Barefoot Investor takes on Facebook’s fake Scott Pape crypto scammers

Barefoot Investor tried to uncover Facebook’s fake Scott Pape scammers but it all descended into chaos with his wife away, the kids sick and German backpackers running his farm.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

My bank manager, Colin, was stressed.

I know this because I could see beads of sweat collecting on his bald head.

We were standing in the middle of the branch while customers and other bank staff tried really hard to act like they were not listening in on our conversation.

Colin leaned in and whispered to me:

“So let me get this straight. You want to open up a new account so that you can be scammed?”

“That is correct”, I said loudly. “I’m planning on being scammed.”

Colin’s eyes darted around the branch nervously.

It was like I’d just announced that I wanted to close down a credit card, or get a vasectomy, or something else that you shouldn’t disclose to your bank manager.

“Alright”, he huffed.

Ten minutes later I walked out of the branch with $500 in a brand new bank account:

It was time to roll.

Yet, before we get into it, I need to take a moment to explain to you just how I got here in the first place.

I Got Scammed ... by The Barefoot Investor?

It all began the week before, when my long-suffering assistant, Louise, was complaining about her job:

“The scammers are targeting you again”, she moaned.

Over the years Louise had painstakingly reported hundreds of these fake posts to Facebook.

… but not this time.

This time, I decided to do something different.

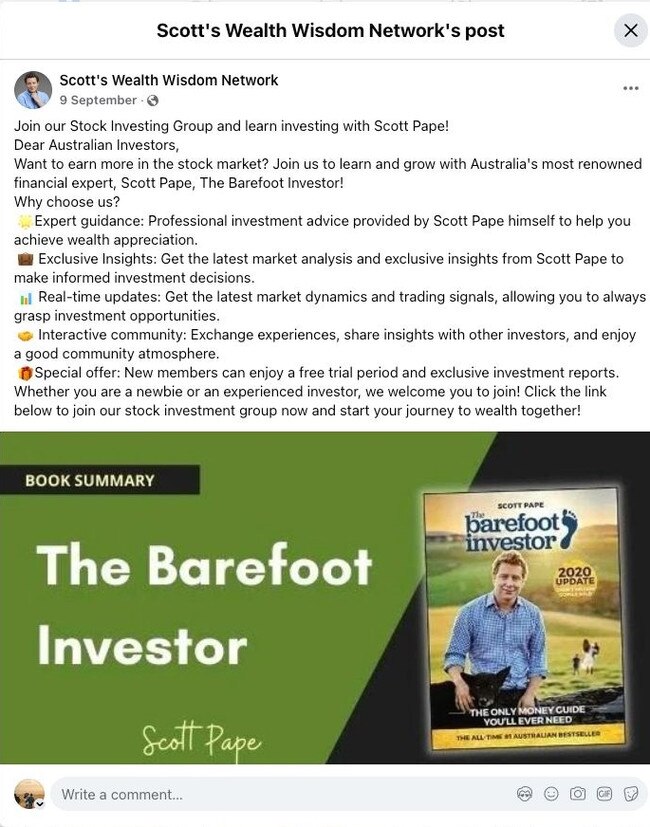

The scammers’ paid Facebook ad read: “Join Scott’s Wealth Wisdom Network Now! Get professional investment advice provided by Scott Pape himself to help you achieve wealth appreciation.”

“Let’s find out what ‘Scott’ has to say” I said, clicking on the link.

Immediately a pop-up page appeared with the headline:

“5674 People Have Participated So Far! Weekly stock market quotes are 90% accurate and have 45% upside potential. Join our stock trading community via WhatsApp today! Only 30 spots are left. Hurry!”

Click.

The next page that appeared was a privacy warning:

“We comply with Facebook’s Privacy Policy and protect your privacy” wrote the scammers, who were diligently following Zuck’s rules.

Then they asked for my phone number.

After I entered my digits, Scott wrote me a special message:

“If you have any stock investment questions you can ask me, I will try my best to reply to you as soon as possible!”

Nice touch, Scammer-Scotty.

The First Contact

Moments later a group called ‘DB Wealth Institute’ popped up in my WhatsApp feed.

“Excellent! The scammers have arrived”, I thought to myself.

I quickly googled their name to see if anyone had outed them as a scam already.

Crickets.

The only mentions of the company were some automated press releases (written by the scammers for exactly this purpose) which had been picked up by the likes of Yahoo Finance, Forbes.com and LinkedIn:

“DB Wealth Institute, founded in 2011 by Professor Cillian Miller, offers practical financial training and developed ‘AI Financial Navigator 4.0,’ integrating AI with big data to enhance trading strategies. By 2024, it had trained over 30,000 students from more than ten countries.”

Now most people would stop at this search, satisfied that it all looked legit.

However, given I was the face of a group I’d never heard of, I kind of had a hunch it was dodgy. So I googled “professor whatsapp investment scam”, and this came up:

US regulators were warning of fake ‘Wealth Institutes’ that promise crypto trading lessons via WhatsApp. A ‘Professor’ provides fake trading signals, while an assistant communicates with investors. Once enough money is stolen, the group vanishes, rebrands, and targets new victims.

Chica-Chica-BOOM!

I was going to make minced meat of these scammers …

… If only I could work out how to read their posts, or even comment on things.

It was all so confusing.

So I messaged DB Wealth Institute’s ‘assistant’, a woman by the name of Ally Brown.

Looking at her profile pic, she was in her mid-thirties, long wavy hair, a perfectly placed pink flower just above her ear, and she had a calm and collected look that says she’s one latte away from running the world.

I asked Ally for instructions on how I could post in the group. Now some would call this method acting.

Yet those who know me well will attest that I have the IT skills of an 89-year-old man. A drunk 89-year-old man.

The scammers were licking their lips.

“Welcome to the Institute”, gushed Ally. “We’re located in Adelaide. Our AI 4.0 investment has Scott Pape’s investment philosophy as well as his investment strategies.”

If You Screw This Up I Will KILL YOU

I chuckled to myself as I read Ally’s message.

My wife, however, was in no mood for humour.

She was in our bedroom, hurriedly packing her suitcase for her very first work trip since becoming a mum over a decade ago. She was heading off to produce a nature documentary overseas; the next month would take her to Iceland to film erupting volcanoes, to Romania to trek through snowy mountains, and then out to the deep seas off Denmark.

“If my card gets blocked while I’m in Iceland, I will kill you. I am not even joking Scott”, she snapped.

I nodded.

“Why do you need to be doing this now anyway? You’ve got four little kids to look after! And the pets! And a farm! And Barefoot!” she pleaded.

I shrugged.

“Honey, I’m just worried you’ve underestimated how busy you’ll be”, she said more softly.

She was right of course.

I didn’t know it at the time, but my entire world was about to fall apart.

I Make a Killing on Crypto

It took roughly 30 minutes from my wife leaving for my youngest to begin violently coughing.

It turns out he’d been exposed to pneumonia.

Three days later he’d spread it to all four kids. Then to me.

Our home turned into the Hunger Games, but with more coughing and snot. I was struggling to even get out of bed, so I decided to outsource the farmwork to two German backpackers I found on a farm worker message board.

And, while all this was going on, the DB Wealth Institute WhatsApp group was buzzing on my bedside every few minutes. They were sending me upwards of 200 messages a day.

It began each morning with a 30-page PDF of “Talking points from the Professor”, outlining the current state of the crypto market, and was peppered with statements like “Get ready to make 1,000% today”.

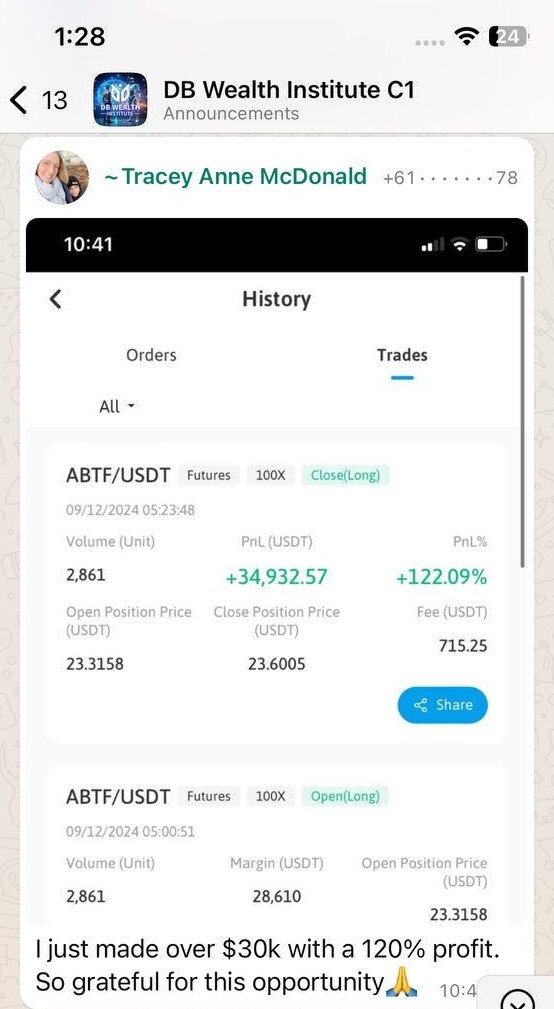

And, at 11am each day, the Professor would give his trading signals. You were encouraged to post screenshots of your winnings in the WhatsApp group, which people did all day and all night. I suspected they were bots.

I also suspected that most people would not realise this and would get sucked in by all this FOMO. And when their greed gland had been tickled hard enough, they’d take the bait and put on a trade.

Not me.

I was crook as a chook, and the kids were next level annoying, so the best I could do was ‘like’ the occasional post in between topping and tailing my three-year-old.

Yet, after about a week of WhatsApp silence, Ally contacted me with a ‘special offer’. She was looking to recruit beta testers for their AI recommendation engine.

“Would you be interested in getting a $500 loan to test out some trades? You can keep all the profits, as long as you return the $500 to our sponsor”, she wrote.

“Hell yes”, I replied.

The catch was that I had to trade on their platform, which was a red flag. It was kind of like going to one of those ping pong shows in Thailand. It sounds like a bit of fun, but the reality is it’s totally gross and weird, and you end up being repulsed by it.

So, instead, I drove to my local library.

“I’d like to, err, book some time on the internet”, I said to the librarian.

She looked at me suspiciously. (And fair enough too. After all, the only people who booked computers at the library were 89-year-old drunk men.)

“Why?” she asked.

“Because I’m in the process of getting scammed, and I’m worried their trading website will corrupt my computer … so I’d rather do it on yours”, I said honestly.

“That makes sense,” she said. “Hop on number 4.”

The trading platform did not disappoint. It was absolutely cringe-worthy. It looked like something a Uzbekistani teenager would code up in between hookah hits.

“Because you are an absolute beginner, I will help you with your first trade”, Ally wrote.

And so at 11am the Professor issued his buy signal for the day:

Contract: ABTF/USDT

Leverage: 100X

Order Type: Market Order

Position in use: 10

Direction: Buy/Long

Ten minutes later Ally advised me to close out the contract.

“Congratulations. You’ve just made 81% profit. Please screen shot your win in the Group”, she wrote.

Yet, before I could, my phone rang, which caused everyone in the library to turn around and glare at me.

It was the German backpackers.

“MR SCOTT, YOU NEED TO COME TO ZEE ORCHARD URGENTLY!” shouted Helga.

“I can’t talk … I’m in the library”, I whispered, and then hung up.

“YOU MUST COME HOME NOW!” came the all-caps text.

Then Helga sent the following picture:

Yes, somehow they’d driven my $25,000 John Deere Gator Utility Vehicle straight into the dam.

I sat there staring at the picture in utter disbelief while a lava of emotions began bubbling up inside me.

And then another text came through:

“We have a solution. We will pull it out with your tractor.”

At that point I exploded like an Icelandic volcano.

And there, in the middle of the library, I called her and yelled at the top of my lungs:

“NOOOOOOOO! Haven’t you ever read a children’s book?! The tractor will end up in the bloody drink as well!”

Silence.

“It is zinking as we speak”, said Helga, cool as a kransky.

The Killing Season

There are three steps that make up these scams:

The first step is confidence.

The second step is greed.

And the final – and most lucrative of all for the scammers – is fear.

I had just graduated from the first step, confidence: I’d responded to the Facebook ad, put on a trade, and made some dough.

I was ready for the second step – greed.

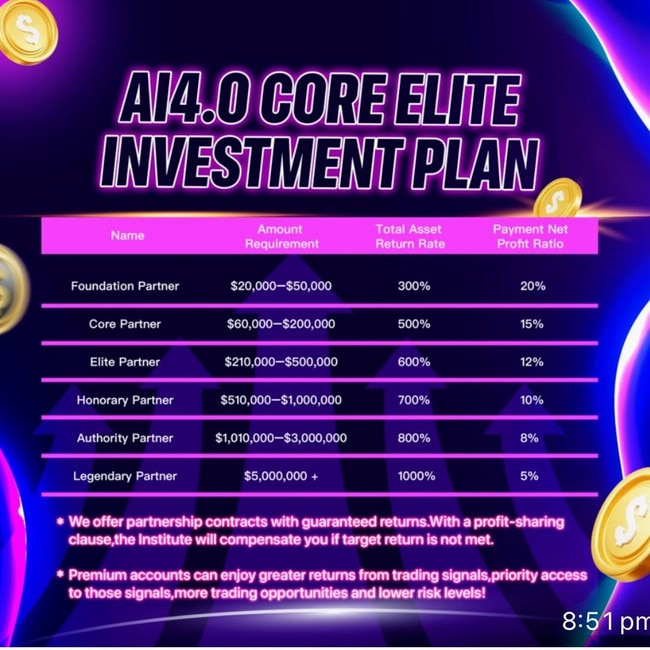

And, like clockwork, Ally went in for the kill: she began messaging me constantly, asking how much money I had to invest. A few days later the Professor unveiled their ‘partner programs’, based on how much you were willing to invest. It started at $20,000 and went all the way up to $5 million.

I didn’t have to put my own money on the line to know how this part of the scam works.

I once helped a woman in her fifties with terminal brain cancer. The scammers encouraged her to invest her insurance payout – and they stole the lot. It was all the money she had in the world. After that she couldn’t afford medicine and was behind on her rent.

Yet the final – and most lucrative – step of the scam is fear.

Once you realise you’ve been robbed, scammers prey on your desperation, often convincing you to borrow money to ‘recover’ your losses.

It’s a little-known fact that the biggest losses happen after you realise you’ve been scammed.

I Came Up with a Crazy Idea

I’ll admit, at this point my mental health wasn’t great.

It could have been because I was still completely knocked out with the flu.

Or perhaps it was because I was missing my wife.

Or maybe – just maybe – it was because our dog, Ginger, was limping around after she hurt her paw, banging her cone of shame into me every five minutes and glaring at me like “This is your fault”.

Yet, after exchanging hundreds of messages with Ally, in a weird way I thought that we had some sort of a connection. So I opened WhatsApp and typed the following message:

“Ally, I know what you’re doing. I’m sure you’re a good person caught up in a bad situation. I’d love to hear your side of the story so that I can help protect innocent people in Australia from losing their life savings.”

Then I took a deep breath, and placed my phone back on my bedside table.

Ring. Ring. Ring.

For the first time ever, Ally was calling me.

The Scammers Turn On Me

“You are pathetic”, sneered Ally in a thick Russian accent. “Please tell me, is it your wife? Are you lacking in love?”

Well …

“Isn’t the child born by your wife yours?”

Oh, dang, that’s a low blow!

“Why have you lived such a miserable life?” she messaged. “I waste my time on you. Goodbye.”

And that was the last time I heard from her or anyone else involved in this scam. They disappeared into the ether, just as quickly as the $25 million they steal from Aussies each and every week.

The Aftermath

This scam was in many ways far-fetched, ridiculous and overwhelmingly amateurish.

And you may be thinking to yourself, who on earth would fall for this?

Well, I’ve helped hundreds of scam victims, and most of them share one thing: they were vulnerable during a major life event – like a cancer diagnosis, depression, divorce, or loneliness in retirement.

The scammers milk that vulnerability, and take over your life, messaging you around the clock. (What they didn’t factor in with me was that I was already living with four little scammers who were experts at exploiting me.)

Yet it’s not always that simple.

Case in point: last week I was looking through the thousands of questions I get from readers.

This one stood out:

“Hi Scott,

Do you recommend the DB Wealth Institute? I have ended up in a group chat with this after I clicked through a Barefoot Investor post.”

Now here is the truly mind-boggling thing:

I googled this guy’s email, and it turns out he is a finance veteran with over 30 years in tax audit and advisory services for high-net-worth clients. Not only that, he holds a Bachelor of Economics and a Graduate Diploma of Applied Finance, and is a Chartered Accountant and Registered Auditor.

What’s his excuse?

Tread Your Own Path!

Thanks for reading. Have a very Barefoot Christmas, and I’ll catch you here next year. XX

Scott Pape returns February 2, 2025.

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.