What we know so far about Albanese government’s first budget

Treasurer Jim Chalmers will deliver his first federal budget on Tuesday. Here’s what we can expect.

NewsWire

Don't miss out on the headlines from NewsWire. Followed categories will be added to My News.

Australians have been promised a “bread and butter” budget on October 25 – one which will be “resilient” but “won’t be fancy”.

With the world teetering on the brink of a recession, Jim Chalmers has sought to downplay expectations about the Albanese government’s first budget.

The Treasurer has said “tough decisions” will need to be made as Labor begins the onerous task of budget repair – finding savings while funding election promises and covering the rising costs of vital public services.

Dr Chalmers routinely names the five fastest growing areas of government spending.

Over the next four years, hospital spending will increase by 6.1 per cent, aged care costs will rise by 5.5 per cent and defence spending will grow by 4.4 per cent.

National Disability Insurance Scheme spending is forecast to increase by 12.1 per cent per year over the same period.

And interest payments on the nearly $1 trillion of government debt will rise by about 14 per cent a year.

Pensions and other welfare payments have also risen due to indexation.

Dr Chalmers has stressed Australia isn’t immune from deteriorating global economic conditions despite an unexpected nearly $50bn improvement to the budget deficit because of low unemployment and high commodities prices.

Dr Chalmers says he will deliver a budget which will bolster Australia’s fiscal defences and provide “responsible” cost of living relief with an “economic dividend”.

The budget isn’t expected to focus on major reforms, but instead lay the foundations for a more substantial May 2023 budget.

The government has announced a few new policies for the October budget, however, adding to Labor’s pre-election promises.

Here’s some of what we can expect.

STAGE 3 TAX CUTS

Debate over the contentious stage three tax cuts package dominated headlines earlier in October after speculation arose over whether they would be scrapped or pared back.

But Labor has ruled out making any changes to the policy, at least for now.

Speaking to reporters in Washington on October 13, Dr Chalmers said “no” when he was asked if the budget would include any changes to the policy.

“The stage three tax cuts are around three budgets away, and they’re currently legislated,” he said.

“We’ve got more pressing priorities in the interim.”

The third tranche of tax cuts is set to be the biggest expense to the budget at $20bn a year when it comes into effect in 2024.

Dr Chalmers last Thursday revealed the latest Treasury costing of the policy had blown out by $11bn – from $243bn to $254bn – over a decade.

Labor is divided over whether or not to amend the policy it supported the Morrison government to legislate and then vowed to keep before this year’s election.

The cuts mean anyone earning between $45,000 and $200,000 will pay no more than 30 cents of every dollar they earn in tax.

Critics, including welfare advocates, The Greens and some within Labor, say the cuts are not equitable or affordable, particularly at a time when Australia is facing such precarious economic conditions.

CHEAPER MEDICINES

The costs of some common medicines will be reduced by $12.50 from January 2023.

Labor has introduced legislation to parliament to reduce the amount customers pay towards the cost of medicines on the Pharmaceutical Benefits Scheme.

The Bill, which is expected to pass through both houses and become law, will slash the maximum general co-payment for medicines on the PBS from $42.50 to $30.

This means the federal government will increase the amount it spends on subsidising about 17 million scripts filled by about 3 million people a year.

The government expects the policy to cost $765.3m over the next three years.

COVID-19

The government will spend $1.4bn to extend Covid-19 response measures by three months.

Due to expire 30 September, 2022, the measures will now be rolled out until 31 December this year.

The funding includes $840m for aged care support including on-site PCR testing; $142m in Medicare rebates for Covid-19 testing; and $235m to distribute PPE and rapid antigen tests from the National Medical Stockpile to at-risk groups and frontline healthcare workers.

CHILDCARE

The Treasurer has said cheaper childcare will be Labor’s “biggest on-budget commitment” in this month’s budget.

Labor made cheaper childcare a cornerstone of its federal election campaign, vowing to bring down prices and boost women’s participation in the workforce.

Legislation to cut the cost of childcare was introduced to parliament last month.

It will lift the maximum subsidy rate to 90 per cent for families for the first child in care and increase subsidies for every family earning less than $530,000 in household income for one child in care.

The government will spend about $5.4bn on implementing the policy from July 2023, but stared down calls to bring it forward by six months, citing the cost.

The Albanese government will also commit $10.8m in this budget for an investigation by the nation’s competition watchdog into spiralling prices in the childcare sector.

The Australian Competition and Consumer Commission will examine why childcare costs and out-of-pocket expenses have risen by 41 per cent in eight years and will recommend ways to ease the financial burden on families.

This is the first step in Labor’s election promise to have the ACCC design a price regulation mechanism to drive down out-of-pocket costs “for good”.

FUEL EXCISE

With inflation running at a 30-year high of 6.8 per cent and set to peak at 7.75 per cent in December, the treasurer has promised “responsible” cost of living relief.

But motorists are set to miss out.

The Albanese government has repeatedly said it will not reinstate the fuel excise discount, which will save it $30bn over six months.

The federal government’s fuel tax for motorists was halved to 22.1 cents a litre until September 28 when the discount expired.

The former Coalition government temporarily cut the excise in late March as inflation started to spike, meaning Australians were partly shielded from soaring petrol prices.

TAFE

The Albanese government announced at its jobs and skills summit in September it would create an additional 180,000 free places at the nation’s public training provider in 2023.

These will be made up of 60,000 additional places and by dropping the fees of 120,000 existing paid TAFE spots.

It will form part of a $1.1bn training package devised by national cabinet, which will be shared 50:50 between the federal government and the states and territories.

The 180,000 extra places are in addition to Labor’s pre-election promise of 465,000 free TAFE places in nominated areas of skills shortages.

UNIVERSITY STUDENTS

Labor before this year’s election promised to fund an extra 20,000 university places for under-represented students in areas of skills shortage.

In order to access the funding, higher education providers must allocate the places to students from low socio-economic backgrounds or rural and remote areas, people with disabilities and Indigenous students.

Education Minister Jason Clare has said the 20,000 places will be funded over two years from 2023.

Labor has said the policy will cost up to $485.5m in total.

MIGRATION

The Albanese government promised at the Jobs and Skills Summit in September to accelerate visa processing times.

It announced an extra $36.1m to hire up to 500 people in the Home Affairs Department for nine months to help get through a backlog of nearly 1 million stalled visas.

CRITICAL MINERALS

Australia has some of the world’s largest reserves of so-called critical minerals, such as lithium, which are used to manufacture advanced technologies such as batteries and are at risk of their supply chains being disrupted.

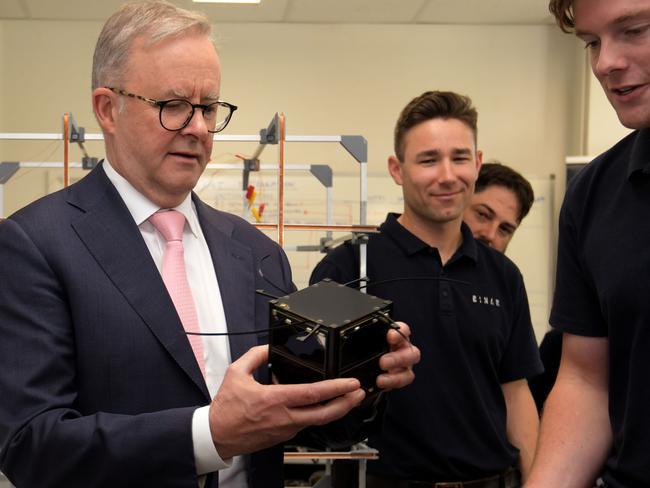

Anthony Albanese announced on Friday that the budget will include $50.5m over four years to establish the Australian Critical Minerals Research and Development Hub.

The Prime Minister says the hub will be staffed by experts from Geoscience Australia, the CSIRO and the Australian Nuclear Science and Technology Organisation to support the resources industry in critical minerals extraction.

The Government will also allocate $50m over three years to fund grants to support early and mid-stage critical minerals projects.

This is in additional to $50m the government recently committed to six key projects across Australia.

And Labor’s National Reconstruction Fund will include the $1bn “Value Adding in Resources Fund” which will work alongside the $2bn Critical Minerals Facility.

The funding comes as part of the federal government’s new strategy for the sector.

WELLBEING

The Treasurer said earlier this year the October budget would for the first time focus on “wellbeing” as well as traditional budget metrics such as GDP and inflation.

It’s since been reported that the budget will include a chapter dedicated to measures of wellbeing such as the standards of the environment, education and health services.

INFRASTRUCTURE

The budget will include $9.6 billion for the construction of road and rail projects across Australia including $300m for western Sydney roads and $2.2bn for the Suburban Rail Link in Victoria.

The government has declared there will be no more cash for “zombie projects” which had been canned, but which the former Coalition government kept on the books.

These include Melbourne’s East West Link and the Perth Freight Link.

DEVELOPMENT ASSISTANCE

The federal government will increase its development assistance for the Pacific as it seeks to strengthen its ties in order to counter growing Chinese influence in the region.

It will commit $900m over four years in development assistance for the Pacific, up from $525m promised at the election.

Labor is also standing by its election pledge of $470m in assistance for South-East Asia and says it will develop an economic strategy for the region.

PAID PARENTAL LEAVE

Australia’s paid parental leave scheme will be extended from 18 to 26 weeks.

An extra fortnight will be added to the scheme each year until the full 26 weeks is available from July 2026.

GREAT BARRIER REEF

The government will spend an additional $204m to protect, manage and restore the Great Barrier Reef, bringing the total spend on the reef to $1.2bn.

Environment Minister Tanya Plibersek has said $20m will be dedicated to assist corals to evolve more quickly and adapt to their changing environment, as well as supporting natural restoration of damaged and degraded reefs.

A $15.3m grant will go towards the new Coastal Marine Ecosystems Research Centre at the Central Queensland University in Gladstone.

Originally published as What we know so far about Albanese government’s first budget