statement filed to the ASX.

AGL Energy also slid 2.7 per cent to $9.43.

The financials sector was the best performer with all big four banks finished higher. Commonwealth Bank edged up 1.3 per cent to $104.66, National Australia Bank climbed 1.1 per cent to $28.40, ANZ added 0.8 per cent to $24.37 and Westpac firmed 1 per cent to $21.37.

The industrials sector also finished the green, adding 1.4 per cent. Transurban climbed 1 per cent to $12.96, Brambles rallied 2.1 per cent to $13.34 and Qantas rose 1.9 per cent to $5.30.

Oil advanced as uncertainties surrounding the high-stakes OPEC+ meeting, scheduled for Thursday evening (AEDT), with the cartel expected to set production targets for 2024, but is yet to overcome a dispute with some African members over output quotas.

“The size and scope of any production cuts will dictate what happens in the oil market,” Mr Waterer said, adding that while a move higher in the oil price could be expected following the meeting, “whether that can be sustained or not remains to be seen”.

In company news, shares in the information services provider Iress rocketed 14.9 per cent to $7.03 after the firm lifted its earnings guidance. The company expects earnings of $123m to $128m for financial year 2023.

Fortescue Metals’ former chief financial officer Ian Wells has been appointed as an executive director of Liontown Resources. It follows his shock resignation from Fortescue in January. Shares for the lithium miner added 2.2 per cent to $1.38.

SkyCity Entertainment shares added 4.2 per cent to $1.75 following a judgment by the New Zealand High Court which ruled in favour of the casino operator over the termination of a 2019 deal to operate car parks at its casino in Auckland.

North Queensland copper prospector Cooper Metals vaulted 67.3 per cent to 44c, after it reported significant, high-grade copper deposits at its Brumby Ridge project near Mt Isa.

More Coverage

Originally published as Australian share market rallies in afternoon trade as Origin board rejects Brookfield ‘plan b’