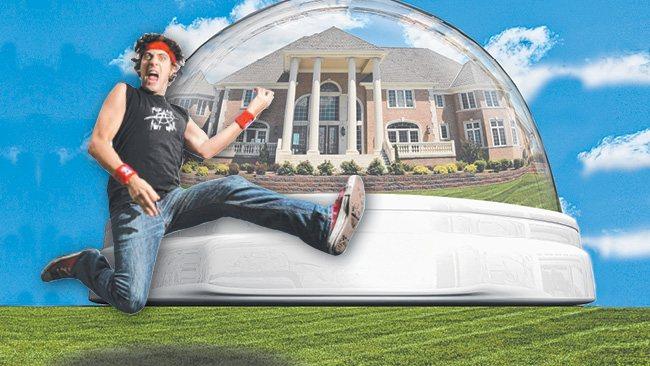

There's no air guitar being played in $2million mansions

I WRITE a weekly Q&A column for the Sunday paper. Due to the volume of questions, the editor likes me to answer at least four each week.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

I WRITE a weekly financial Q&A column for the Sunday newspaper. Due to the sheer volume of reader questions I receive, the editor likes me to answer at least four each week.

Total word count? 700 words.

I've told her that she's asking me to do the financial equivalent of speed dating.

There's no room for small talk.

No "getting to know you" chitchat.

It's all meat, no potatoes.

Yet in this two-minute noodle world that truncated format has proven to be very popular with readers.

But every-so-often a question gets mailed in that's so good it requires a proper first date.

So, here's a question that I received this week - which I am printing in its entirety - along with my unedited, unconventional advice.

The downside of earning $400,000 a year

Hi Scott,

First of all, really enjoy your columns and no-nonsense straight advice.

My wife and I are exceptionally fortunate, despite being wage slaves in our 30s we are lucky enough to pull down about $400,000 a year after tax, have zero debt, a nice home and an emergency fund that is 90 per cent in cash (two years' living expenses).

We max out our super contributions each year, and now have a small share portfolio of about 75k. We have ongoing savings funds for our kids and would like to give them the option of private schooling when the time comes.

In many respects we are very lucky but have worked hard, had a bit of luck and forgone things along the way.

Our immediate goals are to save for the kids' school fees ($280k for 12 years or so) and probably move into a bigger, nicer house ($2 million or thereabouts) and to cease being wage slaves while we are still young.

The dilemma comes from not wanting to take on debt and about where to invest our cash outside of bank accounts to generate a decent return to reach these goals.

"Investment" properties just don't seem to add up (even positively geared), despite tax benefits. Who knows, the fat times may not last forever and we want to make hay while the sun shines.

Any thoughts?

Anonymous.

Hi Anonymous,

I have a few thoughts.

The first is that you are quite clearly a financial rock star. You've achieved a level of (I assume self-made) wealth that people twice your age don't achieve.

Well played.

Here's what interests me about your letter: You've scooped the financial jackpot, but you don't sound like you're fist pumping the air in excitement, or playing air guitar standing on your couch with the stereo up.

Thankfully, a large body of research has gone into examining the first world (first-class) problem you're facing.

The esteemed "economist", rapper Biggie Smalls summed it up perfectly when he said: "Mo Money, Mo Problems".

So let's chat about how to get you strumming your Fender for the least amount of work, stress, and money.

TV producer Aaron Spelling had the biggest home in Hollywood.

It was called "The Manor" and it was so big that he had three rooms dedicated just to wrapping presents.

Maybe he built such a big house so he didn't have to deal with his family. His daughter, actress Tori Spelling, was all but written out of his will and was forced to star in tacky reality shows to pay the bills.

Buying a $2 million home will not make you happy in the long run, and could quite possibly make you very unhappy.

Here is why ...

First, your family and friends will see you differently. They won't come out and say it of course - but they'll think it.

But that's the major reason you buy a trophy home. (You don't need eight bedrooms and six bathrooms any more than you need three rooms for wrapping presents - unless your daughter is Tori Spelling).

To you it says, "we worked hard, and this is the fruits of our success". To others it says, "Look at me! I spent more money on my home than you'll earn in a lifetime!"

Second, the house will cost you at least $100,000 a year to maintain - possibly more.

Your home is an asset, but it's not an investment. As a general rule you're much better off financially renting a home over a million dollars than you are buying it.

Third, your new digs come with a significant tax: Lifestyle inflation.

Your $400,000 a year income (now $300,000 a year) is a king's ransom in a working class suburb, but it's probably about "average" in the trophy cabinet suburb your trophy home is located.

Your kids' friends go skiing in France each year. Everyone in the street drives a late model Mercedes.

You begin to hang out with people called Prue and Dennis who have designer threads, and designer dogs.

The Joneses in your current neighborhood buy a new BMW each year. The Joneses in your new suburb own the dealership (Australia-wide).

And in three years time you won't be any happier than you are today.

Losing a limb or winning the lotto

HARVARD Professor Dan Gilbert did a famous study where he tracked the happiness of two very different groups: people who won the lottery (very happy), and people who had their limbs amputated (very unhappy).

Three years after the event both groups had reverted back to their natural state as if the event had never taken place.

Social psychologists call it hedonic adaptation: Over time our brains get faster at adapting to the sugar hit of accumulating new stuff, and it wears off faster and faster, which leaves us no happier than we were before.

Don't focus on increasing your wealth

YOU'VE already made it. Statistically, you're the 0.1 per cent - you're one of the wealthiest people on the planet. You've reached your "economics of enough".

Each dollar you earn will have a diminishing rate of return on your happiness.

So here's my advice.

Stay in your current home. Live on $3000 a week - more than enough to still enjoy first-class holidays, top private schools, and related wealth trinkets.

Invest $250,000 a year into good-quality shares through a discretionary trust.

In ten years time you'll have a portfolio of $4 million.

That'll roughly pay you $160,000 a year income (what you live off comfortably now), and when you factor in the tax (franking) credits, you'll pay a minimal amount of tax.

By then you'll be in your 40s, with half your life left to decide how to maximise the most valuable thing on earth: Your time.

Good luck finding your air guitar.

Tread Your Own Path!

Contact Scott Pape at barefootinvestor.com

or barefootinvestor@heraldsun.com.au