‘Not a catastrophe’: Expert reacts to damning IMF housing risk report

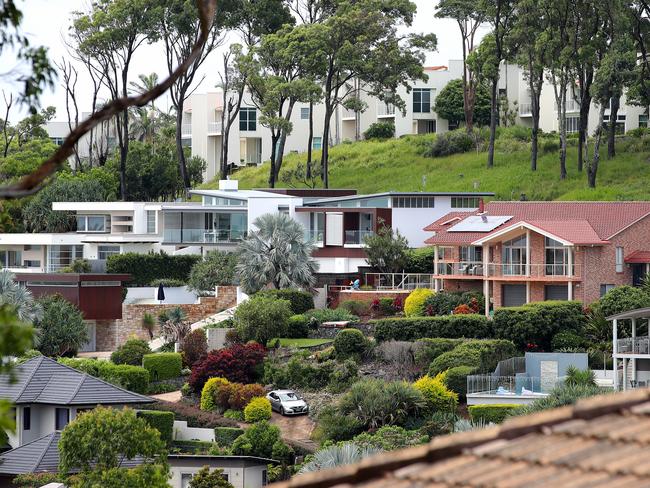

Australia’s housing market has been ranked one of the world’s riskiest but amid the downcast predictions, there remains room for cautious optimism.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Optimism continues to ripple through Australia’s challenging housing market, despite it being recently ranked the second riskiest worldwide.

In a study of 27 countries, Australia ranked second behind Canada for “housing market risk” in the latest global economic outlook by the International Monetary Fund (IMF).

The IMF scored countries on five aspects of housing market risk from outstanding debt vs. income to mortgage holder numbers and the cash rate.

CoreLogic Australia’s head of research Eliza Owen says that while there were risks associated with cash rate changes and house price growth during the pandemic, “it is not a catastrophe” and there was room for cautious optimism.

“There is risk and a cause for concern,” Ms Owen told News Corp.

“The amount of risk boils down to the fact that house prices have gone up over time and we have had to become more indebted to enter the housing market.

“It creates more risk if unemployment goes up. The more risky the housing situation the more risk of economic downturns.”

However she said while Australia was in a volatile period in terms of housing price declines and interest rate rises over the past year, “we seem to be getting through it”.

“So far households are dealing with it, we’re not seeing mass defaults or distressed sales,” she said.

“If our housing and financial market was going to unravel, we would have started to see it by now.”

She said one factor missed by the IMF was that Australia had a well capitalised banking system.

“We have unquestionably strong levels of capitalisation in Australia,” she said,

“For all the risky assets, they hold a lot of capital to cover themselves.”

FIVE REASONS THE IMF CLASSED AUSTRALIA AS HIGH RISK

1. Outstanding housing debt to household income in June 2022

According to the Reserve Bank of Australia (RBA), housing debt represented around 145.4 per cent of the country’s total disposable household income which equated to around $2 trillion.

“It’s relatively high and has blown out in Australia over time,” Ms Owen said.

“That’s basically because home prices have grown faster than income. We are taking out more and more debt … the debt is larger and we are taking it out for longer.”

MORE:

Dream home on offer at Manly’s best address

Sydney’s top 10 first homebuyer ‘hot spots’ revealed

‘It’s time’: 103yr old sells one of Sydney’s oldest homes

However, Ms Owen said there was a positive side when it came to the increase in housing prices, with outstanding housing debt representing just 17.6 per cent of the asset value at the end of 2022.

“Even though we’ve got $2 trillion of outstanding debt, Australia’s housing market is $10 trillion,” she said.

“When you compare mortgage debt to the value of housing … as long as asset values remain high, people keep their jobs it may not be as risky a situation as we first think.”

2. Housing debt on variable interest rates

The IMF noted that Australia has a high number of housing debt on variable rate terms – around 70 per cent at the end of 2022.

“This means that, unlike the US and many European counties, mortgage holders feel the sting of higher interest rates more rapidly,” Ms Owen said.

“Amid cash rate rises, outstanding mortgage rates in Australia have increased an average of just over 200 basis points for owner occupier and investor loans.”

Ms Owen said the interest rate hikes resulted in a “pretty rapid impact to balance sheets of households”.

However she said the flip side was that we can quickly see the impact of higher interest rates, which is one of the reasons there was a pause on interest rates earlier this month.

“That can make more of an impact on household consumption compared to other countries,” she said.

“Australia is quite unique in that so many mortgage holders are on variable rates that can be repriced every month.”

3. Homeowners with a mortgage

Australian Bureau of Statistics data showed that between 2018 and 2020, the number of home

owners with a mortgage jumped from 32 per cent to 37.

The IMF has identified this as a risk with a larger share of the Australian population with a mortgage and ongoing interest rate rises.

“This could have an impact on consumption,” Ms Owen said.

“More and more we are seeing households affected by interest rates. A lot of households with mortgages are less likely to spend money and this could affect economic growth.”

MORE:

Billionaire Elon Musk’s rental crisis at Twitter

‘Controversial’ MAFS wedding venue sold for $20m

10 of the rarest waterfront homes up for sale

4. Cash rate changes from March 2020 to September 2022

The quick rise in Australia’s cash rate has been deemed a risk by the IMF, with Australians experiencing the sharpest rate-hiking cycle on record, as the underlying cash rate went from emergency lows of 0.1 per cent to 3.6 per cent as of March.

“For Australia this has been a record rate hiking cycle,” Ms Owen said.

“We’ve never seen a rise in 350 base points in the space of a year.”

However she said it was worth noting that “a lot of this has played out already”.

“We are seeing in real time how risky this is,” she said.

“Although households still have more pain to come … we still haven’t seen the full extent of interest rate rises.”

Ms Owen said the IMF was correct that we would likely see poor gross domestic product (GDP) growth this year.

“However it’s not as if it’s so risky that it’s going to create irreversible damage to our financial and housing system. It’s not a catastrophe.”

5. Real house price growth between March 2020 to March 2022

The IMF say that housing prices will likely cool more in markets like Australia, where households are more sensitive to rate hikes, after prices rose substantially during the pandemic.

Australian home values rose about 19 per cent, including inflation, between March 2020 and March 2022.

Ms Owen said this was followed by Australia’s biggest housing decline of 9.1 per cent played out between May 2022 through to March this year.

“As of April 2023, a sharp decline in home values has already occurred,” she said.

“While it may still be too early to call the bottom of the market, the steep price falls to date have seen limited increases in home loan defaults or forced sales”.

More Coverage

Originally published as ‘Not a catastrophe’: Expert reacts to damning IMF housing risk report