Australia’s Richest 250 list: meet the 30 women who have made their mark

From mining magnates to technology leaders, healthcare pioneers and retail superstars, Australia’s richest women have made their mark this year.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

From mining magnates to technology leaders, healthcare pioneers and retail superstars, Australia’s richest women have made their mark this year.

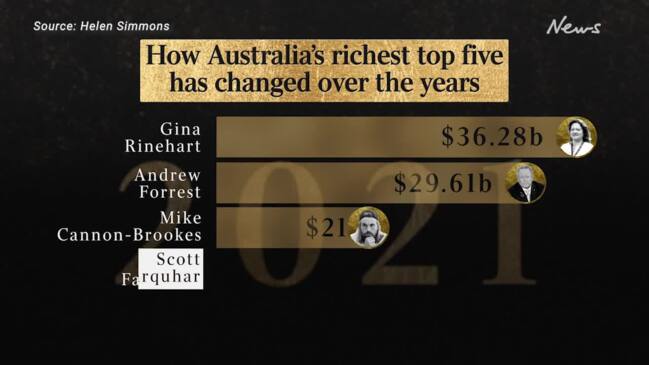

Gina Rinehart is Australia’s wealthiest person, overseeing a business empire worth $37.10bn – all thanks to an innovative $10bn debt package she negotiated – and then paid off in full in less than a decade.

But Rinehart is only one of 31 female entrepreneurs on the The List – Australia’s Richest 250 this year.

The full version of The List for 2023 has been published at www.richest250.com.au.

Here are the richest females on The List this year:

-

Gina Rinehart ($37.10bn)

It has been another big year for Rinehart, who maintains her number-one position on the Richest 250. Rinehart’s Hancock Prospecting delivered another huge profit for 2022, a $5.8 billion net result, though it was less than the record the iron ore miner produced in 2021. It is still one of the biggest profits for a private Australian company in recent memory, and shows how successful Rinehart has been with the huge Roy Hill mine that she had to negotiate a complex $US7.2 billion debt package to start a decade ago.

-

Melanie Perkins ($10.13bn)

The biggest name in the technology sector has fallen back to earth somewhat in the past year, with the value of her digital graphics business Canva slashed by investors by about one-third. Perkins still has a big paper fortune, and says Canva is profitable and hiring more staff around the world. Perkins shares her wealth with husband Cliff Obrecht.

-

Angela Bennett ($4.26bn)

Bennett receives hundreds of millions in iron ore royalties annually from Wright Prospecting, the business formed by her late father Peter Wright, the one-time business partner of Gina Rinehart’s late father Lang Hancock. The royalties have allowed her to form one of the biggest private investment houses in Australia. Her AMB has almost $2 billion in net assets on its balance sheet, including property, energy and resources and other financial assets.

-

Bianca Rinehart, Ginia Rinehart, Hope Welker ($2.88bn each)

The wealth of Gina Rinehart’s children is based on the trust fund that owns almost 24 per cent of the Hancock Prospecting mining and investment business. The children each have an equal share of the Margaret Hancock Trust, which there has been an ongoing family legal battle about.

-

Leonie Baldock & Alexandra Burt ($2.83bn combined)

Baldock and Burt’s wealth is derived from Wright Prospecting, the company they own with their aunt Angela Bennett. The company receives hundreds of millions in iron ore royalties each year and was founded by their late grandfather Peter Wright, who was the one-time business partner of Gina Rinehart’s late father Lang Hancock. Burt also owns tourism assets, including the Voyager Estate winery in Western Australia and Northern Territory cattle station Bullo River Station.

-

Prudence MacLeod ($2.40bn)

MacLeod is the eldest daughter of News Corp executive chairman Rupert Murdoch. Her wealth is based on her share of the $US12 billion the Murdoch family received when 21st Century Fox merged with Disney in 2019. MacLeod and husband Alistair have an investment company, Macdoch, which has invested in several start-ups, including Canva, and regenerative farming businesses via their Wilmot Cattle Co and WA Farming Co.

-

Vicky Teoh ($2.07bn)

Teoh and husband David, with whom she shares her wealth, started what was known as Total Peripherals Group in 1996 after moving to Australia from Malaysia. The business now known as TPG is the basis of their fortune, but David Teoh stepped down as chairman in early 2021. He is now concentrating on another ASX-listed business, telco junior TAUS, which owns and operates the low-cost Simba Telecom brand in Singapore.

-

Charlotte Vidor ($1.50bn)

The Vidor hotel and property empire spans three divisions: a development and construction arm that is developing more than $2 billion worth of projects; a property investment division; and the TFE Hotels joint venture with Singapore’s Far East Orchard. TFE Hotels has about 70 hotels across seven brands, and has expanded into countries such as Singapore, Germany, Denmark and Australia. Vidor shares her wealth with husband Ervin.

-

Imelda Roche ($1.43bn)

Roche and her late husband Bill introduced the Nutrimetics in Australia in 1968, building it into a significant business on home shores and also expanding into 16 countries. In

1991, they bought out its Californian founders, before selling the business to concentrate on property development and tourism. Among the Roche Group’s assets are the large Hunter Valley Gardens in NSW.

-

Rhonda Barro ($1.14bn)

The family-owned cement Barro Group, run by Raymond Rhonda’s brother, also owns 43 per cent of ASX-listed Adbri. The combination means the Barro family are a big force in their industry.

-

Gretel Packer ($1.14bn)

Packer now devotes most of her time to philanthropy, with her wealth based on her share of the family fortune from a settlement with her brother James in 2015. The daughter of late media mogul Kerry Packer, she also owns Sydney property and has invested in brain-mapping software start-up Omniscient Neurotechnology. Packer was also named as a backer of the upcoming movie The New Boy.

-

Nechema Werdiger ($1.05bn)

Werdiger’s family Melbourne CBD properties, and also goes back to the textile business her late husband Nathan ran before a move into property in the 1980s via his Juillard

Corporation. It is now one of the biggest landlords in central Melbourne

-

Jamuna Gurung ($1bn)

Gurung and husband Shesh Ghale own Melbourne Institute of Technology, a successful private tertiary education business that has allowed the couple to buy and develop commercial property holdings in the Melbourne CBD, including future plans for hotel and office projects. They also own hotels in Europe and Nepal, where they migrated to Australia from.

-

Megan Wynne ($927m)

Wynne and husband Bruce Bellinge’s wealth is mostly found in the human services provider APM that Wynne founded in 1994 and has built into a business that employs more than 11,000 people in 11 countries.

-

Junhui Lin (922m)

Junhui and son Shangjin own Aqualand, a big Sydney developer best known for its flagship Central Barangaroo project. It secured development rights over the precinct in September 2019, but the project is embroiled in NSW parliamentary scrutiny and is significantly delayed.

-

Judith Neilson ($785m)

Neilson is one of Australia’s biggest philanthropists, putting a further $138 million into her charitable foundation last year. he has sold down all her holdings in the funds management business started by ex-husband Kerr, Platinum Asset Management, to pursue her charity interests and the White Rabbit Gallery in Sydney.

-

Maree Isaacs ($716m)

Isaacs debuts on The List this year thanks to the surging value of her shareholding in logistics software business WiseTech, which she founded with billionaire Richard White. Isaacs is WiseTech’s head of licence management and is also company secretary. She previously worked with White at Real Tech Systems Integration.

-

Robyn Denholm ($698m)

Denholm’s estimated wealth includes the value of the options she holds over Tesla shares. She is the chairman of Elon Musk’s electric vehicle giant, which has slumped in value in the past year while the billionaire bought Twitter. Denholm has exercised and sold parcels of Tesla shares since she joined the board in 2014 and became chairman four years later. A former accountant, she has had executive stints at Sun Microsystems, Juniper Networks and Telstra.

-

Yenda Lee ($680m)

Lee owns the Bing Lee electrical goods chain run by her son Lionel. The pair often poke fun at each other in radio advertisements, but the business has been successful for

more than 50 years. Bing Lee is named for Lionel’s late grandfather, who started the business in Sydney before it was run by his late son and Yenda’s husband Ken.

-

Fiona Brown ($662m)

Brown’s wealth is found in the shares she owns in Dicker Data, the computer software

and hardware retailer she founded with former husband David Dicker. She was general manager of the business until 2004, and maintains a large shareholding and a board role as a non-executive director.

-

Jina Chen ($658m)

The Wu family has spent about $150 million on commercial and residential properties across Sydney after selling a majority stake in their Nature’s Care business in 2018. Chen and husband Alex Wu sold the stake to Chinese private equity fund JIC Investments and Tamar Alliance Fund.

-

Jo Horgan ($602m)

Horgan and husband Wetenhall celebrated 25 years in business last year, having built a beauty empire that started with her first cosmetics store in Melbourne’s South Yarra

in 1997. Their Mecca is still expanding, taking over a two-storey space in Melbourne’s Bourke Street that will be the biggest beauty store in the Southern Hemisphere.

-

Nicky & Simone Zimmerman ($600m)

The Zimmermann sisters started what has become one of Australia’s most successful fashion brands in 2001, making dresses to sell at Sydney’s Paddington Markets. Today, their luxury brand Zimmermann has stores in New York, Los Angeles, London, Paris, Milan, Sydney and Shanghai. The sisters sold a stake in their business to US private equity firm General Atlantic in 2016, which was on-sold as part of a transaction with Italian company Style Capital in a 2020 deal mooted to be worth more than $300 million. Zimmermann’s revenue reached almost$400 million in 2022.

-

Tania Austin ($555m)

Austin’s women’s fashion chain Decjuba generates about $40 million in pre-tax profits annually, making it one of the most successful homegrown retail businesses in Australia. She began with a handful of stores in 2008 after leaving Cotton On, which she started with ex-husband Nigel Austin, and the group now employs 1400 people and has more than 140 stores.

-

Cathie Reid ($535m)

Reid and husband Stuart Giles are getting back into pharmacy management services, starting up a management division via their Arc31 family office. Arc31’s investments are mostly health and technology based, though Reid and Giles have also backed the fledging Australian Premier League cricket business. The duo made their fortune from the Epic Pharmacy chain and cancer care services provider Icon Group.

-

Cyan Ta’eed ($519m)

Ta’eed and husband Collis started Envato in 2006 from their garage in Bondi, building it into a successful online creative asset marketplace with annual revenue of about $200 million and impressive profits.

The pair moved to Darwin two years ago, focusing on bankrolling First Nations-led charitable programs and climate technology investments.

-

Naomi Milgrom ($508m)

Milgrom’s private ARJ Holdings owns the Sussan chain of women’s clothing stores, which she bought from her billionaire father Marc Besen in 2003. Her foundation has gifted six MPavilions architectural commissions worth $30 million to various institutions since 2014.

More Coverage

Originally published as Australia’s Richest 250 list: meet the 30 women who have made their mark