Australian investors lose $160bn in market bloodbath as Trump tariffs take their toll

Local investors are suffering a wipeout as global turmoil worsens, with the ASX200 index now down 16 per cent from its high point two months ago.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australian shareholders have suffered a $160bn wipeout within minutes on Monday morning as global turmoil worsens amid US President Donald Trump’s trade war.

The local sharemarket plunged 6.3 per cent at the start of trade, to a 15-month low of 7196.9 points.

It is now hurtling toward a bear market, with the ASX200 having fallen 16 per cent from its bull market high of a daily close of 8155.5 two months ago.

Even safe-haven gold miners were hit on Monday morning, with Evolution down 10 per cent. Spot gold dropped 1.7 per cent in early Asian trade after falling 2.5 per cent on Friday amid a liquidity squeeze.

The Australian dollar has been rocked, tumbling below US60c on the news of China’s announcement of retaliatory tariffs. At the local market open it was buying US59.80c.

News of China applying a retaliatory tariff of 34 per cent to US imports from Wednesday cut Wall Street’s S&P 500 futures by 4.3 per cent.

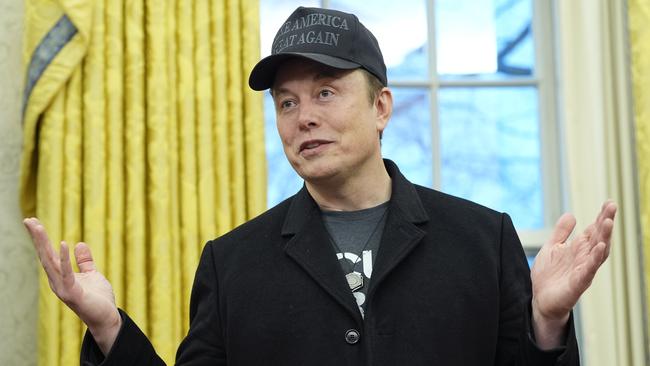

The market mayhem was triggered by Mr Trump’s “Liberation Day” announcement, which slapped a 54 per cent impost on goods imported into the US from China. China returned serve with a 34 per cent tariff on US goods on Friday.

The global uncertainty has analysts leaning towards a number of official interest rate cuts this year, with Westpac analysts saying a May cut is likely.

ANZ head of Australian economics Adam Boyton has suggested a 50 basis point cut in May cannot be ruled out, while HSBC chief economist Paul Bloxham is predicting the official interest rate will be a full 100 basis points lower to 3.1 per cent by early 2026.

Veteran dealmaker David Di Pilla said Beijing’s response caught the market by surprise.

“The reality is the speed and force of the Chinese tariff retaliation probably caught the US market off guard and we obviously saw that steep sell-off Friday overnight,” said Mr Di Pilla, chief executive of asset manager HMC Capital.

“The market is probably pricing in a worst-case scenario from here which is a hit to economic growth. Then add on an inflationary impact from tariff increases and that is not a good combination.”

Mr Di Pilla said on Sunday that investors needed to take stock amid a wave of volatility.

“Ultimately now what needs to happen is a period whereby we can calibrate and understand what the longer-term impacts of these announcements could mean if they are not reversed,” he said. “Ultimately I don’t think the tariff increases will be linear in terms of their impact through to pricing and consequently inflation.

“You’ll get a period of currencies adjusting and absorption through the value cycle and markets will need a period to assess what this really means.”

Market ructions may also flow on to deal flow and investments, Mr Di Pilla said.

“Absolutely everyone needs to calibrate and reassess what this means and what the impact is before considering allocating capital,” he said.

ASX 200 futures markets had priced in in a 4.3 per cent fall on the local sharemarket on Monday, down 331 points to 7388 for a $114bn drop in value.

This would push the local bourse down to levels not seen for more than a year, and translate into a 14.2 per cent loss from the high of 8615.2 early this year.

The benchmark Australian index fell 3.4 per cent across Thursday and Friday but that was dwarfed by Wall Street’s plunge.

The blue chip Dow Jones Industrial Average tumbled 9.3 per cent over the two days since the tariffs were announced, with the tech-heavy Nasdaq off 11.4 per cent and the broader S&P 500 erasing 10.5 per cent.

Global brands were smashed on Friday night, as Tesla dived 10. 4 per cent, while Apple was off 7.3 per cent and Amazon 4.2 per cent.

Ford Motor Company, which arguably stands to benefit from tariffs imposed on automobile imports, was a rare gainer on the day, up 0.4 per cent.

Wilson Asset Management portfolio manager Matthew Haupt said Mr Trump’s tariff strategy was either “the greatest poker bluff of all time leading into April the ninth, or we are going to this new world order of de-globalisation’’.

“And into a really, really bad place,” he said.

“I think the crux of the argument is, is this a bluff into negotiations, or is this actually the new reality we’re heading into?

“If it’s a new reality, things are going to get really, really ugly.’’

Mr Haupt said the message coming out of the Trump administration over the weekend was that they did not care about losses in equity markets.

But based on Mr Trump’s previous negotiating tactics, and the fact that the logic behind the tariffs was “poor” that “tilts you towards negotiations’’, Mr Haupt said.

While the initial 10 per cent baseline tariff took effect on Saturday US time, the more punitive “reciprocal” tariffs, which range up to 50 per cent – some of which stack on top of the baseline tariff and any existing tariffs – are due to come into force on April 9.

Mr Haupt said “logic suggests it’s all a lot of bluster”, but he also suggested that logic might not be in play at the moment.

“We’re sort of in no man’s land at the moment, just waiting for more direction out of the US, what is their playbook?” he said.

Mr Haupt said US Treasury Secretary Scott Bessent had been quoted as saying the administration did not “care about equities”.

“(Secretary of State Marco) Rubio talked about ‘this is the start of a new world order’, so they’re talking tough despite the slowdown so that’s a little bit concerning,” he said.

“That flawed reciprocal tariff logic, is that real or not?

“That’s what we’re trying to work out, and there were no signs over the weekend of them backing away yet, despite this equity sell-off.

“So that’s where I remain cautious until you get a signal that deals will be made.’’

Mr Bessent said in an interview with conservative commentator Tucker Carlson that the share market plunge was more related to China releasing the DeepSeek artificial intelligence platform this year, rather than the tariff policies.

“If I were to analyse in my old hat, and this is the only time I’m going to talk about it … what’s happening with the market I’d say it’s more a Mag 7 problem, not a MAGA problem,” Mr Bessent said, referring to the “Magnificent Seven” stocks – Nvidia, Apple, Alphabet, Microsoft, Meta, Amazon and Tesla – and Mr Trump’s Make America Great Again platform.

Mr Trump over the weekend doubled down on his tariff strategy, saying the US would no longer be a “dumb and helpless ‘whipping post’”.

“We are bringing back jobs and businesses like never before,” he wrote on his Truth Social platform.

“This is an economic revolution, and we will win.

“Hang tough, it won’t be easy, but the end result will be historic.”

The impact on sharemarkets is already approaching historic levels, with US markets off 17 per cent from the its high for the year, with a 20 per cent fall the accepted indicator of a bear market.

Other global markets have also taken heavy hits.

In London the FTSE 100 dropped 6.4 per cent on Thursday and Friday, and Germany’s DAX fell 7.8 per cent.

Japan’s Nikkei has wiped out 15.3 per cent this year after last week’s 5.45 per cent two-day fall.

The Australian dollar dropped more than US3c from Friday to Saturday, briefly dipping below US60c before recovering slightly to be changing hands at US60.4c late Sunday.

Commonwealth Bank analysts are expecting the dollar to drop below US60c in coming weeks “as markets price in more bad news for the global economy’’.

Fears of a global recession are also rising rapidly, with deVere Group chief executive Nigel Green saying the global trade in goods was already falling in the final quarter of 2024 compared with the same quarter the previous year, according to the latest World Trade Monitor figures.

“World trade volumes are shrinking at the fastest pace since the 2008 financial crisis. Investors, businesses and policymakers should be under no illusions – a global recession risk is growing by the day,” Mr Green said.

“Tariffs imposed by the world’s largest economies are not just slowing trade.

“They are eroding business confidence, slashing corporate investment plans, and rippling through supply chains that had once powered global growth.

“The engine of globalisation that fuelled decades of expansion is now being throttled.”

More Coverage

Originally published as Australian investors lose $160bn in market bloodbath as Trump tariffs take their toll