Gold Coast house prices: Everything you need to know about real estate market

The Gold Coast’s property market is caught in a vice between a rapidly rising population and a lack of available housing stock. This is the real story of the city’s wild housing prices.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

THE Gold Coast’s property market is caught in a vice between a rapidly rising population and a lack of available housing stock.

More than 15,000 people are moving to the city every year, while record amounts of development are unable to keep up with the demand for property, with the average prices now sitting around $1m.

With the collapse of several key builders, including Condev and Pivotal, and skyrocketing material costs rendering many towers unfeasible to build, real estate experts tip property prices to continue rising as it remains at a premium.

Housing affordability has long been an issue in the Gold Coast.

In 1990, property industry leaders warned the city had become unaffordable after the Japanese-fuelled development boom of the 1980s.

Figures released that year by Ray White Research showed increases in unit and house prices had outstripped the average between December 1979 and June 1990.

The Gold Coast’s average house price rose from $50,247 in 1979 to $203,085 in 1990, a 304 per cent increase while the rest of the state jumped by 238.7 per cent.

Unit prices also jumped by 204.25 per cent in the same period as a new generation of towers rose in Main Beach, Surfers Paradise, Broadbeach and Burleigh Heads.

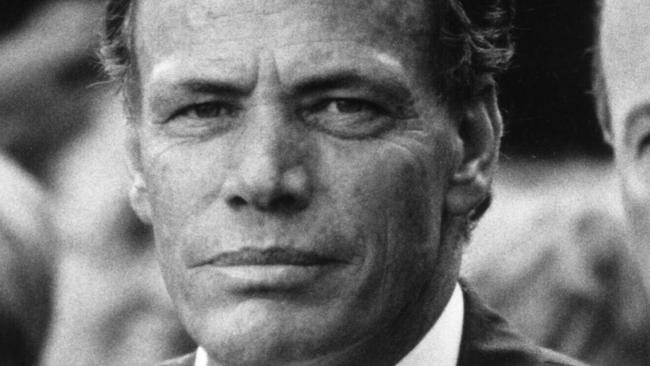

Then-Ray White chairman Brian White said at the time that the city had change dramatically through the 1980s.

“The Gold Coast is now a more sophisticated and varied economy than 10 years ago, and the living patterns mirror that change,” he said. “However, the Gold Coast is typical of popular sunbelt resort communities worldwide where people choose to purchase investments or second residential properties for lifestyle reasons.”

Fast-forward to the 2000s and that era’s development boom.

In 2001, the average home on the Gold Coast cost $244,511.

As prices continued to rise dramatically and the city’s population surged, there were calls for a population cap.

But these calls were dismissed in 2005 by then-state treasurer Terry Mackenroth.

“Capping the population artificially increases the price of property and what it would do is it would price most of the young people who live on the Gold Coast out of the region. They wouldn’t be able to afford to live there,’’ he said.

Then-premier Peter Beattie told the Bulletin at the time that population caps were “unfair and unrealistic” and his government would rather lead population growth to other areas by providing infrastructure.

By 2006, the Gold Coast was declared an unaffordable property market by prominent researcher Michael Matusik.

At the time the state’s average house price was $300,000.

The Gold Coast’s property stocks continued to expand in the mid-2000s, with Pacific Pines among the major growth areas at the time.

The dream of cheap Gold Coast property took another hit 15 years ago this week when a new report warned the “great Australian dream” of owning a house was out of reach for most.

A report from the Urban Development Institute of Australia (UDIA) highlighted the city’s then-housing crisis, warning just 9 per cent of Gold Coast homes on the market were classed as affordable for the average family.

By 2007, the average Gold Coast house cost $507,578, while most could only afford to borrow $263,651.

Then-UDIA Queensland president Brent Hailey said the findings were shocking but not unexpected.

“We highlighted this problem 12 months ago when we first started to compare prices from ’01 to ’06,” he told the Bulletin at the time.

“There have been some serious erosions in affordability for new entrants to the market.’’

He said 62 per cent of Gold Coast homes were viewed as “affordable” in 2001, compared with the paltry 9 per cent of 2007.

Housing and property prices took a dramatic hit in the late 2000s as a result of the global financial crisis and credit crunch, which also ground development to a halt for several years.

By 2010, the market began to turn and the alarm bells were already being sounded about the impact of low availability on housing prices.

Ray White Surfers Paradise CEO Andrew Bell that year warned Gold Coast’s construction approvals were failing to keep pace with the booming population, which he believed would in turn drive up property prices.

“Authorities call the current situation the perfect storm – lack of supply, difficult financing conditions, rising construction costs and high infrastructure charges resulting in land prices rising by 10 per cent,’’ he said.

“The South East Queensland Regional Plan predicts 300,000 new arrivals for the region over the next 22 years and we will need 143,000 new dwellings to house them.

“Yet broadacre undeveloped land is expected to provide only 32,000 dwellings and will run out by 2016.”

Now, 12 years on, housing is at even more of a premium.