Bill shock sets in as RBA goes hard on cash rate

The Reserve Bank is playing catch-up as it scrambles to contain the inflation wildfire spreading through the economy.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The Reserve Bank is playing catch-up as it scrambles to contain the inflation wildfire spreading through the economy as it pushes through another super-sized rate hike.

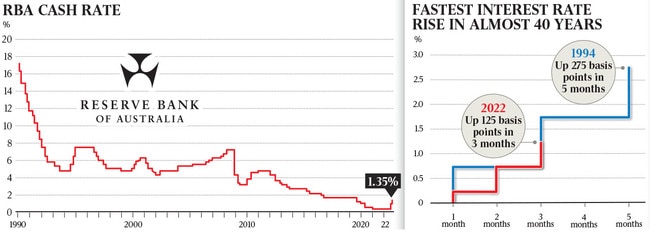

With another 0.5 percentage point rise on Tuesday, RBA governor Philip Lowe has taken the nation’s cash rate back over the 1 per cent mark and warned there is more to come.

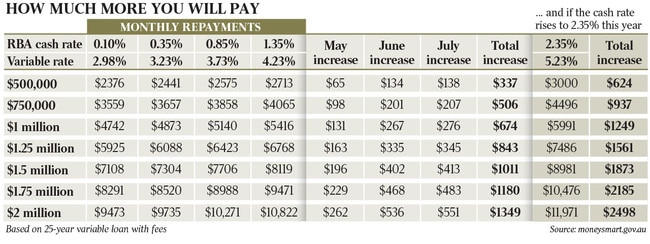

The bill shock of the back-to-back 0.5 percentage point rate hikes will be severe. But even a new cash rate of 1.35 per cent in the eyes of the central bank represents an expansionary footing with fuel still being thrown onto the economy – albeit at a slower rate – while inflation is taking hold.

The key is the central bank’s view on when inflation is expected to peak. There’s always a lag between a rate rise and how it shifts activity and the RBA is tipping the ceiling to be hit later this year. The June quarter inflation figures due for release next month will be critical on whether this view still holds and will determine if we have seen the end of the 0.5 percentage point rises for now.

There is a very busy inflation calendar coming over the next two quarters. Supermarkets are still working through price rises, NSW floods will adding to tighter food stocks; global oil expected to remain elevated and winter household power bills are set to soar. Meanwhile wage rise requests are slowly making their way through to higher prices and this will continue through to the rest of this year.

Treasurer Jim Chalmers has been working to front load the bad news, keeping it close as possible to the previous government. After the RBA move Chalmers warned inflation is expected to get “worse before it gets better”, which means more rate rises were likely. Chalmers said the latest hike will “bite” but noted the resilience of Australians.

Tuesday’s move is the first consecutive 0.5 percentage point rate rise this century and the biggest rapid interest rate hike since Paul Keating was Prime Minister in the early 1990s.

While a technicality given Chalmers has only been in the job for six weeks, he needs to manage the harsh message around rising costs that is coming under his watch. He is the first treasurer in three decades to see more than 1 percentage point rate rise in just a few quick months.

‘Extraordinary support’

Borrowers need to remind themselves they have been living through an extraordinary economic period of ultra-low rates. It now seems like a distant memory, but for almost a three-year period from August 2016 the cash rate was a whopping 1.5 per cent. For a full year before that we laboured under a cash rate of 2 per cent. In fact the average cash rate of the past decade before Covid-19 hit was 2.5 per cent. This is where economists are tipping the cash rate to peak.

“The resilience of the economy and the higher inflation mean that this extraordinary support is no longer needed. The (RBA) board expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead,” Dr Lowe said on Tuesday.

Australians are already adjusting to the end of the cheap money party through the Covid-19 years. All that is a distant memory as the price of everything from fuel, food to rail tickets has already risen. All central banks that matter massively underestimated the impact of the stimulus would have on stirring inflation. Adding to the mix, war in Ukraine has put rocket fuel on commodity prices.

Now rates are rising at a rapid rate to contain inflation which both here and around the world is running at the fastest pace in decades.

The key is how much can a highly leveraged economy handle? Nearly $500bn in new loans were added to the economy during the Covid-19 downturn. That’s a lot of leverage for households and businesses which locked in at a much cheaper rate. The borrowing spree, the fastest since the lead up to the global financial crisis, now sees total debt through the economy of $3.3 trillion – some three times the amount of Australia’s annual economic output.

Bubs seizes its chance

Fast-growing player Bubs has moved quickly to take advantage of a mini-boom in infant formula brought about by the supply shock in the US. Bubs has sought to lock in a $63m capital raising to fund rapid ramp-up of production to meet US demand.

With shareholders including Kerry Stokes, Chemist Warehouse and an AliBaba-linked fund CT Capital, Bubs secured the institutional leg, which covered half the total funds.

At 52c a share this represents an 18.8 per cent discount. Retail investors will look to cover the remaining stake through an entitlement offer in coming weeks with the discount remaining.

Bubs has found itself in an extraordinary position where it has been placed on the regulatory fast track to help address the supply shortage in the US, brought about by a factory closure following a health scare and two deaths linked to one of the market’s biggest suppliers, Abbott Laboratories.

This includes approval from the US Food and Drug Administration for access to the market, and earlier this week it was added to a subsidy program which will be used by 22 state agencies. Bubs has also qualified for tariff relief under the Australia-US free trade agreement – something which will see it edge out New Zealand rivals, which are not covered by a FTA.

Melbourne-based Bubs has so far managed to navigate the geopolitics, given it still counts China as its biggest market, representing two-thirds of sales. Bubs is betting the US developments will mean US sales will be as big as China by next financial year.

While investors have got used to companies launching capital raisings to fund blue sky such as M&A or future growth, the Bubs move is a relative rarity as it is designed to fund actual organic growth. This includes securing funds to help pay for working capital needs and boosting inventory. It is also planning to install a second high-speed canning line at its Deloraine factory in Melbourne.

Equity is generally more expensive than debt, and in Bubs case it comes at a cost because it represents nearly 20 per cent of the company’s capital base. But management including chief executive Kristy Carr and the board don’t want to enter a rapidly-rising interest rate environment and volatile export markets with all of the risks of a highly leveraged balance sheet.

Bubs has received a little bit of help from well-connected former Washington ambassador Joe Hockey and his new advisory shop Bondi Partners.

Only a handful of Australian companies have been namechecked by a US president; now Bubs is one after Joe Biden in late May tweeted that the Australian company was coming to the rescue. This gave significant momentum as it was securing distribution deals with companies including Walmart, Target and Kroger. Last month the US government chartered three 747 cargo planes, each carrying around 90,000 tins of Bubs formula, with the fourth plane scheduled to take off from Melbourne this week.

For all the sunshine there is one big risk on the horizon. Bubs’ access to the US remains temporary, with the company needing a “no objection notice” from the FDA so it can continue to distribute there after November 14 on a permanent basis.

Bubs chairman Dennis Lin has a “high level of confidence that the US journey will continue” beyond this date. His confidence is “based on the discussions that we have had with the regulators and based on our understanding of the formula shortage and what we need to do to address that”.

At the same time there are now more than 100 global suppliers knocking on the door of the US. To date fewer than 10 have been given an FDA green light.

johnstone@theaustralian.com.au