Barefoot Investor: Financial freedom begins by building a bucket list

A MELBOURNE couple started paving a future by following the advice of the Barefoot Investor to set up a bucket strategy.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

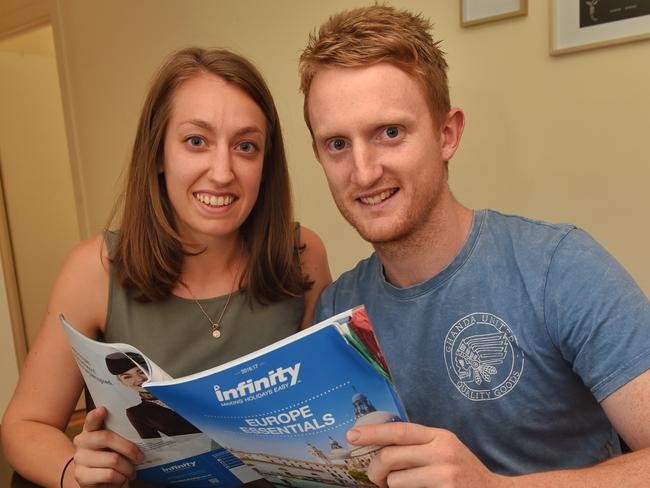

DANDENONG couple Olivia Ryan and Matt Sherwood, both 26, are at the very start of their working careers and, while retirement is a fair way off, they are determined to pave a future of comfortable living.

The pair received The Barefoot Investor as a Christmas gift in 2016 and Mr Sherwood said the book greatly helped him understand his superannuation.

He decided to boost his super contributions to 15 per cent by incorporating a 5.5 per cent salary sacrifice into his weekly wage, a move which will help ensure a comfortable retirement.

“I really like knowing that some day, I will be able to retire without money stress and live the lifestyle that I deserve,” Mr Sherwood said.

“It was really easy to set up and I barely notice the difference in my take-home pay.”

The couple has separate mortgages, which they are paying off using The Barefoot “bucket strategy”, having set up numerous accounts for various needs with automated transfers.

They are now busy filling their buckets for a trip to Europe, with plans to escape to a European summer over the winter.

“We’ve realised that finance doesn’t have to be a foreign concept,” Ms Ryan said.

HOW YOU CAN RETIRE WITH JUST $250K IN SUPER

YOU need $1 million in retirement,” say most financial planners.

“$2 million might not even be enough,” wrote a financial planner in the newspaper recently.

Stop!

If you’re aged in your 50s these retirement figures will likely scare the bejeezus out of you. After all, the average Aussie couple retires with $200,000 in super.

Let me be clear: you do not need a million dollars in super to retire. A million dollars is way above what you actually need.

At a minimum, you need a paid-off home, plus:

Couples: $250,000 in super

Singles: $170,000 in super

Make this your ‘retirement number’. To be clear, this is the number you need to nail before you even think about retiring — and that’s in addition to owning your own home outright.

Hang on, what if you don’t have $250,000 before you retire? You keep working.

Hang on, what if you have more than $250,000 saved up in super? You keep smiling. Barefoot rule number 3445 states: ‘when it comes to your retirement, you will always be better off having more money in super. Always.’

Here’s you, here’s me

Here’s you: I think old Barefoot needs a pedicure! I mean, really, what sort of retirement will $250,000 get us? We don’t want to dine out on dog food!

Here’s me: If you follow my strategy to the letter, you’re going to have a very comfortable retirement.

Here’s you (crossing your arms): Your idea of retirement might be a little different to ours, young man.

Here’s me: Okay, well let me paint you a picture of what a paid-off home and $250,000 (or $170,000 for singles) buys you in terms of lifestyle in retirement.

What your retirement will look like

• You enjoy a three-week trip to Noosa each year with your friends, staying in a nice hotel.

• You regularly eat out at nice restaurants, and you choose whatever you want on the menu.

• You enjoy a nice glass of wine (or two) as the sun sets each night.

• You own a near-new Toyota Corolla.

• You regularly buy nice new clothes.

• You continue going to the same hairdresser you always went to while you were working (they’re an absolute magician at hiding the grey, and — let’s be honest — they’ve got a bit more work to do these days).

• You keep track of the footy scores on your iPad … and download the occasional dirty movie.

• You enjoy fishing with the latest gear. Your wife goes to pilates once a week, and you both go to art class and learn how to draw nudes.

• You buy your grandkids nice presents, without spoiling them. More importantly, you buy an annual zoo pass and take them out on day trips. Lots of snaps on the iPhone for the weekly battle of ‘my grandkids are cuter than yours’ at the golf club.

• You’ve got enough dough to replace your drab kitchen and bathroom when you retire (you’ll be spending a lot more time in the toilet, old boy … drip, drip, drip).

• You’ve got top-quality private health insurance so you can have your choice of doctor and hospital.

• You’ve got emergency money socked away so you don’t have to worry about day-to-day bills — and you know your long-term income will never run out.

BAREFOOT INVESTOR: BOOTING KIDULTS OUT GIVES THEM A KICKSTART

Again, just to be clear, that’s what you can look forward to if you retire with a paid-off home and $250,000 (or $170,000 for singles), if you follow my Donald Bradman Retirement Strategy. Sound good?

Well, you’ll be pleased to know I haven’t plucked any of this out of thin air. What I’ve just described (minus the dirty movies) is what the stodgy Association of Superannuation Funds of Australia (ASFA) has calculated as being achievable for retirees living a ‘comfortable retirement’.

So how much dough does ASFA calculate that this comfortable retirement will cost? $59,971 a year for couples; and $43,665 a year for singles.

At this point you’re thinking, ‘Does this plan of yours involve me holding up convenience stores with cricket bats? Because I can’t see how my $250000 will afford me a $59 971 per year lifestyle’.

Let’s head to the crease.

BAREFOOT INVESTOR: HOW TO DETONATE YOUR CREDIT CARD DEBT

Rule 1: You must have the banker off your back

This strategy only works if you retire debt free ... as in no mortgage.

Even better, the Age Pension doesn’t take into account the value of your family home. (Which means that, theoretically, James Packer could cash in his chips when he’s older, buy a $7 billion home and collect the Age Pension.)

You need to own your own home — debt free — before you retire.

Rule 2: Nail your number

You can’t retire until you’ve nailed your retirement number as a minimum (more money is better): $250000 in super for couples and $170000 for singles.

Hang on, what’s so special about these numbers?

This is the maximum dollar amount of assets (excluding your family home) that you can have and still get close to the maximum rate of Age Pension. At the time of writing, the maximum rate of Age Pension is $34 819.20 per year for couples and $23 095.80 for singles. And it will get you 60 per cent of the way towards your comfortable retirement number on its own.

Think of this as your safety net: it’s guaranteed by the government, it’s indexed twice a year to keep up with inflation and it will be paid until the day you die.

Rule 3: Never, ever retire

It’s said that the two most dangerous years of your life are the year you’re born and the year you retire.

Well, it looks like you made it through the first one, so let’s talk about the second.

The golden rule of retirement is ... keep working.

That doesn’t mean you have to keep your existing job (especially if you’re a tiler with dodgy knees).

You can do something less labour intensive — just a day or so a week, and it doesn’t need to be every week.

Work is good for you: retirees who continue doing some kind of part-time work are found to be the happiest and the least likely to suffer depression.

Why not use the skills you’ve honed over your career to do some useful work? I meet so many Uber drivers who are well-to-do retirees who don’t need the money — they just like chatting to people and earning their keep at the same time.

And better yet, if you do work, the government will bend over backwards to help you.

Once you reach pension age, you’ll not only be able to draw a tax- free pension from your super, but in addition a couple can earn up to $28974 each without paying a cent of income tax (singles can earn $32279 per year).

BAREFOOT INVESTOR: YOUR 2018 FINANCIAL ROAD MAP

Yet what if your adviser says, ‘You’re a winner, you don’t have to work another day in your life’.

Barefoot says, ‘Work anyway, even if it’s a day a week’. The biggest mistake you’ll make with your retirement is to give up working.

You’ll never, ever, run out of money

Let’s take a final look at the retirement scoreboard, after you’ve applied all three rules:

1. You’ve paid off your home.

2. You’re getting the Age Pension of $34,819.20 (per couple) a year, indexed for life. And you’ve got $250, 000 in super. (After you turn 65, you’re legally required to draw down a minimum 5 per cent of your account balance — or in this case $12 500 of tax-free income per year. As you get older, the minimum you’re required to drawn down gradually increases.)

3. You and your partner each work just one day a fortnight (and not every fortnight, you’ll be in Noosa, remember) to bring in a combined $13,000 a year, completely tax free. Better yet, a couple can earn $6500 ($13,000 combined) a year via the Centrelink ‘work bonus’ without it reducing their age pension; this is on top of the $7592 a couple can earn each year via the income test.

Age pension$34,819.20

Super pension$12,500

Work$13,000

Total$60,319.20

That’s bang on what you need for your comfortable retirement!

The truth is, though, that you’re probably going to work more than one day per fortnight, and if you do you’ll lose 50 cents out of each dollar of pension.

However, if you decide to work one day a week, you’ll earn an extra $13,000 ... and be about $7000 better off than the ASFA standards.

SUPER Q&A

What if the government cuts the age pension?

It won’t. Can you really imagine any politician getting re-elected if they cut the sole source of income for the largest voting demographic? Of course not.

Will the government change the low-tax status of super?

It will. It’s inevitable. Politicians from both sides have form on stuffing around with super. Every year super will become a little less attractive. But they still have to provide us a carrot to get us to save and not be totally reliant on the age pension.

What if I don’t have $250,000 (or $170,000 as a single)? Should I downsize my home?

Sure, why not? Then you could buy something cheaper and put the balance into super. Remember, the value of your house is exempt from the age pension assets test. Your other option is to keep working full-time for the next few years until you nail your number. The government encourages older people to continue working by allowing them to draw on their super while they work. This results in you paying less tax, allowing you to sock more money into super.

How much Mojo do I need in retirement?

Aim to have three to five years of pension payments in cash or fixed interest, within super.

Why should I bother saving at all? The government will just reduce my pension

You’ve been listening to talkback radio, haven’t you? Having more money in retirement is always better. Yes, if you save a lot you’ll lose some (or all) of the pension, but that’s because you’ll be much better off!

How do I know I’ll get the full rate of pension?

There are experts you can sit down with — for free — who will help you maximise the amount of pension you receive. They’re called FISOs (financial information service officers) and you can arrange a face-to-face meeting with them by calling Centrelink on 132 300.

BAREFOOT DATE NIGHT WEEK 4

TONIGHT you’re going to nail your number. There’s no need to go to “pensioner night” at the pub — your retirement is going to be a snap after you create a plan to nail your retirement number.

ENTREE

Call your super fund or find your latest statement and write down how much you currently have in super.

Then, work out how close you are to nailing your “retirement number”.

The number you need to nail before you can comfortably retire is:

Couples: $250,000 in super

Singles: $170,000 in super.

MAIN COURSE

Next, whip out your phone and Google “ASIC MoneySmart Retirement Calculator”.

Type in your details — your age, your expected retirement age, your annual income, current super balance, and investment choice (balanced).

It’ll calculate how much income you’ll likely have in retirement. Play around with the variables and see what adding extra money will do to your end balance.

DESSERT

Chocolate (you’ll be eating a lot of that in retirement).

The Barefoot Investor holds an Australian Financial Services Licence (302081). This is general advice only. It should not replace individual, independent, personal financial advice