Interest rate rises: nightmares becoming a reality for many

The pace of rate rises in recent months would have left iconic movie character Darryl Kerrigan quaking, and more are coming.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

A disturbing scene keeps forcing its way into my head. It’s Darryl Kerrigan, proud homeowner and patriarch from classic Aussie film The Castle, curled up in a corner of his pool room, continually crying “I thought they were dreamin’. I thought they were dreamin’”.

No, he’s not upset about people selling second-hand jousting sticks. In my vision he’s freaked out by the forecasters who correctly predicted today’s interest rates smashing many homeowners and first home buyers.

I was not one of those accurate forecasters. I honesty felt rates wouldn’t rise so high so quickly.

I invoked the spirit of Darryl Kerrigan in a column I wrote back in May, shortly after the Reserve Bank of Australia announced its first increase in the official cash rate since 2010 – a 0.25 percentage point rise from 0.1 to 0.35 per cent.

Since then, there have been four super-sized rate rises of 0.5 percentage points, taking the RBA’s official cash rate to 2.35 per cent, and another rise is expected on October 4.

This will lift total RBA rises this year above 2.5 per cent, a number that financial markets and some economists predicted back in May, when I argued they were dreamin’ to expect such a harsh increase.

Well, here it is, about six months before even they predicted, and we now have the money market pricing in an RBA cash rate of 4.15 per cent by mid-2023 – which would be 1.8 per cent above current levels.

It’s tempting to tell ‘em they’re dreamin’, again, but I won’t, considering the US central bank keeps jacking up its official rate by 0.75 percentage points a pop and expects to be above 4 per cent by December.

The coming pain for Aussie borrowers is unimaginable, especially for those who previously locked in low fixed rates at around 2 per cent – and could face 6 or 7 per cent rates when their fixed term expires next year.

Reserve Bank rate rises to date have already increased mortgage costs by 25 per cent. AMP chief economist Shane Oliver said taking our cash rate to 4.15 per cent would “knock home prices down by 30 per cent and put the economy into a recession we don’t have to have”.

Mr Oliver said the RBA shouldn’t raise rates as much as the US because Aussie borrowers are more vulnerable and responsive to interest increases.

He argues we have much larger household debt, and most borrowers are on variable rates or short-term fixed rates. That’s “in contrast to the US where most mortgages are 30-year fixed, so only new borrowers are impacted by rising rates”.

It’s a small glimmer of hope for households battling their biggest cost increases in decades.

While a cowering Darryl Kerrigan continues to haunt my brain, I won’t quote him again for a long time for fear of further upsetting the financial gods.

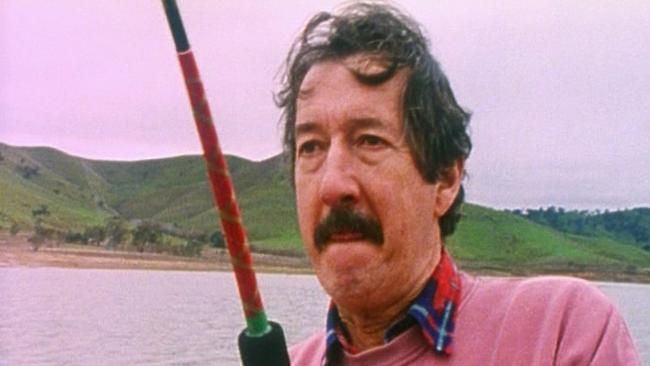

Instead, let’s go to his loveable son Dale for some mathematical wizardry: “Dad reckons fishing is 10 per cent brains and 95 per cent muscle, the rest is just good luck”.

More Coverage

Originally published as Interest rate rises: nightmares becoming a reality for many