How Scott Pape became Australia’s most influential personal finance gurus

SCOTT Pape is arguably Australia’s most influential finance expert. He grew up as a typical Aussie battler. This is how he became a money guru.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

ON ARRIVAL to the Barefoot Investor’s lush sheep farm it’s instantly obvious he’s happiest away from the hustle and bustle of the city.

Scott Pape strolls out of his beautiful country homestead with one of his young sons perched on his shoulders and his shoes firmly on, albeit a pair of RM Williams boots.

Some of his family joke that he’s a really just a Collins St farmer, flitting between Melbourne’s CBD and the farm, but it’s in the country he now spends most of his time.

Pape’s picturesque home is buried in a sea of beautiful green rolling hills with sheep and alpacas dotted throughout.

The serenity is magnificent — at his front door is a large dam that’s the family’s haven in summer but also their safeguard against frightening bushfires.

It’s hard to imagine Pape’s farm, tucked away near Romsey one hour north of Melbourne, was completely ruined by a raging bushfire just four years ago.

It literally stole everything he and wife Liz owned.

Australians have come to know and love Pape because this no-nonsense financial guru isn’t afraid to say it how it is.

He speaks their language.

Born and bred in the Victorian regional town of Ouyen, 440km northwest of Melbourne, a town arguably put on the map for its famous vanilla slices, it was here as a youngster he began learning about the importance of money.

Pape grew up in a family like many others — typical Aussie battlers.

There’s no doubt the affect his frugal parents Joan and Donald had on him from a young age has helped lead to his success.

“My dad was really interested in money, when I was in primary school I would ride my bike down to the local newsagency and the newsagent was drunk from the night before and wouldn’t open up,’’ Pape said.

BAREFOOT: Where financial intelligence begins

BAREFOOT: Why you need to tell the truth at tax time

MORE: Scott Pape reveals the talk you must have with your kids

“So the papers would be out the front and everyone would put their money under the door.

“I would take a Sun newspaper and then I would ride home and read the business section to dad.

“Together we would watch Business Sunday with Jim Waley and Terry McCrann.”

Pape’s father worked as a small business operator and his mum as a conveyancer and this too is helped Pape’s fascination with money bloom.

Growing up with older sister Sue-Ellen the Pape family decided to relocate to Bendigo while Scott was finishing primary school days.

Pape says as a kid he watched his folks “scrimp and save” to buy a home in the gold-digging Central Victorian town and without the need for a loan.

“My parents didn’t graduate from high school but that doesn’t mean that they are not very smart, they are just country people,’’ Pape said.

“I watched them over probably the first 10 years of my life save … they saved for the house (in Bendigo) and they bought it with cash, they are still in that same house.”

Pape says he listened intently as his parents discussed their finances in front of him, it was never a taboo topic.

“I got to see my parents having responsible adult discussions about saving and about not having too much debt,’’ he said.

“I sat there with no TV on listening to them about saving and investing and that stuff seeps in.”

Pape worked with his dad as a youngster and had a range of jobs before he took up employment at Safeway in the deli department in Bendigo.

“I wore a white butcher’s hat, pink bow tie and paper hat so I looked like a member of the village people,’’ he says laughing.

To his cult followers — including some hardcore fans who even have Barefoot tattoos inked on to their bodies — Pape is a hero.

He’s someone who speaks to them in his no bulls*** lingo about how they can successfully manage their money.

He has the gift of the gab and can turn often dull personal finance topics into something worth listening to.

This has made him a household name.

His well-known terms includes “buckets”, “date nights” and “mojo accounts” and at just 39 he arguably Australia’s most influential personal finance expert.

The father-of-three’s fame grew rapidly from his regularly money columns that started in Melbourne’s Herald Sun newspapers about 15 years ago.

His knack for responding to real-life money questions from readers including those who suffered marriage breakups, amassed huge credit card debts or even won Tattslotto resonated with readers.

“Everything I write is common sense, it has all been said before but what I bring to it is my own take,’’ Pape said.

“I don’t claim anything I do is revolutionary.”

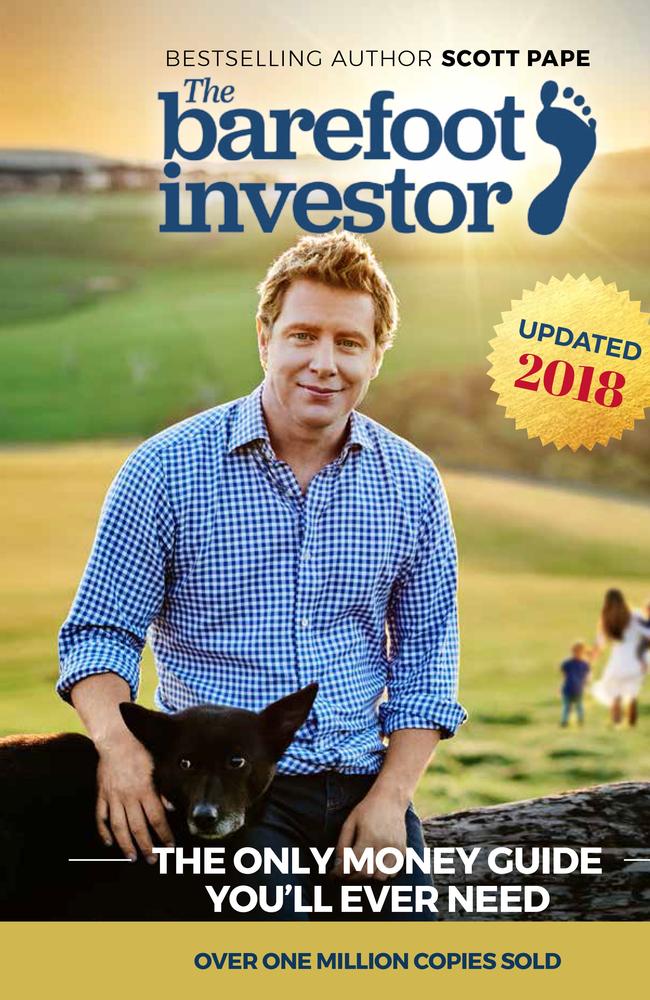

His cult following has no doubt helped lead to the huge success of his best-selling book, The Barefoot Investor: The Only Money Guide You’ll Ever Need.

It has already sold more than 1 million copies nationwide.

Pape cut this financial teeth by studying a business degree at La Trobe University in Bendigo before finishing the course at the university’s leafy campus in Melbourne’s northern suburbs at Bundoora.

He then took up his first full-time gig at the Australian Stock Exchange in Sydney.

But this didn’t stop the then Glebe resident from working two jobs, stockbroker by day, barman by night — something that was unheard of in the finance industry.

“Even when I was at the Stock Exchange, which was quite a coveted position I started working at a pub in Balmain and people were like, ‘why would you do that’,” he laughed.

“It was partly for the money and also because that’s how you get to meet people.”

The pub — the Royal Oak — is now a trendy watering hole in Sydney’s Balmain.

But what irked Pape most at this time was the financial advice kicking around.

As he puts it, “It was for old people who were nearly dead.”

On his return to Melbourne Pape moonlighted as a radio commentator at the Student Youth Network offering financial tips and tricks.

It was here too he wrote his first book.

Dubbed, The Barefoot Investor: Five Steps to Financial Freedom in your 20s and 30s: Scott Pape, it was nowhere near the success of his latest book but still managed to sell thousands of copies.

As to how he became Barefoot, he laughs.

“I don’t even know, it was ‘kick off your shoes and tread your own path’ and that was written at the end of my first column,’’ he said.

“Here I am 15 years later still doing it.”

There’s no denying Pape has a horde of fans hanging off his every word and hoping it will help teach them how to be financially better off.

Pape’s official Barefoot Facebook page has more than 239,000 likes and it doesn’t stop there.

There’s other unofficial groups including with one with more than 82,000 likes.

Pape is busy juggling life as a husband, father, farmer and writer, with his wife, Liz, and three small children, 5, 2, and 5 months.

On their kitchen bench is their children’s neatly lined up jam jars for spending, saving and giving all with a small mass of coins mounting up inside them.

The Pape first met while Scott was working with Channel 10 show The Project and Liz was the producer for his segments.

“Liz is the best producer I ever had and she still is my producer,” he said.

Mrs Pape says she likes to keep a low-profile and this also means the same for their three young children to which Scott agrees.

“There are people who are very obsessive, as the kids get older I don’t want people reading and knowing about them,’’ he said.

“Everything on the internet is searchable and I just think with my kids, it’s not their choice they are too little.

“Everyone knows me and I think it would be hard for them.”

Pape’s best-selling book may well be bumped off the top of the charts upon the arrival of his next piece of financial wisdom, Barefoot for Families: The Only Money Guide Your Kids Will Ever Need.

It’s due out this year.

It zooms on how to help parents raise financially-fit children of all ages and instead of date nights it’s all about “Barefoot Money Meals.”

Pape is passionate about putting money on the table for Australian families.

“It needs to be done, it’s a core life skill that kids get tested every day,’’ he said.

“It is the antithesis of living in a really big home with a leased BMW looking fancy but not having any money, my parents were the opposite.

“Stats shows only one in six families talk about money with their kids, a lot of people want to shelter them and they don’t want to talk about it with them.”

And it’s not the only project the Papes have in the wings — they’re also working on a documentary on how to help kids with cash.

But for the Papes while they are living the dream in their quiet yet busy country lifestyle, there’s no denying they’ve endured heartache along the way.

The day the devastating bushfire raged through their property in 2014 and destroyed everything to their names is still clear in their minds.

Pape was sitting at home knee-deep in an investment report on a code red day and Liz and their then-only son, 10 months, were in the city.

Beside him was his fire alarm buzzer but much to his dismay it failed to go off.

“Then I got call from my neighbour, he rang the home phone and said everyone is evacuating you have to get out,’’ Pape says — he’s involved with his local Country Fire Authority.

Betty his prized sheep dog, the one on the cover of his now-famous book, was also at their farm as disaster loomed.

“I grabbed the dog and jumped in the ute,’’ he says.

“I could hear on the radio if you are in this area it’s too late to leave you have to take shelter.

“But I managed to get out, the fire came through and I got out.

“I came back the next day and kept fighting it but the fire took the house, it took the whole thing.”

The only remnants remaining is the brass bell he gave Liz on their wedding day with their wedding date engraved on it.

They collected it from the ashes of them home — everything they owned was turned to black ash.

It was in the weeks later, when their pair managed to take stock of what torn their life apart was the outpouring of grief from those most loyal to Pape, his fans.

“Liz would come back with trolleys full of things from readers everywhere,’’ he says.

“You sit here on a farm and you write something and you shoot it out and it’s not until something like that happens to you … literally little kids sent us pocket money which we sent back.

“It was overwhelming and lovely.”

But four years on they have recovered and life is back to normal.

They are have a household with three little people running around.

Mrs Pape speaks proudly of her husband and also business partner.

“Scott involves me in all the decisions and we make business decisions jointly because they affect the family,’’ she says.

“I like to keep a low-profile behind the scenes with Scott.”

She says they are still in shock at the success Pape’s book has had.

“We are both surprised that this book has been the success it has been, I don’t think anybody could have expected that,’’ she says.

“I am super proud of him.”

As for moving to the city, that’s not on the cards for them, it’s country life all the way.

“This is where I live now, I don’t go off to the opening of an envelope,” Pape says.

“I say no to practically everything, I’m happiest here on the farm with the family.

“I don’t want to be somewhere in Toorak, I don’t want to be a celebrity hanging out with celebrities.”

sophie.elsworth@news.com.au

FIVE NEW FINANCIAL YEAR TIPS FROM SCOTT

1. Make sure your super fund isn’t ripping you off.

The only free lunch in finance is lowering the fees you get charged. How much is too much? Start with 1 per cent per annum and work your way down. Keep the bastards honest.

2. Boost your super

If you’ve bought a home and you’re paying it off, consider bumping up your super contributions to 15 per cent of your pre-tax wage (call your fund to make sure you don’t go over your contributions caps). You’ll thank me in 30 years.

3. Switch your bank account

Change your bank accounts to a zero fee, high interest saver. Yes, I know that most of the banks don’t charge ATM fees any more (though some still do!), and yes I know it is small beer in the scheme of things. Yet it’s also a daily reminder that you’re smart with money.

4. Get a pay rise (in 12 months time)

At your annual review, work with your boss to set three goals for you to achieve over the next 12 months. Then create a document on your work computer, and set a daily calendar reminder to do something tiny towards achieving them.

5. Get App-ed

Download the Australian Taxation Office’s myDeductions app, which will track all your receipts throughout the year (including a very handy logbook for your car). If you’re an employee with a simple tax return, you probably don’t need to pay an accountant, just use MyTax via your MyGov instead.