Aurizon non-coal earnings jump as hauler plots path to future

Earnings from Aurizon’s non-coal bulk handling business lifted almost 25pc last financial year as the company looks to diversify beyond its coal haulage business.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Earnings from Aurizon’s non-coal bulk handling business lifted almost 25 per cent last financial year as the company looks to diversify beyond its traditional coal haulage business.

Aurizon released its full year financial results on Monday, saying it had delivered a “solid” performance, despite volume hits in its key coal haulage business as China’s bans on Australian coal bit into the industry.

The rail major said on Monday it had booked $1.48bn in underlying earnings for the full financial year, up 1 per cent on the previous corresponding period, on a 2 per cent fall in revenue to $3.02bn.

Aurizon booked $533m in underlying earnings, with a $607m statutory result including a $113m one-off gain from the sale of its Acacia Ridge intermodal terminal to Pacific National.

Underlying earnings before interest, tax, depreciation and amortisation grew 1 per cent to $1.48bn.

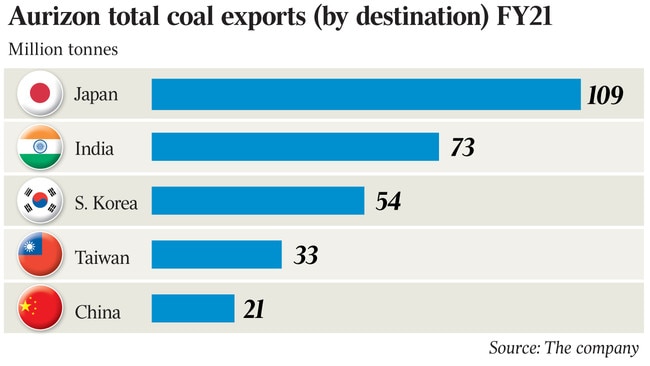

Its coal business hauled 202.1 million tonnes through the year, down 6 per cent on the previous fiscal period as China’s bans on Australian coal bit in Queensland.

But, with coal prices back on the up despite China’s ongoing action against Australian producers, Aurizon says it expects stronger volumes and revenue in the current fiscal year, flagging a 5 per cent boost to coal volumes for the year.

Aurizon’s forecast was based on information from its customers, and strong pricing could help coal exporters to push volumes higher.

But pressure will mount on thermal coal producers over the next year amid dire predictions about the impact of climate change from the latest UN Intergovernmental Panel on Climate Change report, and about half of coal volumes hauled by Aurizon is made up of energy coal.

Aurizon boss Andrew Harding told The Australian the company was looking to grow its business in other commodities to reduce its reliance on energy coal.

That will include looking at further opportunities to move beyond rail into other infrastructure services – during the year Aurizon established a port services subsidiary – as well as expand into other commodities, he said.

Mr Harding said Aurizon expected that thermal coal haulage would make up only about 20 per cent of its business by 2030, on current forecasts.

Aurizon sketched out the worst-case scenario for Australian coal in an investor presentation in June, telling analysts and shareholders it had modelled the impact of a range of scenarios on its Australian rail haulage business, saying Australian coal exports could halve over the next two decades if major Asian coal customers move to rapidly decarbonise their energy networks.

Alternatively, coal exports could rise by more than 25 per cent to more than 500 million tonnes if major buyers of Australian coal take little or no action on climate change, according to Aurizon’s modelling.

Either way, the rail major will work to expand its income from hauling grain, lithium, rare earths and other battery-making commodities as it looks beyond its traditional coal haulage business.

Aurizon won a boost to its WA business late last week, signing a six year deal to haul grain for CBH Group, the state’s biggest grain handler.

Mr Harding said the CBH deal would give the company a stronger platform to expand its WA operations, as it looks to win more business around the Kalgoorlie goldfields and the state’s Mid West.

“What a contract like that does is – it is of reasonable scale – and the haulage business benefits from scale, and that business also has maintenance activity, which also benefits from scale,” he said.

“That provides more opportunities into the future.”

Earnings before interest and tax in its bulk haulage business rose 24 per cent to $112 million as Aurizon won new contracts last financial year, putting the company well on its way to generating $250 million and $300 million of earnings from the business by 2030.

Earnings from Aurizon’s network business – income from charging for access to its rail tracks – rose 9 per cent to $509 million, beating analyst expectations.

Aurizon said it expected EBITDA of $1.42bn to $1.5bn for the current financial year.

Shares in the transport company closed up 7c to $4.13 on Monday.

Originally published as Aurizon non-coal earnings jump as hauler plots path to future