AustralianSuper to quit big tobacco in $900m blow for Philip Morris, British American Tobacco

AUSTRALIA’S biggest super fund is quitting big tobacco, offloading almost $1 billion worth of shares in a punishing blow for the cigarette industry.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

AUSTRALIA’S biggest superannuation fund is selling out of big tobacco, offloading more than $900 million worth of shares in a punishing blow for the cigarette industry.

AustralianSuper is planning to sell out of tobacco merchants including heavyweights Philip Morris and British American Tobacco over the next two years.

It will be the biggest divestment of tobacco stocks yet by an Australian super fund.

Push for governments to sue big tobacco for health care costs

Victorians want smoking to be banned in apartment buildings

Opinion: Smoking is vile, but it’s not illegal

The move comes after wealth manager AMP announced in March that its investment house, AMP Capital, was dumping $440 million worth of investments tied to the tobacco sector.

AMP made that move as it overhauled its guidelines for investing ethically.

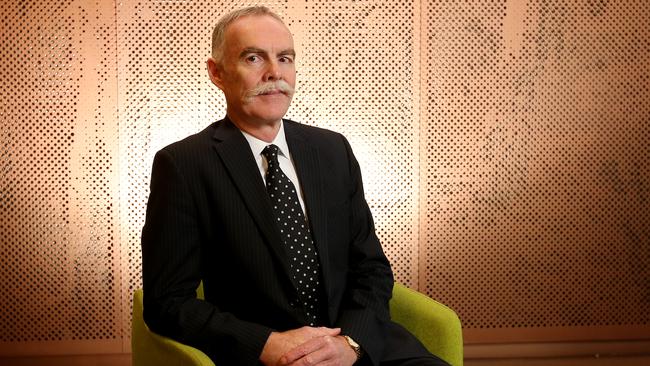

AustralianSuper chief Ian Silk has told fund members that the industry superannuation provider felt it had to exit tobacco because of the health problems caused by the sector.

“We believe tobacco warrants special consideration due to its particular characteristics and the damage it causes,” Mr Silk said.

“There is no safe level of consumption and we concluded that continued investment in tobacco is inconsistent with the fund’s purpose of helping members achieve their best possible retirement outcome.”

The AustralianSuper divestment has been revealed in an investment update on the fund’s website.

With more than $125 billion in funds under management, AustralianSuper is the nation’s biggest superannuation fund.

It is rivalled only by the federal government’s sovereign wealth fund, the Future Fund, as the nation’s biggest pension fund.

AustralianSuper says it will carefully manage the divestment of its tobacco holdings to minimise the impact on the portfolio and members’ returns.

It is expected to complete the sell-off by the end of 2019.

AustralianSuper said it was applying its usual methodology to replace tobacco investments with alternatives that would deliver ongoing long-term net returns.

In the investment update, the industry super fund said its usual approach was to engage directly with companies to get them to change unhealthy practices.

But in this instance, it was better to simply leave the sector, the fund said.

“While we believe engaging with companies through our ‘Active Owner’ program is an effective way to influence and improve environmental, social and governance outcomes, tobacco is the exception to our ESG framework given its unique characteristics,” AustralianSuper says on its website.

It is the only divestment AustralianSuper has ever undertaken on ethical grounds, Business Daily understands, although it has never invested in sectors such as those dealing in landmines and cluster munitions.

AustralianSuper has been prominent in engaging with companies to push for changes in policies that it disagrees with.

Last year the fund was prominent among investors who voted against the Commonwealth Bank’s executive remuneration report amid concerns the bank was allocating $44 million in pay and perks to senior managers.

At the CBA’s annual meeting last year, more than half the votes came down against the report — far exceeding the 25 per cent threshold required to deliver a pay “strike”.

New CBA chair Catherine Livingstone has since overhauled executive pay policies at the bank, and its executive remuneration report received the backing of investors including AustralianSuper this year.

AustralianSuper’s most popular balanced fund notched up a return of 12.44 per cent the past financial year, ranking second overall on the national league table.