‘Boomer fund’: Superannuation mistake too many Aussies are making

A young Aussie has revealed how much she has set aside for her future – and how uncommon it is should scare you.

Super

Don't miss out on the headlines from Super. Followed categories will be added to My News.

Natasha Etschmann isn’t worried about her superannuation balance or retiring, but only because she’s been investing since she was 18.

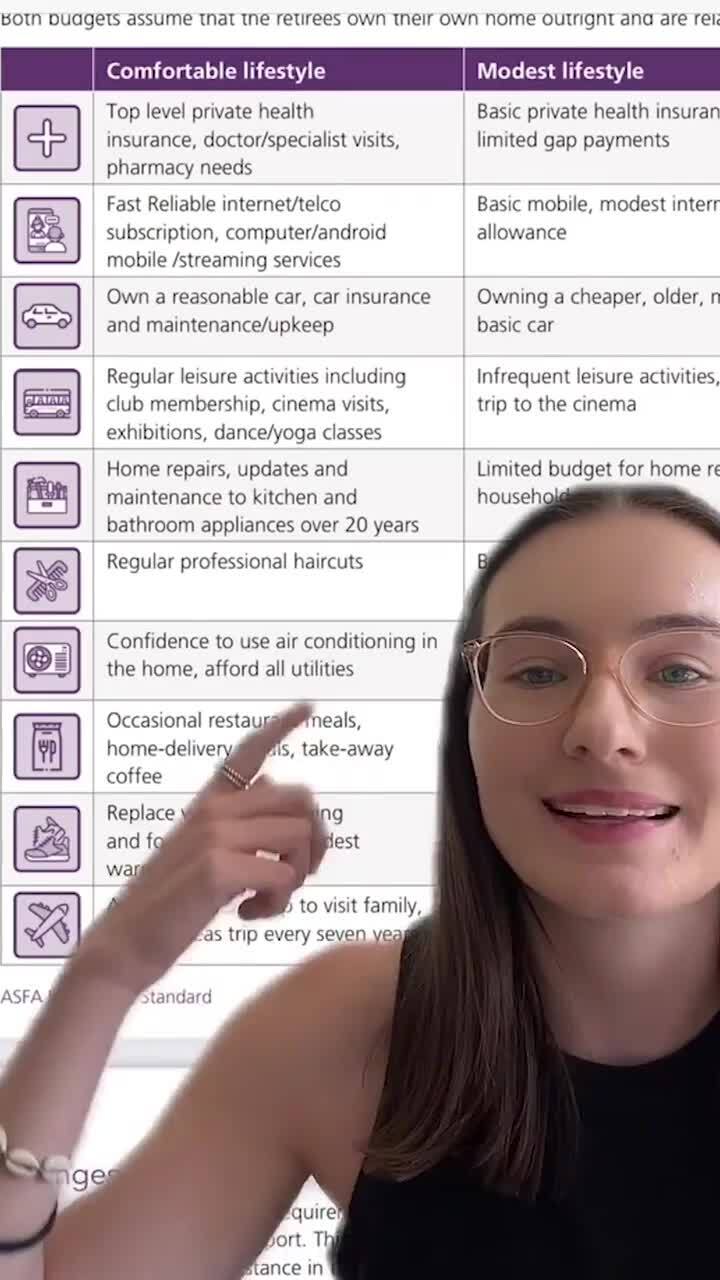

According to The Association of Super Funds Australia, to retire comfortably, single Aussies need $545,000 in superannuation, and Aussie couples need $640,000, and that is only if they own their own home.

According to UniSuper, the average Aussie aged between 25 and 29 has less than $30,000 in their super. Men have an average of $25,981, and women have only $23,429.

By the time Australian men hit their sixties, they have over $400,000 in superannuation, but women only have $318,000.

The scary part, of course, is that this amount is noticeably lower than what people need to be able to retire comfortably.

Ms Etschmann said she started looking at her superannuation hen she was 21, but even someone like her, who is very into finance, found it “hard to get excited about because it is so far away”.

The 27-year-old bought her first home, an apartment in Perth, at 22, and she’s focusing on investing outside of superannuation for retirement.

“I’ve been investing outside of super since I was 18 and I still have 30+ years until retirement,” she told news.com.au.

“I have almost $300,000 in total, including super, shares/ETFs outside of super. Even if I don’t invest another dollar, I’ll have around $2.2 million in 30 years assuming an average annual return of seven per cent.”

Ms Etschmann said that she’s still investing, though, so she imagines the number will be much higher when it is time for her to retire.

The 27-year-old said that young people need to understand their superannuation and “make sure your super is invested in the right portfolio”.

Ms Etschmann advised that young workers “make extra contributions a regular habit rather than once off”.

She also understands why it can be so tempting not to learn more about superannuation because it is one of the “most complex retirement systems” in the world.

“It’s done well in helping people save for retirement, but the rules, regulations, and wording used is hard to understand,” she explained.

“To understand super, you first need to understand the power of investing and compound interest, how the tax system works, and then you need to learn about super”.

Riley James, the CEO of SuperAPI, an engagement tool for super funds, said that young Aussies must avoid signing up to a “Boomer Fund”.

Mr James said that sometimes young Aussies sign up for superannuation funds that are “suitable for Aussies who are in or nearing retirement” rather than thinking critically about where they’ll get the most bang for their buck.

He said young workers can afford to take some “risks” when investing their superannuation because they have time to “weather the ups and downs of the markets”.

“If you’re stuck in a conservative or defensive option with lower growth options, you’re not making every year count. That could be the difference between a very comfortable retirement, and financial hardship in your senior years,” he warned.

Mr James said he doesn’t believe in young people putting their superannuation in “conservative funds”.

“For a 21-year-old, accidentally investing in a conservative fund is a lifetime of lost opportunity,” he said.

“When you’re young you have less to put into your super, but, those smaller amounts have 30+ years to compound into a large balance that will fund the rest of your life, from the day you retire.”

Financial expert Alex Jamieson said the best way to ensure your financial future is to understand what superannuation fund you have and not blindly follow your employer’s recommendation.

“The best starting point is to look at your super and check you are in the right fund. Don’t let your employer decide your retirement future; make sure you are in a higher-performing super fund,” he told news.com.au.

Mr Jamieson believes that in the future, to retire comfortably, you’ll need much more than $500,000.

“To retire comfortably – to do this an annual figure of around $73,000 would be ideal. To achieve this, you would need around $1.2 million in super if you don’t want your capital to deplete,” he said.

More Coverage

Originally published as ‘Boomer fund’: Superannuation mistake too many Aussies are making