Fears building industry will return to ‘bad old days’

There are concerns the construction industry could take a U-turn to the bad old days when the state’s top building cop steps down soon.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

OPINION

Applications to replace the forceful inaugural NSW Building Commissioner closed earlier this month as David Chandler will retire in August after five years in the job.

The prospect of a replacement as fervent as Chandler to head the state’s construction industry watchdog is slim. But hopefully the apartment construction industry does not take a U-turn back to the bad old days.

With proactive surveillance, Chandler oversaw the nascent improvement in apartment construction practices.

His appointment as cop on the beat came after the Opal Tower, Sydney Olympic Park and Mascot Tower calamities, although of course many more strata complexes have less obvious faults.

The lasting impact of shoddy work was apparent again last month with the latest loss in Opal Tower. The off-the-plan (OTP) buyer in the troubled Ecove-developed tower secured an $800,000 sale for their two-bedroom, two-bathroom 22nd floor apartment that had cost $840,000 in 2014.

The structural cracking calamity took place Christmas Eve 2018, just four months after completion, so, six years on, the owners are still suffering, reinforcing the need for buyers to exercise due diligence in their purchasing decisions.

The Building Commission NSW has an invigorated workforce of 440 as the regulator, taking over building and construction-related compliance from Fair Trading, which disappointed in its consumer protection role.

Chandler exits after securing extraordinary legislative powers from recent state governments to improve the construction of apartments and private home builds, too. He was regularly in his high-vis vest inspecting construction sites. Displaying none of the normal public service hesitation, he would then expose poor practices regularly on his LinkedIn page when developers took shortcuts.

He stressed the most effective time for action against shoddy construction was through issuing orders during pre-occupation audits.

His legacy includes the iCirt star-rating system for developers, builders and contractors, which hopefully gains awareness among OTP buyers who should be increasingly wary of the risks of buying from the non-rated.

Buyers should also favour developers taking latent defects insurance (LDI) for their apartment buildings, providing the prospect of 10-year liability insurance.

Legislation now ensures a continuing duty of care for all involved in the design and construction including builders, architects, engineers and certifiers.

Knowing that hazardous construction practices were killing tradies, Chandler was also keen to see the new industrial manslaughter law.

He also championed more women working in construction.

Chandler’s successor will take the baton in the pursuit of property developer lenders and insolvency practitioners accepting their obligations to apartment buyers rather than facilitating phoenixing.

“The penny must drop at some point with risky players. The cost of doing it properly, will always be cheaper than stoppages and rework,” the 74-year-old Chandler said in a recent LinkedIn post.

VICTIMS APLENTY IN LABOR’S CHASE FOR ‘AFFORDABLE HOMES

Local and foreign investors face higher property taxes on the premise of the NSW government facilitating more affordable homes for locals.

No doubt many landlords will seek to pass on the state budget tax hikes to their tenants. And if they can’t pass on the costs, some landlords may sell their rental property and thereby reduce rental property availability amid the housing crisis.

The upside is some tenants will potentially escape the tight rental market and take on home ownership.

The Minns Labor government says its adjusted property tax regimen was “striking the right balance” to ensure investors are contributing back to housing and infrastructure across NSW.

The NSW budget will collect more tax from locals given the $1.075m land tax threshold and the $6.571m premium rate threshold will no longer be indexed annually in line with property price changes.

The adjustment mimics most other Labor government states.

BIG PROPERTY TAX CHANGES

The NSW tax-free threshold for the unimproved land value liable for the annual tax recently increased by $106,000, from $969,000 to $1.075m, with the tax rate remaining at 1.6 per cent of the land value.

More than 165,000 primary or joint taxpayers currently pay land tax in NSW.

South Australia is now the only other state to index land tax thresholds.

The other big change in the state budget is that the foreign purchaser duty surcharge will increase from eight per cent to nine per cent.

From the 2025 land tax year, the foreign owner annual land tax surcharge will also increase, from 4 per cent to 5 per cent.

There are an estimated 20,000 foreign-owned residential properties in NSW, which sits at just 0.6 per cent of the state’s stock of properties.

The foreign purchaser duty surcharge was introduced in 2016 at 4 per cent by then treasurer Gladys Berejiklian. It was increased to 8 per cent in 2017 by Dominic Perrottet.

The accompanying annual foreign owner land tax surcharge was introduced at 0.75 per cent from December 31, 2016 and increased to 2 per cent from 2018 and 4 per cent from 2023.

All these measures are expected to boost revenue by $1.68bn over the next four years, with $1.5bn from locals.

Principal places of residence for locals and farms will remain exempt.

PROPERTY TAX MOVE COULD HURT INVESTORS AND RENTERS

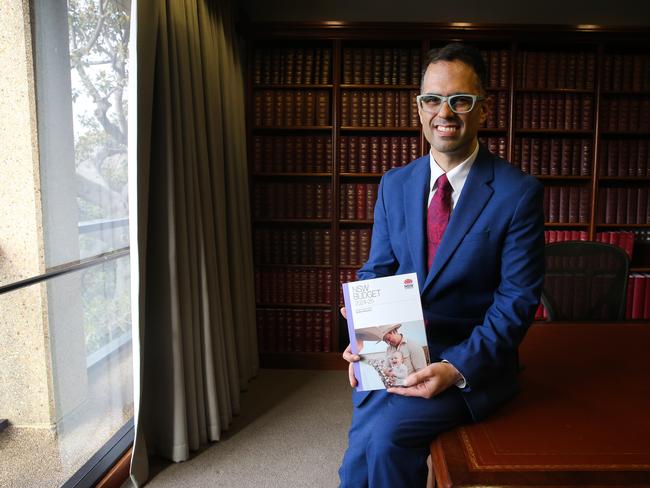

Treasurer Daniel Mookhey, in his second budget, said the funds will be directed to addressing the housing crisis. “These are modest adjustments against the backdrop of a generational housing crisis,” Mookhey said.

The foreigner tax increase is expected to encourage more properties to be made available to NSW residents and to ensure that overseas investors buying homes in NSW are also contributing to the necessary infrastructure to support them, he said.

Of course the anticipated extra revenue from these real and stealth tax rises on residential investment properties, holiday homes and commercial real estate will only come if investors stay in the market.

The move could especially impact investors and renters of houses and pricey apartments given their higher land values.

Originally published as Fears building industry will return to ‘bad old days’