Faith on Trial podcast: Hillsong Church accused of misusing tax exemptions as it makes profit

Former Hillsong members have revealed how pastors got donations, as one woman has accused the megachurch of misusing tax exemptions in court. Listen to the podcast.

Faith On Trial

Don't miss out on the headlines from Faith On Trial. Followed categories will be added to My News.

Christian Megachurch Hillsong should be stripped of its legal status that allows it to avoid tax, a former member has demanded.

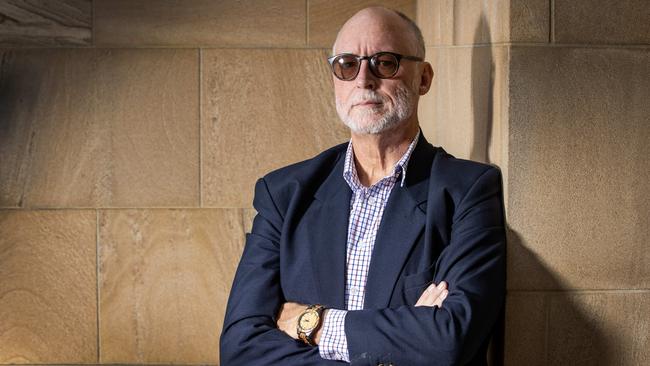

Alec Spencer has spent the past four years working on a PhD into why churches like Hillsong get so many lucrative tax breaks.

Mr Spencer, who is based on the Gold Coast, told the Faith of Trial podcast, that a “weak … historical law” – the 1601 Elizabethan Act – was the basis of tax-free status for churches.

“If you’re running a business, you know, you pay taxes,” Mr Spencer told the podcast.

“But if you’re running a charity, you don’t pay taxes. So it’s an exemption. But religion lives within an exemption within the exemption.”

LISTEN TO THE PODCAST:

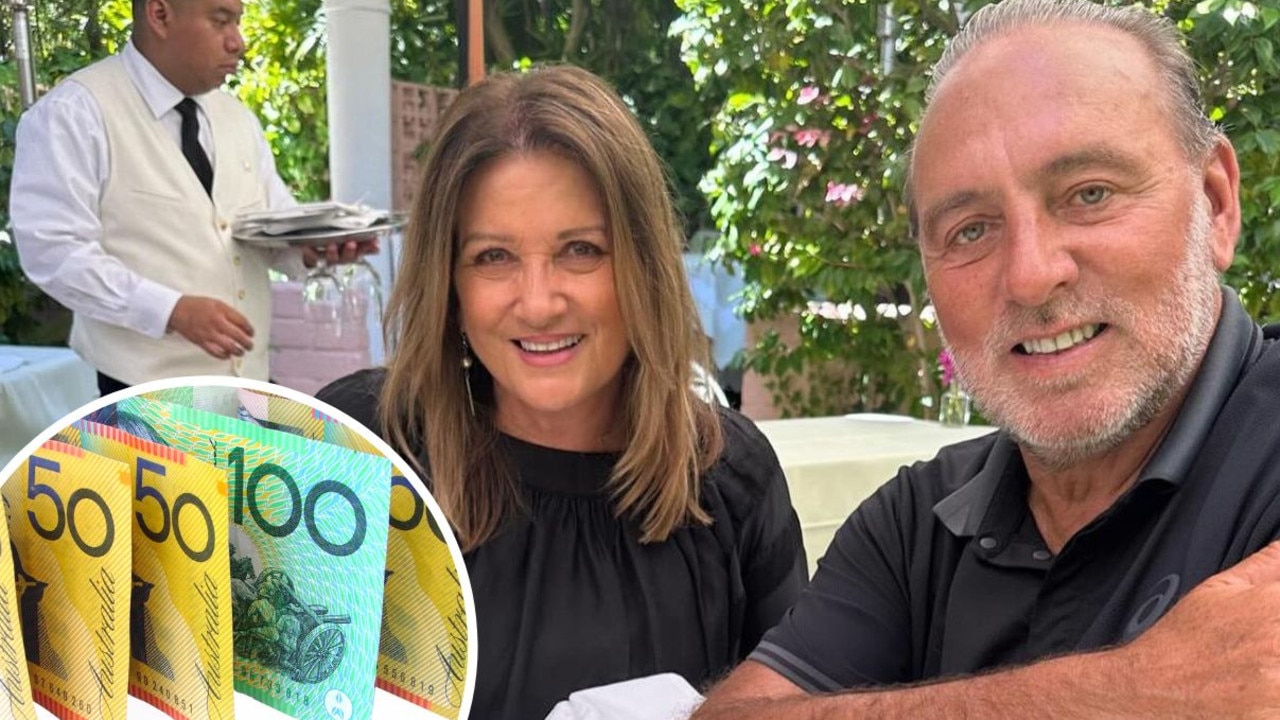

Another former Hillsong member told the podcast of “love offerings” pastors were given while on speaking tours, which were cash payments.

“A pastor from the US would come out here, hed’s get his love offering,” Melissa Kennedy said.

“Then (name removed) would go visit his Church and get his love offering from over there”.

The woman said it would amount to thousands of dollars “because they would put it in a bucket, hand it round, and then they put it in their suitcase and go home”.

Hillsong had revenue of $76 million, its latest annual report audited by Ernst and Young states.

The church also had a cash surplus, carried forward, of $35 million.

It made $3 million from its investments, which include property, and loaned $13 million between related entities.

Former bookkeeper Natalie Moses has filed a complaint against Hillsong in the Federal Court, claiming she was treated unfairly because she raised concerns about accounting practices.

The case remains before the court, but in Ms Moses’ 25-page statement of claim she accused Hillsong of misusing its tax-free exemptions.

The court documents state that Ms Moses claims she flagged with Hillsong’s chief financial officer Peter Ridley that the church was not allowed to tell its followers that donations to purchase Festival Hall were tax deductible.

The church paid $23 million in 2020 for the iconic Melbourne music venue where the Beatles once played.

“‘Hillsong’ was putting itself at risk by stating that such donations were tax deductible and that a smart journalist could work this out and that this was unethical and fraudulent,” Ms Moses told Mr Ridley, the documents state.

The Australian Charities and not-for-profits Commission launched a probe into four Hillsong entities in March 2022.

It was claimed in court documents that Mr Ridley told a meeting about the ACNC investigation that “God protects the righteous and Hillsong is the righteous.”

Ms Moses also claimed in court documents that in that meeting Mr Ridley asked Tirza Graciella, the financial controller to “offset” a payment which resulted in “no record of any cash payment from Hillsong Church to the United States of America.”

Hillsong denied in its defence statement that Mr Ridley had made any statement about his trust in God.

The church also denied that he instructed Ms Graciella to “offset” a payment, claiming that there was no “such pending or actual transaction”.

Hillsong was contacted for comment.

Send your story tips to crimeinvestigations@news.com.au or stephen.drill@news.com.au

More Coverage

Originally published as Faith on Trial podcast: Hillsong Church accused of misusing tax exemptions as it makes profit