Gold Coast property: Cheapest and most expensive streets to buy houses on revealed

A new report has revealed the Gold Coast’s most expensive and cheapest streets to buy on, as a leading economist reveals what will happen to property prices this year. FULL DETAILS

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

THE Gold Coast property market has been dubbed a “unicorn” by a leading economist who says a 10 per cent fall in prices won’t derail booming sales.

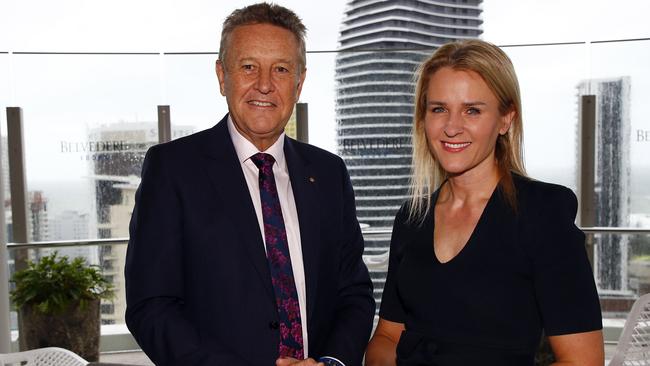

A report by Ray White chief economist Nerida Conisbee to be unveiled today, reveals the tens of thousands of people who bought in during the hottest real estate market in 30 years will come out ahead financially, even as it slows from the heights of 2021.

Despite rising interest rates and growing rates of mortgage stress, Ms Conisbee said the Gold Coast remained stronger than the national average, making it “somewhat of a unicorn”.

“Over the early months of this year, the Gold Coast has defied the slow down being felt elsewhere,” she said.

“The unit market is a great example of the strength of the property market, whereas overall Australian unit prices decreased by 1.5 per cent since the start of 2022, Gold Coast unit prices have risen 9.5 per cent.

“Even a predicted price fall of 10 per cent needs to be tempered against the dramatic rise in property prices during the pandemic.”

However, the economist admitted dramatically spiking cost of living issues and rising interest rates would have an impact on homebuyers struggling to make repayments.

“Cost of living is going up, though you are still in a remarkably better position by owning than those who continue to rent,” she said.

“Long-term I think prices will stabilise but for families it will be hard to make things balance out.

“On the Gold Coast, unemployment is really low, so there is no major fear of people losing their jobs so that is a positive.”

Melbourne-based analyst Martin North last week revealed the number of Gold Coast households in mortgage stress had increased by 20 per cent to nearly 23,000 in the three months leading up to the Reserve Bank’s decision to raise interest rates.

The postcode with the highest proportion of struggling homeowners was 4216, home to the expensive waterfront mega mansions of Sovereign Islands, Paradise Point and Runaway Bay.

Mortgage stress means homeowners are spending at least 30 per cent of their income on loans.

Ms Conisbee’s report reveals:

• The pandemic resulted in a 61 per cent increase in Gold Coast house prices and a 52 per cent in unit prices.

• The number of suburbs with a median house price of more than $2m tripled in the past year, with the top growth suburbs including Mermaid Beach, Bundall, Coolangatta, Currumbin.

• Mermaid Beach was No. 1 on the list of top growth suburbs for the past 20 years, ahead of Tallebudgera Valley, Broadbeach Waters.

• Surfers Paradise’s Southern Cross Drive and Sovereign Island’s Westminster Court tied for the Gold Coast street with the highest median sale price – $5.8m

• Coomera’s Fortune St and Upper Coomera’s Koala Town Road tied for the city’s most affordable streets with a median sales price of $280,000.

Mermaid Beach, Broadbeach Waters and Tugun were the top growth suburbs in rentals last year.

Ms Conisbee warned an increase in construction costs – the biggest rise since 2005 – would impact on housing and unit prices in coming months as it becomes increasingly difficult to get projects built.

Increased costs have hit both builders and buyers in the past year.

Several prominent builders, including the Gold Coast’s Condev have collapsed, while new buyers are paying more for units and homes.

The shortages are primarily the result of worldwide supply chain issues as well as the significant increase in construction activity in the past 18 months.

Materials in short supply include wood and steel, with the latter now costing up to $2300 a tonne.

Ray White Surfers Paradise boss Andrew Bell tipped demand for Gold Coast property to remain strong in the decade leading up to the 2032 Olympics.

“The fundamentals of real estate are very much about supply and demand,” Mr Bell says.

“It continues to receive high levels of buyer demand from those migrating from other parts of Australia, yet the supply of properties for sale is at record low levels which will underpin the property market moving forward.

“History has always shown that any city in the world preparing to host the Olympic Games has an added stimulant and confidence builder into that marketplace.”

IT’S A SELLOUT

Almost 900 residential units at The Star have sold out after a late surge of buyers following the opening of The Dorsett tower.

Broadbeach Island’s first permanent residents will move into the tower’s Star Residences units this month, five months after construction was completed.

Its units, as well as those in the under-construction 63-storey Epsilon supertower, have been sold.

Destination Gold Coast Consortium project director Jaime Cali said sales had remained strong into 2022 despite the property market’s slight cooling.

“High-quality stock across the Gold Coast is low and demand is high,” she said.

“The market has caught up and we’ve seen record growth and resiliency, despite the pandemic.

“So much so apartments in the second $400m tower were quickly snapped up, which means all 879 residential apartments across both towers have now sold.”

Ms Cali said the bulk of sales in the second tower were made in late 2021 and early this year.

“Investors were out in force over the past summer with 80 per cent of the purchasers in the second tower being locals looking for a second investment,” she said.

“Remote and decentralised working arrangements as a result of the pandemic have seen investors attracted to a lifestyle, where they have the convenience of dining and other facilities right on their doorstep.”

The $400m Epsilon tower is under construction and has reached its fifth level.

It is expected to be completed in 2024.

Reason it’s so hard to find a property on Coast

ALMOST 35,000 units have been approved but not built on the Gold Coast despite the city’s spiralling housing crisis.

State government figures show that at the end of the last financial year, 691 permits for “multiple dwelling” developments had been “approved and as yet unconstructed”.

If built, those development approvals would yield 34,452 units.

Building industry sources said rising costs, labour shortages and delays caused by Covid and wet weather were some of the factors contributing to development lag on the Gold Coast.

“The industry is going as hard as it can, it’s just impossible for us to do any more,” Housing Industry Association regional executive director for Queensland Mike Roberts said.

“The number of commencements across the country is at a record high. We’ve started more projects than we’ve ever started before.

“But the number of completions hasn’t risen to match that number of commencements. The number of completions is flatlining.

“And it’s because of constraints on labour and materials. We just can’t build things as quickly as we normally would.”

Mr Roberts said project times had blown out, which combined with rapidly rising costs made it difficult for builders to accurately plan ahead.

This in turn caused difficulties for developers when they sought finance from lenders.

“It’s extraordinarily difficult for anybody to schedule work in the way they normally would because the materials are taking three, four, five times longer to be delivered than they normally would.

“To try and schedule work and to make sure the labour’s on site and ready to go when those materials are delivered is really difficult.

“... It’s a pretty common practice these days for developers, in discussions with their financiers, to have a percentage of presales before the bank will sign off on the project and they can begin construction.

“If you can’t predict with a level of accuracy what the cost is going to be, how do you price the product before you go to market?

“Without being able to answer some of those fundamental questions the banks just won’t give the loan.”

The problems getting developments off the ground have come despite house and unit prices on the Gold Coast soaring to new highs of $1.07m and $654,000 respectively, while the rental vacancy rate in the city has fallen to a record low of 0.4 per cent.

In March, the Bulletin reported the Gold Coast property sector was banking on more than 2500 units across 20 new tower projects hitting the market in the next three months to ease the city’s apartment shortage.

The lack of available units had not eased in the past three months, according to an apartment essentials report by property consulting firm Urbis, and just 2.3 months of supply remained if new projects were not launched.

Council planning chair Cameron Caldwell said the city had received a record number of development applications, which should allow developers to ultimately meet demand.

“We have had the strongest year of development application activity that we have ever seen in the last 12 months, which gives developers the opportunity to take new product to the market to meet demand,” he said.

“We have also seen increases year-on-year in building approvals and plumbing approvals which are indicative of actual construction activity.

“The market demand, if it continues, will provide positive economic settings for developers to go ahead with their approvals.”