ASX 200: Strong economic recovery likely to offset expensive stocks

Stretched valuations and earnings headwinds for Australian shares are being offset by the prospect of a rapid economic rebound when lockdowns end.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Stretched valuations and earnings headwinds for Australian shares are being offset by the prospect of a rapid economic rebound when lockdowns end, and a flood of money from dividends, share buybacks and takeovers should mostly flow back into shares amid low interest rates.

Ex-dividend falls in BHP, CSL and Woolworths accounted for all of a 0.6 per cent fall in the ASX 200 on Thursday. Moreover, the sharemarket remained well supported on dips, as US economic data suggested Friday’s non-farm payrolls data won’t be strong enough to prompt Fed tapering.

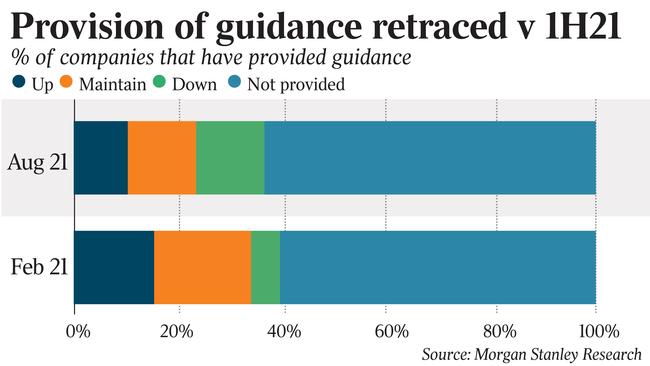

Dividends beat estimates as payout ratios normalised, share buybacks were mostly well received and takeover intensity continued to rise and broaden, but caution is needed as the ASX 200 is 4 per cent above a mid-2022 target of 7200 points, according to Morgan Stanley’s Chris Nicol. After a strong upgrade cycle in Australian corporate earnings for much of this calendar year, this momentum has potentially stalled, with growth rates rolling over and aggregate earnings per share levels looking to have peaked for now, Nicol says.

A re-emergence of incremental headwinds for banks, an aggressive move lower in iron ore prices and escalating supply chain and freight costs will feed into the post-results wash-up.

And for domestic-facing companies, the extending lockdowns in the key states of NSW and VIC – attached to higher alert levels from other states – are at the very least resetting earnings bases lower for FY22 earnings and asking more of the second half, Nicol cautions.

He sees a “clear rollover in growth rates”, with the consensus estimate for earnings per share in FY22 and FY23 slipping to 19.4 per cent and minus 1 per cent respectively.

Those estimates may fall further as commodity price assumptions are lowered.

“The bulk of this adjustment should come at the expense of 1H22 trading for domestic-facing companies as the lockdown bites harder this time around,” Nicol says. That will partly be offset by a weaker exchange rate helping about 30 per cent of companies.

But the recent lockdown and mobility restrictions, at a time when cost pressures are elevated, leave much greater than normal uncertainty about the outlook.

“Unlike 12 months ago, tolerance levels were low, with meaningful post-result underperformance,” Nicol says.

He now expects upcoming annual general meetings from corporate Australia to “crystallise the 1H22 earnings impacts and provide the necessary adjustment to estimates”.

He warned that persistent cost pressure was a key feature of the outlook commentary.

Many companies mentioned rising transportation and sourcing costs, West Australian labour shortages and wage escalations were “acutely evident”, and this could spread to the east coast.

“Our recent survey showed that materials pressure is impacting 38 per cent of coverage, supply chain 35 per cent and wages 49 per cent,” he said.

“Sectors most exposed to multiple pressures include retail, building & construction and resources. Wage and labour issues are a dominant theme for most sectors.”

It’s a key issue for domestic-facing industrials and potentially an under-appreciated risk.

But while just 40 per cent of ASX 200 enjoyed positive revisions to earnings estimates for FY22, the consensus estimate for aggregate earnings remained intact at about 20 per cent, according to David Cassidy, head of investment strategy at Wilsons.

“In this regard, the earnings outlook has survived Delta’s force – something we thought was likely in late July,” he says.

“This might have been seen as optimistic, with domestic lockdowns likely to still be limiting mobility late in 2021.”

While the healthcare, retail, travel and tourism sectors are operating at only partial capacity, Cassidy says there remains a sense of optimism that catch-up can start as soon as October.

“We continue to believe that the most impacted companies from Covid lockdowns largely remain outside of the listed environment,” he says.

Results season left him comfortable that the earnings recovery pathway remains intact.

“As Australia and the world reopens and activity normalises, corporate earnings will likely expand to record levels,” he says.

“While the growth rate of corporate earnings will fade as the low base effect of Covid now falls outside of the comparison period, supportive policy and pent-up demand sets the scene for a multi-year period of earnings growth.”

Originally published as ASX 200: Strong economic recovery likely to offset expensive stocks