What your home is worth: Every Qld suburb’s house and unit value

Hundreds of Queensland suburbs have defied the pain of ongoing rate hikes, with home values growing by as much as 34 per cent in some places. SEARCH INTERACTIVE LIST

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

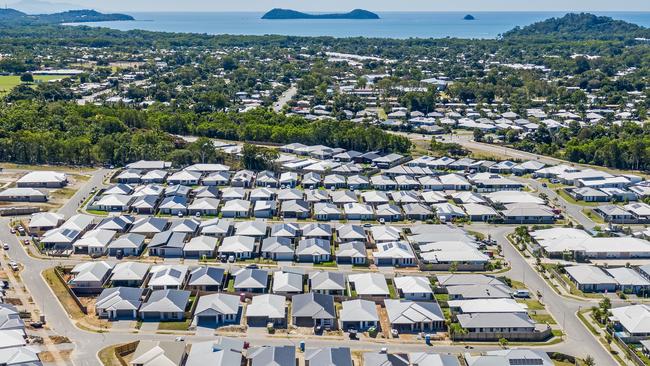

Over 400 Queensland suburbs have defied rate rise hits to see home values rise, some by as much as a third in the past year – an unexpected result say experts.

PropTrack’s Quarterly Home Value Index, out Saturday, found 414 Queensland suburbs notched median price growth in the past year, 57 of which were double digit jumps that dramatically outpaced Brisbane’s overall annual growth of 0.07 per cent.

The greater capital region made up 13 of the 57 highest performing suburbs, only one of which was for house price growth in Brisbane City that rose 15.1 per cent to just under $2.4m.

SCROLL DOWN TO SEARCH INTERACTIVE TABLE OF SUBURBS

MORE: ‘I’ve been rejected so many times’: 31-yr-old’s battle for housing legacy

Twist in ‘remarkable’ Brisbane property market as sales drop

Across Brisbane, Ipswich and Moreton Bay, a dozen unit markets cranked up in value significantly in the past 12 months: Highgate Hill (up 26.6pc to $1.03m), Sunnybank (up 23pc to $774,080), New Farm (up 19.4pc to $1.14m), Beachmere (up 18pc to $690,668), Yeronga (up 16.9 per cent to $772,568), Scarborough (up 16.5pc to $849,046), Annerley (up 16.1pc to $717,026), Moorooka (up 14.9pc to $617,493), Raceview (up 14.3pc to $383,309), Coopers Plains (up 11.6pc to $631,633), Goodna (up 11.2pc to $324,116) and Fairfield (up 10.9pc to $634,207).

As shocking as some of those median price surges may be for buyers – especially in relatively cheaper outer suburbs like Goodna and Raceview – they were outshone by huge increases in regional Queensland.

PropTrack economist Angus Moore said Brisbane and Queensland was “a substantially more expensive place than it used to be” with prices up 46 per cent since the start of the pandemic.

“We were still expecting price declines given how far interest rates had risen last year, but clearly that’s not what ended up happening,” he said. “In part that’s because we are just not seeing a lot of properties available for sale at the moment and there’s pretty strong competition and demand from buyers for them when they do become available.”

Queensland’s most expensive suburb medians continued to come off houses across the south east’s blue chip triangle, led by Noosa’s Sunshine Beach despite it seeing an -8.1pc fall to $3,065,727. Four Brisbane suburbs made up the rest of the top five – Teneriffe $2,831,800, Hamilton $2,731,220, New Farm $2,636,484 and Ascot $2,624,348. The Gold Coast’s Mermaid Beach $2,618,836 and Surfers Paradise $2,428,707 were also in the top 10 with Brisbane City, Chandler and Noosa Heads.

Mr Moore said unit price growth held up “a little bit better over the past 12 months or so” than houses.

“That’s a big change from what we saw during the pandemic,” he said. “Units at the moment look relatively affordable compared to houses. For some buyers, particularly those for whom higher interest rates has made affordability more of a constraint, units might be a bit more attractive than they were 18 months ago.”

The biggest price rise in the state came out of units in Darling Heights in Toowoomba, where the median jumped by more than a third (34.3 per cent) in just one year to over half a million dollars now ($532,474). Toowoomba made up 10 of the 57 double digit jumpers Queensland had in the past year.

Also up by a third (33.4pc) was the median unit price out of Garbutt in Townsville which now sits at $396,186 – or about as much as it cost to buy a mid-range house in the north Queensland city 13 years ago.

Townsville had four of the strongest Queensland performers, including Pimlico (up 19.4pc to $363,196), Belgian Gardens (up 17.6pc to $429,908) and West End (up 10.8pc to $314,579).

By far the strongest region for double digit growth was Cairns, where a dozen suburbs jumped significantly, 11 of which were for units ranging from a 10.1pc annual increase in Parramatta Park to as much as 27.2 per cent in Bungalow.

Unit values in Manoora, Whitfield, Mooroobool, Earlville, Palm Cove, White Rock, Edge Hill, Westcourt and Yorkeys Knob are all up more than 12.3pc, with the lone suburb with a double digit house price rise was Tully (up 10.2pc to $282,025).

MORE: See the latest PropTrack Home Price Index

After hectic pandemic-driven surges, the Gold Coast was the quietest it’s been in years, with no suburbs seeing double digit price rises, and only 10 markets logging increased medians.

Mr Moore said lifestyle areas that saw really strong migration during the pandemic have seen prices “come back a little bit, but not massively”.

“They continue to be popular areas. They always have been areas that see migration from other states and the data from rental vacancies is consistent with that continuing.”

The highest jump on the Gold Coast was 7.6pc, logged by both units in Main Beach ($1.32m) and houses in Benowa ($1.55m). The only other house market on the Gold Coast that rose was Surfers Paradise, up 1.4pc to $2.42m.

The rest were units out of Arundel (up 6pc to $660,731), Surfers Paradise (+3.6pc, $661,409), Coombabah (+2.7pc, $548,198), Paradise Point (+2.2pc, $880,895), Hope Island (+1.4pc, $797,531), Ashmore (+0.9pc, $515,686) and Labrador (+0.4pc, $553,692).

Every other suburb on the Gold Coast has gone backwards in the past year, according to PropTrack figures, giving relief to buyers looking in almost 90 different unit and house markets there.

FOLLOW SOPHIE FOSTER ON TWITTER

More Coverage

Originally published as What your home is worth: Every Qld suburb’s house and unit value