Australian Taxation Office’s warning to Australians accessing superannuation early

Cash-hungry Australians will soon have another opportunity to access another $10,000 from their superannuation. But the ATO has warned they will face hefty penalties if they do the wrong thing.

Super

Don't miss out on the headlines from Super. Followed categories will be added to My News.

Cash-hungry Australians rushing to access $10,000 in superannuation from Wednesday have been put on notice by the Australian Taxation Office to be honest before submitting an application — or face severe fines.

Under the Federal Government’s early access to superannuation, applicants who have suffered income loss during COVID-19 are eligible to apply to access their retirement savings in the second tranche which starts on July 1.

Latest figures show 2.36 million Australians have already accessed their retirement savings this year, withdrawing $19.4 billion.

The average amount withdrawn is $8220.

But the Australian Taxation Office’s deputy commissioner Will Day warned applicants who were not honest when applying for early access to superannuation would face hefty penalties.

“If you are unable to demonstrate your eligibility when we ask for evidence we may revoke the determination that we issued in respect to your application,” he said.

“This means the amount paid to you under COVID-19 early release of super will become assessable income and need to be including in your tax return and you will pay tax on the released amount.”

On top of this fines could also be issued.

The scheme relies on Australians honestly self-reporting their income losses or financial situation via the myGov website before the application is approved and sent to the relevant super fund for processing.

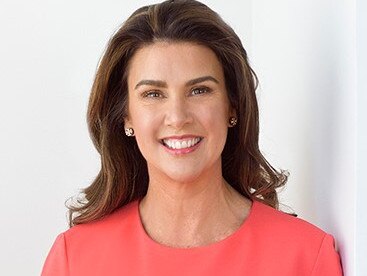

Assistant Minister for Superannuation Jane Hume said the scheme helped Australians “support themselves at a time of great financial uncertainty”.

“Every day my office hears stories of Australians who’ve taken up the option of accessing some of their super savings to support themselves at a time of great financial uncertainty,” she said.

“For many it’s been the lifeline they needed.”

Senator Hume urged people to “take the application process seriously.”

“It’s important to remember there are consequences for misleading the tax office and in the same way you wouldn’t lie about your tax return neither should you mislead the tax office about whether you meet the criteria about early access to super,” she said.

The ATO recently released information showing they would collect information from Services Australia relating to three million people to check they were eligible for early access to super and JobKeeper payments.

This data-matching process is similar to what is done for childcare benefits and unemployment payments.

To be eligible for earlier release applicants must satisfy one or more of the following requirements:

• Be eligible for a JobSeeker payments, youth allowance or parenting payment, special benefit or farm household allowance.

• On or after 1 January 2020 they were either made redundant or had working hours reduced by 20 per cent or more.

• For sole traders their business was suspended or there was a reduction to your turnover of 20 per cent or more.

The Australian Institute of Superannuation Trustees’s chief executive officer Eva Scheerlinck warned of the dangers of accessing super early.

“Even in these difficult economic times, tapping into your super before your retirement should be a last resort,” she said.